PRIMECAP Management (Trades, Portfolio) recently released its portfolio updates for the second quarter of 2021, which ended on June 30.

Founded in 1983 in Pasadena, California as an independent investment management company, PRIMECAP Management (Trades, Portfolio) serves a limited number of institutions and mutual funds. The company’s investment philosophy is based on individual assessment of each company’s long-term fundamentals and plans for the future, with a focus on developing separate opinions without Wall Street influence. The goal of its investments is long-term capital appreciation, with a primary focus on investing in U.S. companies.

Based on its investing strategy, the firm’s biggest sells for the quarter were Eli Lilly and Co. (LLY, Financial) and NetApp Inc. (NTAP, Financial), while its most significant buys were Splunk Inc. (SPLK, Financial) and Alibaba Group Holding Ltd. (BABA, Financial).

Eli Lilly

The firm continued trimming its top holding, Eli Lilly (LLY, Financial), reducing the position by 1,418,968 shares (or 4.01%) for a remaining stake of 33,959,267 shares. The trade had a -0.18% impact on the equity portfolio. During the quarter, shares traded for an average price of $200.40.

Eli Lilly is a pharmaceutical company headquartered in Indianapolis. Founded in 1876, the company now sells its products in more than 125 countries. It is perhaps best known for its neuroscience products, though it also offers products in the areas of diabetes, oncology, cardiovascular and critical care.

On Aug. 11, shares of Eli Lilly traded around $266.52 for a market cap of $255.89 billion. According to the GuruFocus Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. The cash-debt ratio of 0.2 is lower than 82% of industry peers, but the Altman Z-Score of 5.13 indicates the company is not at risk of bankruptcy. The return on invested capital is typically higher than the weighted average cost of capital, meaning the company is creating value as it grows.

NetApp

The firm also cut its NetApp (NTAP, Financial) stake by 3,016,791 shares (or 11.65%) for a remaining holding of 22,884,731 shares. The trade had a -0.15% impact on the equity portfolio. Shares traded for an average price of $77.95 during the quarter.

NetApp is a tech company headquartered in Sunnyvale, California. It provides hybrid cloud data services and data management and has ranked in the Fortune 500 ever since it got into the cloud business in 2012.

On Aug. 11, shares of NetApp traded around $83.42 for a market cap of $18.68 billion. According to the GF Value chart, the stock is modestly overvalued.

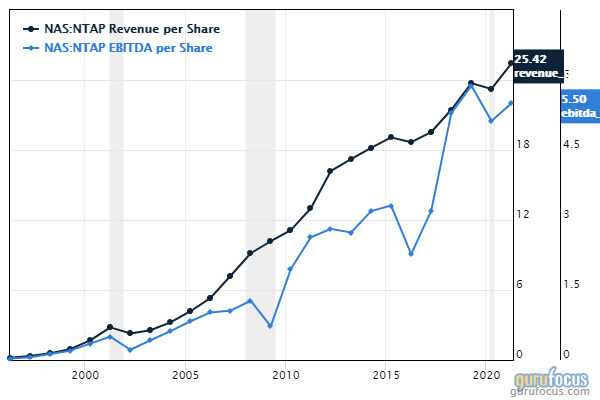

The company has a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. The debt-to-equity ratio of 4.02 indicates leverage higher than 98% of industry peers, though the Piotroski F-Score of 6 out of 9 is typical of a financially stable company. The company has a three-year revenue per share growth rate of 5.8% and a three-year Ebitda per share growth rate of 1.3%.

Splunk

The firm added 1,186,701 shares (or 20.89%) to its investment in Splunk (SPLK, Financial) for a total holding of 6,867,151 shares. The trade had a 0.12% impact on the equity portfolio. During the quarter, shares traded for an average price of $127.52.

Splunk is a San Francisco-based technology company that produces software for searching, monitoring and analyzing machine-generated data. Its customers are primarily in the cybersecurity, IT and DevOps fields.

On Aug. 11, shares of Splunk traded around $145.32 for a market cap of $23.87 billion. According to the GF Value chart, the stock is fairly valued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 2 out of 10. The Piotroski F-Score of 1 out of 9 implies poor business operation, though the Altman Z-Score of 2.87 shows the company is not at high risk of bankruptcy. The operating margin and net margin remain in the negatives and have been trending further down over the past decade, indicating the company is not yet profitable.

Alibaba Group Holding

The firm upped its stake in Alibaba Group Holding (BABA, Financial) by 518,556 shares, or 3.43%, for a total of 15,635,272 shares. The trade had a 0.08% impact on the equity portfolio. Shares traded for an average price of $222.15 during the quarter.

Alibaba is a Chinese multinational conglomerate with holdings in e-commerce, retail, internet and technology assets, among many others. By volume, Alibaba is the largest e-commerce company in the world, with millions of merchants and hundreds of millions of users.

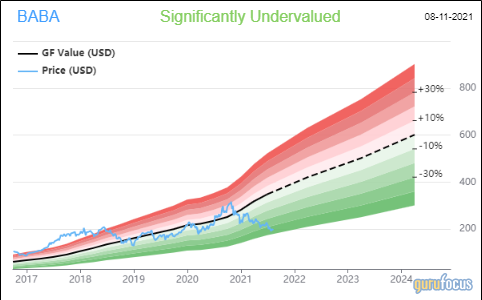

On Aug. 11, shares of Alibaba traded around $195.18 for a market cap of $530.10 billion. According to the GF Value chart, the stock is significantly undervalued.

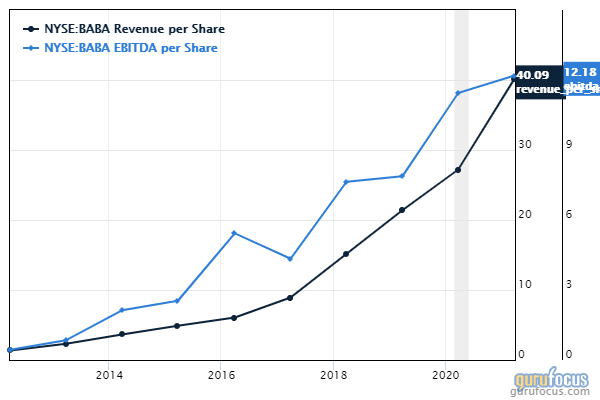

The company has a financial strength rating of 7 out of 10 and a profitability rating of 8 out of 10. The interest coverage ratio of 18.64 and Altman Z-Score of 4.81 show a fortress-like balance sheet. The three-year revenue per share growth rate is 38.2%, while the three-year Ebitda per share growth rate is 16.8%.

Portfolio overview

As of the quarter’s end, PRIMECAP Management (Trades, Portfolio) held shares of 334 stocks in an equity portfolio valued at $148.84 billion. The turnover rate for the quarter was 1%.

The top holdings were Eli Lilly with 5.24% of the equity portfolio, Biogen Inc. (BIIB, Financial) with 3.83% and Microsoft Corp. (MSFT, Financial) with 3.40%. In terms of sector weighting, the firm was most invested in technology, health care and industrials.