One of my investment themes for this year has been to prioritize investing in companies that provide dividend increases above their long-term average. Given the difficultly encountered last year due to Covid-19, dividend growth was muted for many companies. Those that have raised their dividends by a larger than usual amount this year have my attention as this could be a sign that the company is doing well despite the pandemic and/or prioritizing shareholders.

Of course, there are many stocks trading above their historical averages and/or the intrinsic values, so even if they do pay high dividends, they might not be buys at the moment. In this article, we will examine two names that recently announced double-digit dividend increases that I would be interested in acquiring at a lower valuation.

Deere

Deere & Company (DE, Financial) is the world’s largest manufacturer of farm equipment. The company also provides equipment used in constriction and forestry end markets. Deere has a market capitalization of $115 billion and generated revenue in excess of $38 billion over the last four quarters.

The company announced a 16.7% dividend increase for the Nov. 8 payment date. This is the second increase this year following a 18.4% raise for the May 10 payment. In total, shareholders should receive $3.90 of dividends per share in 2021, a 28.3% increase from last year. Deere had maintained the same dividend distribution for the previous nine consecutive quarters.

Despite the more than two-year pause, Deere’s dividend has a compound annual growth rate of 7.2% over the last decade. Using the new annualized dividend of $4.20, shares yield 1.1% at the moment, which is lower than the 10-year average yield of 2.2%.

According to Yahoo Finance, Wall Street analysts expect Deere to earn $18.92 per share this fiscal year (which ends Nov. 1), resulting in an expected payout ratio of 21%. This is below the 10-year average payout ratio of 32%.

Deere has traded with average price-earnings ratios of 17.1 and 14.3 over the last five- and 10-year periods of time, respectively. Using the current share price of $369 and expected earnings per share for the fiscal year, Deere has a forward price-earnings ratio of 19.5. By this measure, the stock is expensive compared to either the medium- or long-term average valuations.

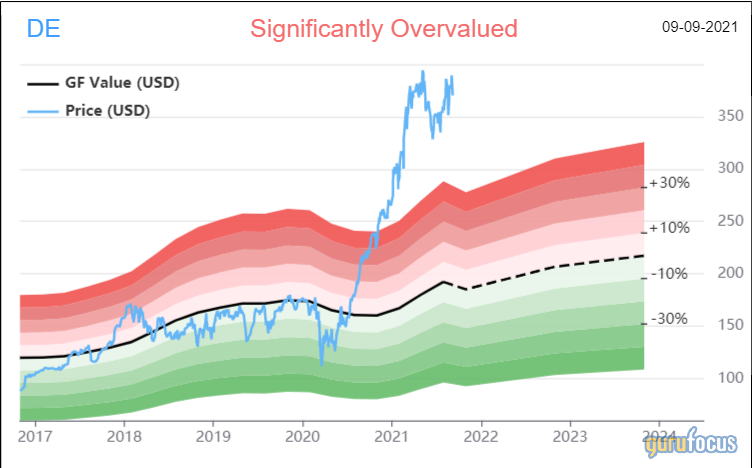

However, Deere looks very expensive based on the GuruFocus Value chart:

With a GF Value estimate of $189.22, Deere has a price-to-GF-Value ratio of 1.96. The stock would need to retreat by nearly half to trade with its GF Value. As a result, Deere receives a rating of significantly overvalued from GuruFocus.

Deere is the largest name in a highly cyclical industry. The company hasn’t been shy about pausing its dividend growth, but does have a decent CAGR over the long-term. The two increases given this year combine for a much higher than usual growth rate, which investors could interpret as a bullish sign from the company. That said, the stock is above its average historical valuation and trades at a premium to its intrinsic value. I would wait for a pullback before adding the stock to my portfolio.

EastGroup Properties

EastGroup Properties, Inc. (EGP, Financial) is an internally managed equity real estate investment trust that provides facilities for distribution and logistics customers. The company has more than 1,550 tenants among its more than 400 industrial properties across 11 states, including California, Florida and Texas. No tenant makes up more than 1% of rental revenues. EastGroup Properties generated revenue of $363 million last year and is valued at $7.3 billion today.

EastGroup Properties increased its dividend almost 14% for the Oct. 15 distribution date. As a result, the trust now has raised its dividend for 11 consecutive years. EastGroup Properties’ dividend has increased with a CAGR of 4% over the last decade, making the most recent raise well above normal.

Shares of EastGroup Properties yield of 2%, which is considerably below the long-term average yield of 3.4%.

Following the recent increase, the new annualized dividend is $3.60. With analysts expecting funds from operation of $5.87 for 2021, EastGroup Properties has a projected payout ratio of 61%. This is just below the average payout ratio of 62% since 2011.

EastGroup Properties’ shares trade hands at $180 presently, equating to a forward price-to-funds-from-operation ratio of 30.7. The stock’s valuation has traded with a higher multiple recently as the five-year average price-earnings ratio is 21.2. Dating back to 2011, the average price-earnigns ratio drops to 19.2. Either way, EastGroup Properties is expensive on a historical basis.

EastGroup Properties is also trading with an elevated valuation according to the GuruFocus Value chart:

EastGroup Properties has a GF Value of $140.40, giving the stock a price-to-GF-Value ratio of 1.28. Shares would need to decline 22% to trade with their estimated intrinsic value. The stock is rated as modestly overvalued.

EastGroup Properties is an interesting name in the REIT industry. The trust is well diversified by tenants and has a presence in some of the largest and fasting growing states in the U.S. This provides EastGroup Properties some protection in case a group of tenants are unable to pay rent or a certain geographic location faces difficulty. The yield is low for a REIT, but the payout ratio is very manageable. For those looking to diversify their REIT holdings, EastGroup Properties could be an interesting opportunity if the stock were to correct.

Final thoughts

Both Deere and EastGroup Properties provided investors with higher than usual dividend growth this past year. In the case of Deere, investors have received two raises this year after seeing the same quarterly dividend for nine quarters in a row. However, the stock is trading at nosebleed levels.

EastGroup Properties is overvalued as well, but not as much. The trust operates a highly diversified business model and sports a low payout ratio.

Both names will remain on my watchlist due to their business models and higher than normal dividend growth rates, but I would wait for a pullback in share price prior to purchasing.