Bank of America (BAC, Financial) has slapped a new $260 price target on Nvidia Corp. (NVDA, Financial) after it beat its earnings estimates on Wednesday. The company released a strong earnings report, beating revenue and EPS targets by $169.08 million and $0.02, respectively.

Don't worry about chip shortages

Semiconductor chips usually take 16-20 weeks to deliver after ordering, but the global shortage has pushed that number up to 20.2 weeks on average. The lack of supply means that the sector's entire value chain is facing pressure, which could translate into below-par earnings.

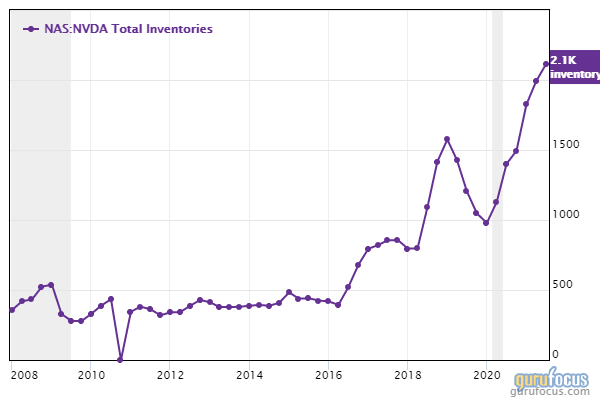

Fortunately enough, Nvidia holds an abundance of inventory, providing the company with enough slack to push through the systemic issue. According to Bank of America, Nvidia should not face any significant headwinds to earnings from the semiconductor shortage.

Shareholder compensation

Bank of America also cites Nvidia's strong committment to shareholder compensation as one of its key reasons for being bullish on the name. Nvidia's $7.24 billion share repurchase plan has been authorized and will be valid until the end of 2022. If shares are repurchased, we'll likely experience a further uptick in the earnings per share, which is often a leading driver of the stock price.

It is also possible that the company could announce a series of significant dividend payout hikes, though no plans for this are currently being reported. The current payout ratio of 4.10% is low considering the sector average of 30%. Nvidia's dividend coverage ratio of 26.89 and its free cash flow to dividend ratio of 13.98 also signals plenty of additional dividend capacity.

In the chart above, it's apparent that assets are growing faster than debt. By combining the analogy made with the potential for future share repurchases, one can conclude that the intrinsic share value is set to skyrocket.

Wall Street

Wall Street analysts also expect Nvidia's stock to reach the $225 handle (average estimate), with some expecting it to get to as high as $300.

Source: TipRanks

The word on the street is that many analysts are waiting on the Arm acquisition outcome, which has stalled due to objections from certain licensees as well as the British government.

Without going too in-depth, I personally think the Arm acquisition is likely to be approved, which will add another element to Nvidia. Still, I believe the acquisition won't have much short-term bearing on Nvidia's stock price.

Final word

Nvidia's stock has been upgraded by a number of big banks, with Bank of America being one of the latest. It's easy to see why the stock is liked by many; operational and financial efficiency will drive the stock higher during the continued semiconductor boom, and the potential for higher returns to shareholders is also promising.