Canaccord Analyst Says It's Time to Get Your Green Mountain Roasters (GMCR, Financial) On, Using the Parallel of Hansen Natural (HANS, Financial).

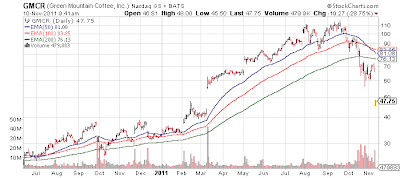

While Monster Energy drinks (via Hansen Natural) have little to do with coffee other than both are caffeinated, Canaccord analyst Scott Van Winkle (no relation to Vanilla Ice aka Rob Van Winkle), is pounding the table this morning after the 30% selloff in after hours yesterday for Green Mountain Roasters (GMCR). One wonders if Mr. Einhorn [Oct 26, 2011: David Einhorn Has Crushed Green Mountain Roasters] is satisfied enough to cover - what a mega jackpot in a short period of time (although his hedge fund is still down on the year).

Notable Calls has the thesis behind the analyst's call:

'...A bear would argue that our (positive) opinion is shaded by our rose colored glasses. Well, we heard people saying the exact same thing in the exact same situation in Hansen Natural (HANS : NASDAQ : $90.09 | HOLD) in May 2010. We remember this so clearly because the HANS correction last May was the greatest buying opportunity we have ever seem on a timing issue around a price increase and the greatest miss we have ever had as a sell-side analyst. HANS instituted a price increase in January 2010 that led to massive buying by distributors ahead of the increase and even though the company knew there was a channel load, it didn’t realize how significant the buy-ahead was. Sound familiar? The result was that HANS crushed Q4/2009 results and then missed the subsequent Q1/2010 estimates by an even wider margin than GMCR’s relatively modest miss last night. HANS shares plummeted from near $45 to as low as $25 intraday.

The stock plummeted on an apparent slowing. Yet, third-party data from the likes of Nielsen and IRI continued to show robust growth at point of sale. Sound familiar? GMCR just put up a figure that will lead some investors to think business is slowing. It isn’t, in our view, because the third-party data from the likes of Nielsen and IRI, but more importantly NPD on brewers, show continued growth and even accelerated growth of brewers. For those who follow consumer staples, we don’t need to remind you what happened next with HANS. It is obvious in hindsight. Growth continued, shipments caught back up to the sell-through data in the next quarter, and HANS went on an extended rally to close yesterday at $90.09 ($97.31 is the recent high). If you dumped HANS on the miss, you missed a triple. This may not sound familiar yet for GMCR, but we expect it will....'

-------------------------

Mark's note - to be clear, while there might be some similarities, GMCR is being attacked by one of the world's foremost short sellers for things such as accounting irregularities so the issues are of a different nature than just disappointing the street (as HANS was experiencing). That said, Green Mountains Roasters is a functioning business and at some price there is value.

That said, the Einhorn short mojo continues to be the kiss of death for most any stock he targets.

No position