Roku Inc. (ROKU, Financial) has appreciated by more than 130% over the past year. Much of the driving force behind the stock is due to the disruptive business model. User growth has been key to investor optimism, but that's slowed down over the past quarter, so it is arguably set for a short-term pullback.

Citigroup expects the company, which manufactures digital media players for video streaming, to have 79 million active accounts by 2023, a downgrade from its previous estimate of 100 million. Although platform revenue per account remains robust, I believe the fantasy is over and Roku will probably be priced closer to its current, rather than its future, valuation.

Fundamentals

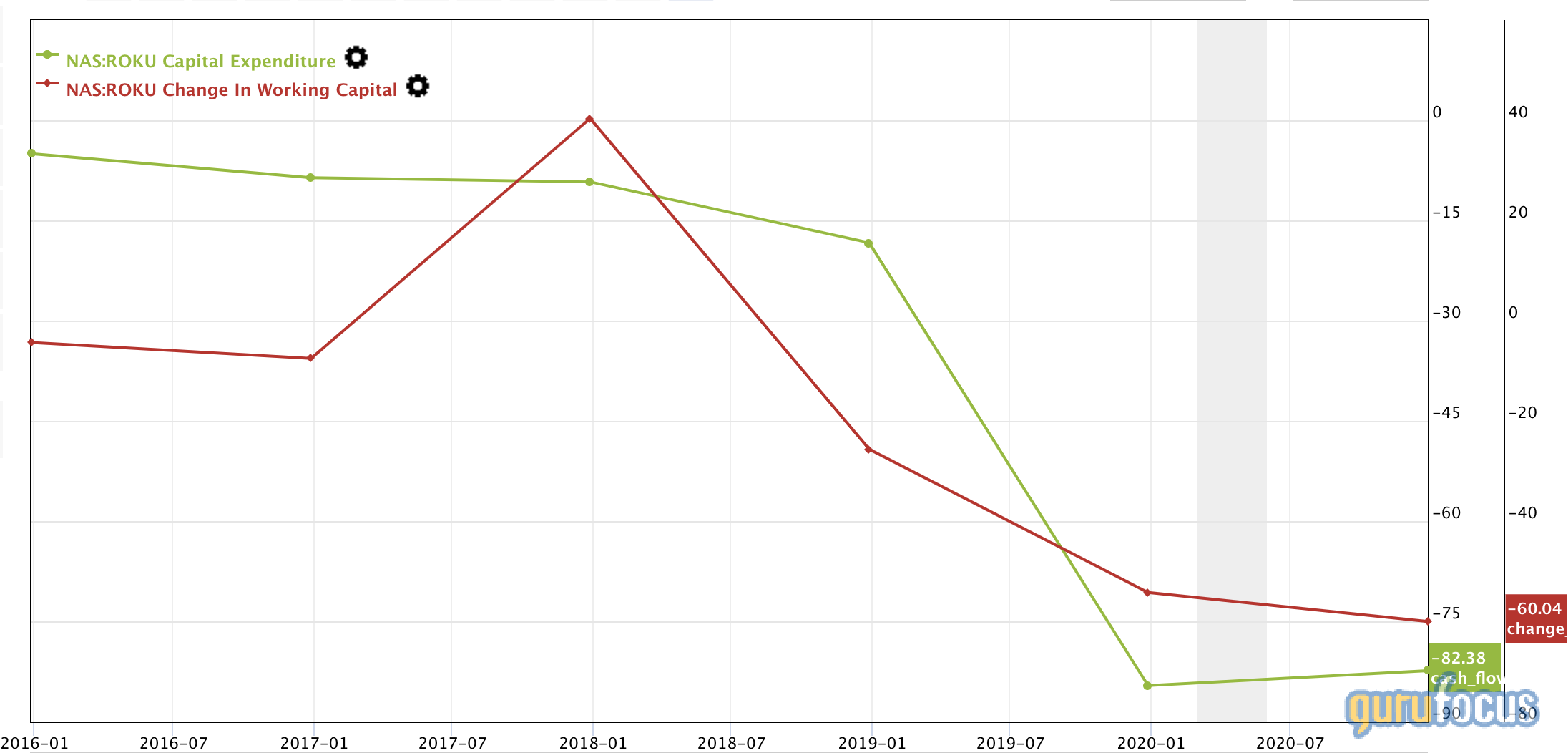

A downward trajectory in working capital and capital expenditure is a concern at the moment. Roku will need to continue spending big to beat the competition. Furthermore, evolving TV standards, such as 4K, 8K and HDR, along with technology upgrades will require continued investment.

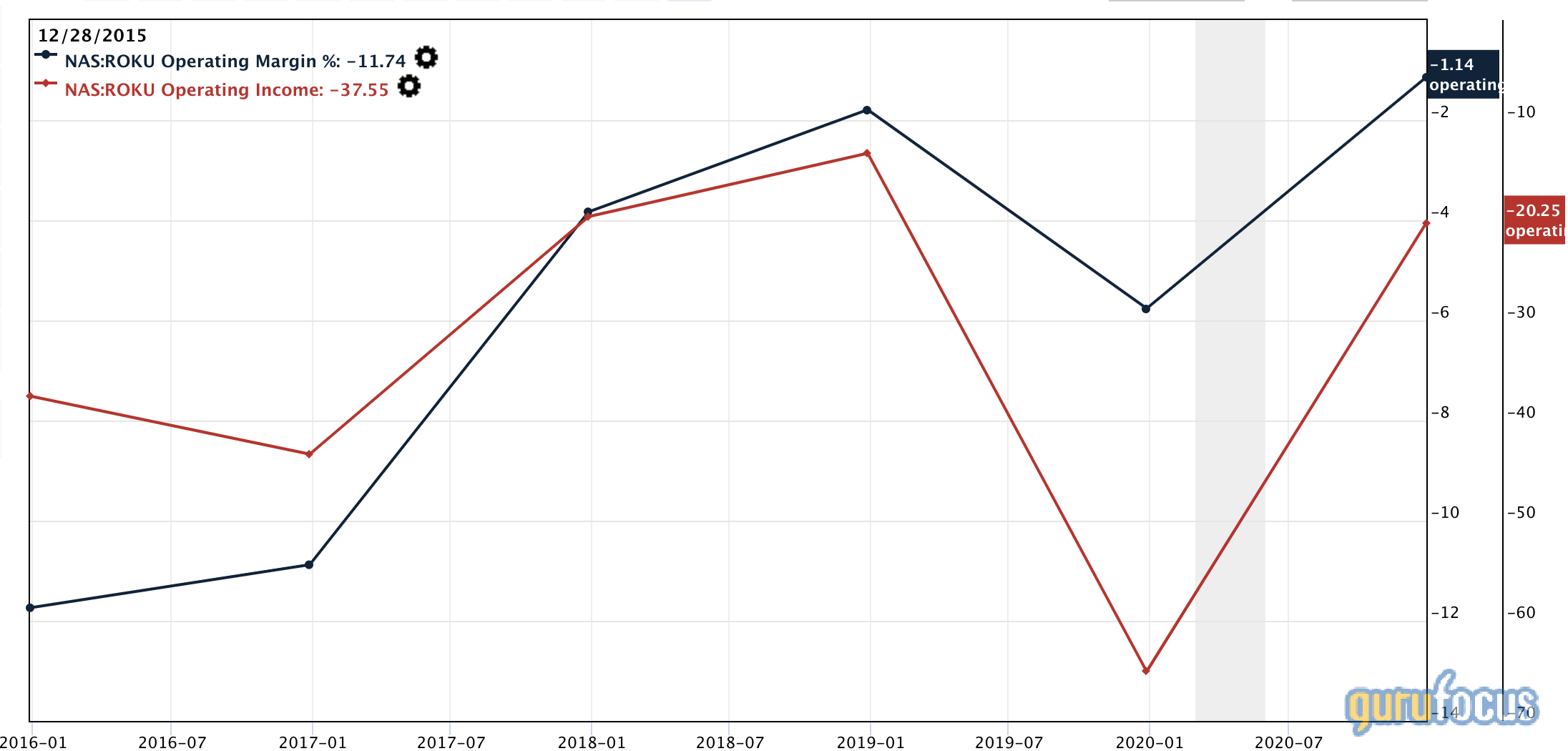

Although operating margins and absolute operating income have improved, it's still in negative territory. This could scare off many investors since the company has a significant debt burden that can't be covered with current income levels, meaning that a share issuance could be on the cards.

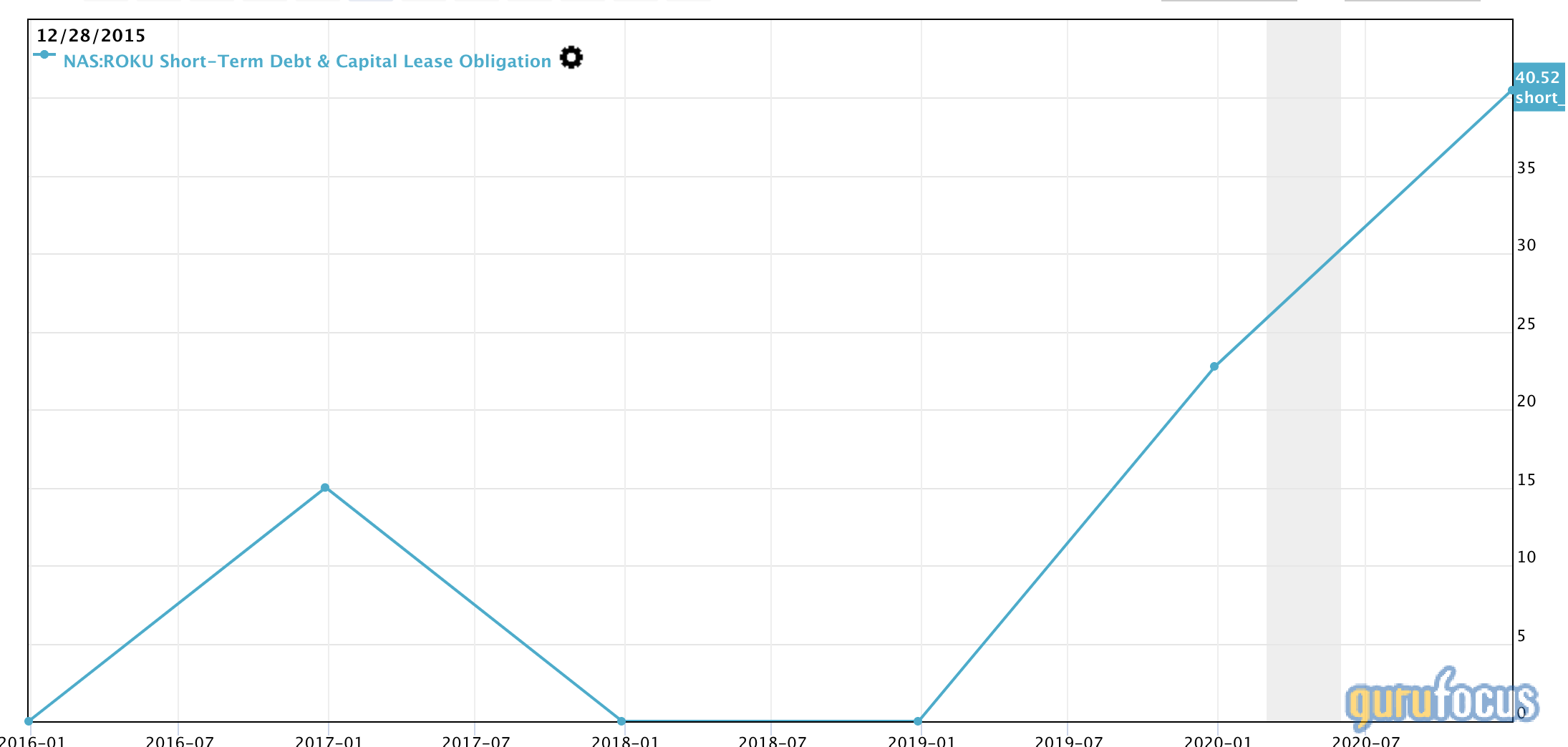

Another worrying aspect about Roku's debt is the recent buildup in short-term debt and lease obligations. The mounting short-term financing can, in many instances, be a sign of a distressing period. The only way to get out of such a situation is by adding equity to the balance sheet through asset sales or share issuance, which would dilute shareholders.

Valuation

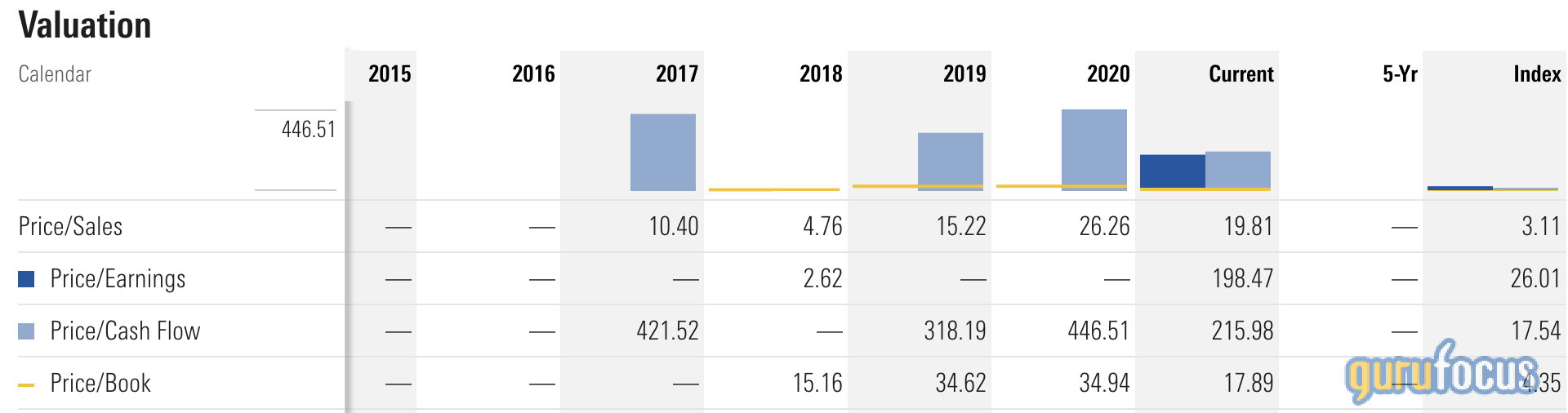

Source: Morningstar

Roku's relative valuation metrics are way out of sync. If you asked me if this mattered three months ago, my answer would've been no. But economic factors are becoming more prevalent for stock pricing metrics in the current market climate.

The price-sales ratio is trading 19 times above its benchmark, and the price-cash flow ratio is trading 14 times the required benchmark. Both of these metrics are critical for a growth stock, and I believe they'll come into play soon for Roku.

Final word

Roku is set for a short-term pullback. While it is a great company, the current share price is higher than it should be if you consider fundamental aspects. The company will definitely be a buy again in the future, but it is a stock that has run its course for now.