After the economic crisis due to the first wave of the Covid-19 pandemic, the Chinese economy is now growing again thanks to fiscal stimulus packages worth billions issued by the government to support families and businesses. The Chinese gross domestic product (GDP) completed its recovery in the final quarter of 2020 and added 12.7% year over year in the first half of 2021.

With a GDP of $14.72 trillion in 2020, China is the second largest economy in the world, behind only the United States, whose GDP is about 1.4 times higher. However, according to some analysts, the Chinese economy is expected to become the world's largest economy in less than 10 years, driven by expected strong growth in some sectors such as the internet, healthcare and the manufacturing industry as well as China's larger population.

The latest statistics from the Fortune Global 500 give a strong idea that the Asian economy is on the right path to surpass the U.S. The 2021 edition of Fortune magazine's annual survey tells us that the presence of Chinese companies among the world's largest 500 companies in terms of turnover is becoming more and more numerous. There were 143 Chinese businesses in the latest ranking, exceeding the U.S. for the second time in a row.

China Petroleum & Chemical Corp (SNP, Financial) (HKEX: 00386) (SSE: 600028), more commonly called Sinopec, made a huge leap forward in the ranking. Despite a drastic decline in 2020 revenues, the major integrated energy company managed to achieve fifth place in the list and became the top-ranked among publicly traded Chinese equities.

Total revenue of approximately $322.6 billion in 2020 dropped by 24% from about $324 billion in 2019, mainly because of less people traveling by plane, which weighed on the demand for fuels. Gross profit and net income to common stockholders also went down significantly, falling by 7% to $62 billion and 38% to $5.1 billion, respectively. These figures have dragged the share price lower over the past 52 weeks, losing nearly 2% on the U.S. stock listing and underperforming the benchmark index substantially.

But for shareholders of Sinopec, it seems that things are going to improve soon, as analysts are recommending buying shares of the Chinese energy giant. They expect that the stock will strongly benefit from the expected improvement in the market conditions for crude oil, gas and other energy commodities.

The global economy is expected to continue to recover and grow, giving a boost to the demand for fuel and other petrochemical products. The price of these commodities should trade higher over the next several months, which is going to be beneficial for the financials of Sinopec and other fuel providers.

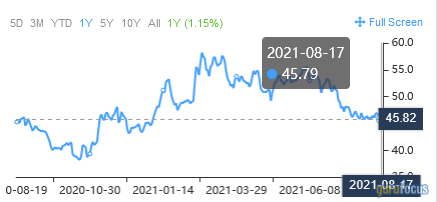

Wall Street analysts forecast that the stock will hit a target price of $69.69 within 52 weeks, which would represent a more than 50% upside from Tuesday’s closing price of $45.79.

The company will disclose its financial results for the first half of 2021 on Aug. 30. Sinopec's most recent guidance anticipates that the net income will turn positive, possibly hitting as high as $6 billion, after the loss of the year before. $6 billion would also represent growth from the $4.6 billion it net income reported in the first half of 2019.

The stock doesn’t look expensive compared to its strong outlook. It has a market cap of $55.44 billion and a 52-week range of $38.18 to $58.40. The share price is trading below the 50-Day Moving Average of $47.41 and the 200-Day Moving Average of $51.77.

Furthermore, the price-earnings ratio is 5.29 versus the industry median of 13.52, the price-sales ratio is 0.18 versus the industry median of 1.2 and the enterprise value-Ebitda ratio is 3.37 versus the industry median of 9.16.

As of the writing of this article, Sinopec’s shares are trading at 3.64 Hong Kong Dollars apiece (about $0.47) for a market cap of HK$557.07 billion (about $71.5 billion) in Hong Kong and at 4.08 Chinese Yuan apiece (about $0.63) for a market cap of ¥468.52 billion (about $72.3 billion) in Shanghai.

Disclosure: I have no positions in any securities mentioned.