Investors could be interested in the three stocks listed below, as their earnings yields (as calculated via Joel Greenblatt (Trades, Portfolio)'s method) are doubling the 20-year high-quality market corporate bond spot rate of 3.00% as of the writing of this article. Greenblatt calculates the earnings yield as the company's earnings before interest and tax (Ebit) divided by its enterprise value.

Euroseas Ltd

The first stock investors could be interested in is Euroseas Ltd (ESEA, Financial), a Marousi, Greece-based marine shipping company providing worldwide ocean-going transportation of manufactured products and perishable goods through dry and refrigerated containerized cargoes. The company owns and operates a nearly 42,300 Twenty-Foot Equivalent Unit cargo capacity fleet of 14 vessels.

The stock grants an earnings yield of 7.27% as of the June 2021 quarter. This stands above the median point of the past 10-year historical earnings yield range of -405.71% to 10.01%. Euroseas Ltd's earnings yield ranks higher than 66% of 920 companies that are operating in the transportation industry.

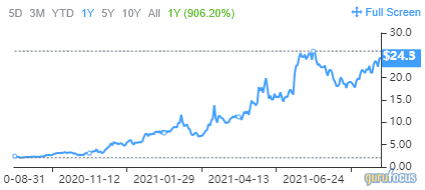

The share price was trading at around $24.34 at close on Friday for a market capitalization of $176.34 million and a 52-week range of $2.02 to $26.58. The stock has risen 906.2% over the past year.

Its price-earnings ratio is 14.15 and the price-book ratio is 3.74.

Currently, Euroseas Ltd doesn’t pay dividends.

On Wall Street, the stock has a median recommendation rating of buy with an average target price of $34 per share.

Boston Omaha Corp

The second stock investors could be interested in is Boston Omaha Corp (BOMN, Financial), an Omaha, Nebraska-based advertising agency operating 3,200 billboards containing approximately 6,000 advertising faces in the southeast United States.

The company grants an earnings yield of 21.01% as of the June 2021 quarter. This stands significantly above the median point of the 10-year historical range of -437.51% to 332.63% and ranks higher than 89% of the 981 companies that are operating in the media - diversified industry.

The share price was trading at around $36 at close on Friday for a market capitalization of $1.06 billion and a 52-week range of $14.80 to $49.91. The stock has increased by 120.72% over the past year.

Its price-earnings ratio is 8.53 and the price-book ratio is 2.01.

Currently, Boston Omaha Corp does not pay dividends.

On Wall Street, the stock has a median recommendation rating of buy with an average target price of $39.50 per share.

IRSA Propiedades Comerciales SA

The third stock investors could be interested in is IRSA Propiedades Comerciales SA (IRCP, Financial), a Buenos Aires, Argentina-based investment arm of IRSA Inversiones y Representaciones S.A. Alto Palermo S.A. owning and operating 10 shopping centers located in Argentina and covering a total of almost 270,000 square meters.

The company grants an earnings yield of 22.08% as of the March 2021 quarter, standing well above the median point of the 10-year historical range of -70.34% to 180.71%, and ranking higher than 97% of 1,787 companies that are operating in the real estate industry.

The share price was trading at $2.45 at close on Friday for a market capitalization of $77.18 million and a 52-week range of $1.55 to $3.66. The stock has risen by 34.22% over the past year.

Its price-earnings ratio is 0.62 and the price-book ratio is 0.17.

Currently, IRSA Propiedades Comerciales SA pays annual dividends. On Dec. 3, 2020, the company paid $0.888 per common share to its shareholders.

On Wall Street, the stock has one recommendation rating of hold with a target price of $2.62 per share.

Disclosure: I have no position in any securities mentioned.