When screening the market for bargain opportunities, value investors could be interested in the following securities, as their share prices are trading near or below the intrinsic value estimated by the GuruFocus Value Line. The GF Value is a unique intrinsic value calculation from GuruFocus that utilizes the three components listed below:

- The stock's historical multiples, such as the price-earnings ratio, the price-sales ratio, the price-book ratio and the price-to-free cash flow ratio.

- A GuruFocus adjustment factor based on the past returns and growth of the company's business.

- Estimations of future business performance.

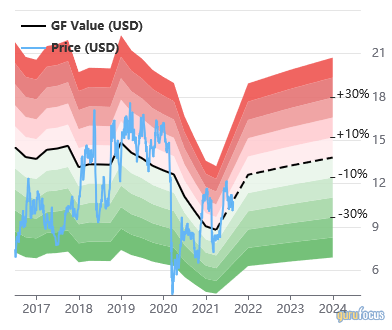

Petroleo Brasileiro SA Petrobras

The first stock investors could be interested in is Petroleo Brasileiro SA Petrobras (PBR, Financial), a Rio De Janeiro, Brazil-based oil and gas integrated operator.

Petroleo Brasileiro SA Petrobras' share price was $10.77 at close on Thursday, while its GF Value stands at $11.42, resulting in a price-to-GF-Value ratio of 0.94 and a rating of fairly priced.

The stock price is currently up 26.71% year-over-year, determining a market capitalization of $69.84 billion and a 52-week range of $6.15 to $12.38.

The price-earnings ratio is 6.51 (versus the industry median of 1.5) and the price-book ratio is 1.19 (versus the industry median of 1.18). Also, the price-sales ratio is 1.31 (versus the industry median of 1.22) and the price-to-free-cash-flow ratio is 2.50 (versus the industry median of 8.77).

The stock has a GuruFocus profitability rating of 6 out of 10.

Concerning the future business performance, sell-side analysts on Wall Street estimate that on a year over year basis, earnings per share will increase by approximately 322.50% in 2021 and by approximately 16% in 2022.

As of August, the stock has a median recommendation rating of overweight with an average target price of $13.19 per share.

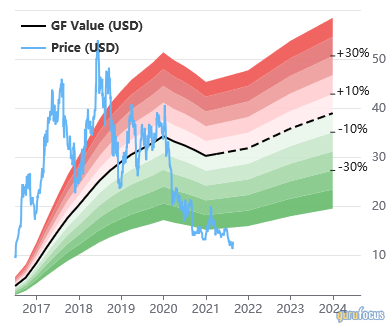

Hello Group Inc

The second stock investors could be interested in is Hello Group Inc (MOMO, Financial), a Beijing, China-based internet content and information company that operates a social network and entertainment platform in China.

Hello Group Inc’s shares closed at $12.92 apiece on Thursday while its GF Value is $31.24, resulting in a price-to-GF-Value ratio of 0.41 and a rating of significantly undervalued.

Currently, the stock price is down 39% year-over-year for a market capitalization of $2.66 billion and a 52-week range of $11.08 to $21.25.

The price-earnings ratio is 9.38 (versus the industry median of 26.35) and the price-book ratio is 1.23 (versus the industry median of 3.55). The price-sales ratio is 1.35 (versus the industry median of 4.24) and the price-to-free-cash-flow ratio is 6.77 (versus the industry median of 24.53).

The GuruFocus profitability rating is 8 out of 10.

Regarding future business performance, sell-side analysts on Wall Street forecast that on a year over year basis, the earnings per share will increase by 405% this year and by 23.40% next year. EPS is projected to grow by 2.05% per annum over the next five years.

As of August, the stock has a median recommendation rating of overweight with an average target price of $111.27 per share.

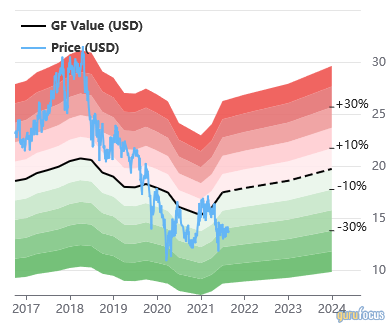

Embotelladora Andina SA

The third stock investors could be interested in is Embotelladora Andina SA (AKO.B, Financial), a Chilean producer, marketer and distributor of Coca-Cola trademark beverages in South America.

Embotelladora Andina SA was trading at $13.80 per share at close on Thursday while its GF Value was $16.45, resulting in a price-to-GF-Value ratio of 0.84 and a rating of modestly undervalued.

The stock has risen by 4.55% over the past year, determining a market capitalization of $2.18 billion and a 52-week range of $11.80 to $17.36.

The price-earnings ratio is 12.52 (compared to the industry median of 24.98) and the price-book ratio is 1.65 (versus the industry median of 2.45). The price-sales ratio is 0.81 (compared to the industry median of 1.94) and the price-to-free-cash-flow ratio is 6.79 (versus the industry median of 18.04).

GuruFocus has assigned the stock a profitability rating of 6 out of 10.

Concerning the future business performance, sell-side analysts on Wall Street predict that the earnings per share will increase 10.50% every year over the next five years.

As of August, the stock has a median recommendation rating of overweight with an average target price of $16.43 per share.

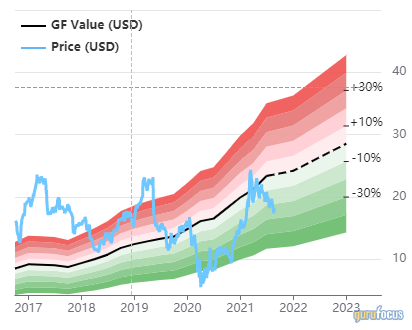

The E W Scripps Co

The fourth stock investors could be interested in is The E W Scripps Co (SSP, Financial), a Cincinnati, Ohio-based media enterprise operating through a network of more than 60 local and national television stations.

The E W Scripps Co was trading at $18.08 per share at close on Thursday while its GF Value was $23.62, resulting in a price-to-GF Value ratio of 0.77 and a rating of modestly undervalued.

The stock has risen by 52.57% over the past year, determining a market capitalization of $1.49 billion and a 52-week range of $8.95 to $24.78.

The price-earnings ratio is 5.24 (compared to the industry median of 20.04) and the price-book ratio is 1.03 (versus the industry median of 1.84). The price-sales ratio is 0.68 (compared to the industry median of 1.89) and the price-to-free-cash-flow ratio is 6.04 (versus the industry median of 15.22).

GuruFocus has assigned the stock a profitability rating of 6 out of 10.

Concerning the future business performance, sell-side analysts on Wall Street predict that after a 42.60% drop this year, the earnings per share will grow by 171.40% in 2022 and by 10% on average every year over the next five years.

As of August, the stock has a median recommendation rating of overweight with an average target price of $26.17 per share.

Disclosure: I have no positions in any securities mentioned.