According to current portfolio statistics, a Premium feature of GuruFocus, the top-performing stocks in Warren Buffett (Trades, Portfolio)’s equity portfolio as of Monday are The Kroger Co. (KR, Financial), Bank of America Corp. (BAC, Financial), American Express Co. (AXP, Financial), Bank of New York Mellon Corp. (BK, Financial) and Moody’s Corp. (MCO, Financial).

Buffett celebrates his 91st birthday, yet continues major stake in Apple

As of the June quarter filing date, technology stocks occupy 43.21% of Berkshire’s $293.02 billion equity portfolio, with Apple Inc. (AAPL, Financial) carrying a 41.46% equity portfolio weight.

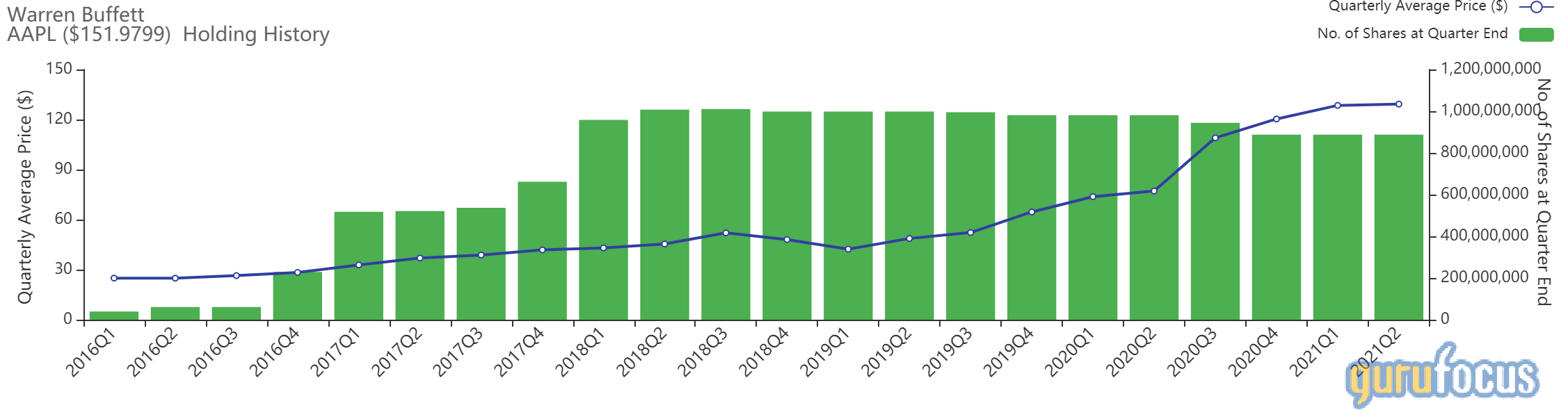

Buffett established his conglomerate’s stake in Apple during the first quarter of 2016, buying 39,246,988 shares. Berkshire owns 887,135,554 shares of the Cupertino, California-based tech giant as of the second quarter.

CNBC added that during the years leading to his 91st birthday, Buffett took steps to make sure that Berkshire is “better positioned to benefit from the technology-driven economy." Despite this, Buffett’s equity portfolio also contains a 31.74% equity portfolio weight in financial services and a 12.75% equity portfolio weight in consumer defensive. Figure 1 shows a heat map illustrating the year-to-date total returns of Berkshire’s top 20 holdings as of Monday.

Figure 1

Kroger

Berkshire owns 61,787,910 shares of Kroger (KR, Financial), giving the position 0.81% weight in the equity portfolio. The stock has gained approximately 45.03% year to date and is significantly overvalued based on Monday’s price-to-GF Value ratio of 1.36.

GuruFocus ranks the Cincinnati-based grocery store company’s profitability 8 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and a return on equity that outperforms more than 70% of global competitors.

Other gurus with holdings in Kroger include Jim Simons (Trades, Portfolio)’ Renaissance Technologies, Pioneer Investments and Ray Dalio (Trades, Portfolio)’s Bridgewater Associates.

Bank of America

Berkshire owns 1,010,100,606 shares of Bank of America (BAC, Financial), giving the position 14.21% equity portfolio space. The stock has gained approximately 41.37% year to date and is modestly overvalued based on Monday’s price-to-GF Value ratio of 1.30.

GuruFocus ranks the Charlotte, North Carolina-based bank’s financial strength 3 out of 10 on several warning signs, which include cash-to-debt and debt-to-equity ratios that underperform more than 68% of global competitors.

American Express

Berkshire owns 151,610,700 shares of American Express (AXP, Financial), giving the position 8.55% equity portfolio weight. The stock has gained 40.55% year to date and is significantly overvalued based on Monday’s price-to-GF Value ratio of 1.38.

GuruFocus ranks the New York-based credit card company’s profitability 6 out of 10 on the back of a high Piotroski F-score of 8 despite net profit margins and three-year revenue growth rates outperforming just over half of global competitors.

Bank of New York Mellon

Berkshire owns 72,357,453 shares of Bank of New York Mellon (BK, Financial), giving the position 1.27% equity portfolio weight. The stock has gained 35.18% year to date and is modestly overvalued based on Monday’s price-to-GF Value ratio of 1.12.

GuruFocus ranks the New York-based asset management company’s financial strength 3 out of 10 on several warning signs, which include a low Piotroski F-score of 3 and a debt-to-equity ratio that underperforms more than 81% of global competitors.

Moody’s Corporation

Berkshire owns 24,669,7787 shares of Moody’s (MCO, Financial), giving the position 3.05% weight in the equity portfolio. The stock has gained 30.83% year to date and is modestly overvalued based on Monday’s price-to-GF Value ratio of 1.29.

GuruFocus ranks the New York-based credit rating company’s profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank, a high Piotroski F-score of 8 and an operating margin that is near a 10-year high of 48.20% and outperforms over 77% of global competitors.

See also

According to the Aggregated Statistics Chart, a new GuruFocus feature, Berkshire’s equity portfolio holdings have a mean year-to-date total return of 16.50% and a median year-to-date total return of 12.48%. Six of Berkshire’s holdings have a year-to-date return of at least 40%, including other stocks like Wells Fargo & Co. (WFC, Financial) and RH (RH, Financial).