Etsy Inc. (ETSY, Financial) is one of the leading global online marketplaces for handmade and vintage goods. The company has had a tremendous growth trajectory that has been both organic as well as a function of smart acquisitions. The company has expanded its e-commerce ecosystem as well as its product uniqueness through acquisitions like Elo7, a Brazil-based handmade goods marketplace, and Depop, a second-hand fashion reseller. These acquisitions helped Etsy to expand its product categories as well as worldwide reach. The company is trying to make the most of the booming e-commerce macro trend and possesses strong network effects. Let us take a deep dive into its key growth drivers and see if the stock is worth buying at current levels.

Recent financial performance

Etsy reported a strong quarterly result surpassing Wall Street expectations for the period ended June 30. The company’s top-line of $528.90 million implied 23.36% growth as compared to the $428.74 million in revenue reported in the corresponding quarter of 2020. The company beat the analyst consensus estimate of $525.51 million on the revenue front.

These revenues translated into a gross margin of 71.83% and an operating margin of 18.73%, which were lower than in the same quarter of last year.

Etsy reported net income of $98.25 million, and adjusted earnings per share (EPS) of 68 cents came in 4 cents above the average Wall Street expectation.

Moreover, the company generated $121.70 million in the form of operating cash flows and spent $100.81 million in investing activities during the quarter, leaving the company with positive free cash flow.

Strong network effects

A growing user base means the business is using network effect to grow its economic moat. More sellers attract more buyers, and vice versa. In the most recent quarter, its active buyers increased by a staggering 50.1% year over year to 90.5 million whereas the number of active sellers grew by 66.7% year over year to 5.2 million.

This significant growth and its product uniqueness show that it is extremely difficult for a new entrant to compete with Etsy’s scale, and it does create a kind of barrier to entry for potential competitors. It is worth highlighting that 88% of Etsy’s buyers reported that the marketplace is full of necessary items that they cannot find anywhere else.

Additionally, an eye-popping stat is that the company’s habitual buyers with six or more purchase days or at least $200 in spending over the last twelve months increased by 115% in the second quarter of 2021 compared to the previous year. This indicates that the average spending on the platform is going up, which is a major green flag.

Etsy is also offering more tools to its sellers, such as Etsy Payments and Etsy Ads, in order to extract more value for the business. It has increased its take rate to a healthy 17.4%, up from 15.9% in the second quarter of 2020. Overall, we can say that more users and a higher take rate are tell-tale indications of how strong Etsy’s offerings are.

Excellent growth prospects

The pandemic has helped several e-commerce companies to multiply their revenues as a result of a spike in online shopping. Large companies have also embraced a strong e-commerce strategy, which has helped them survive in the lockdown phase. Etsy is making the most of these digitization trends, carving out a niche for itself to stand out amongst its competitors.

The company primarily serves as a platform for third-party sellers that offer unique, custom, vintage and handmade goods that are durable, unique and often impossible to find anywhere else, helping to build a competitive advantage along with strong network effects.

The company’s gross merchandise value (GMV) of $3.04 billion also grew by 13.1% as compared to the last year. The company’s addressable market size could be as large as $1.7 trillion, and the company believes it still has a long way to go, so the growth story could continue for a while.

Final thoughts

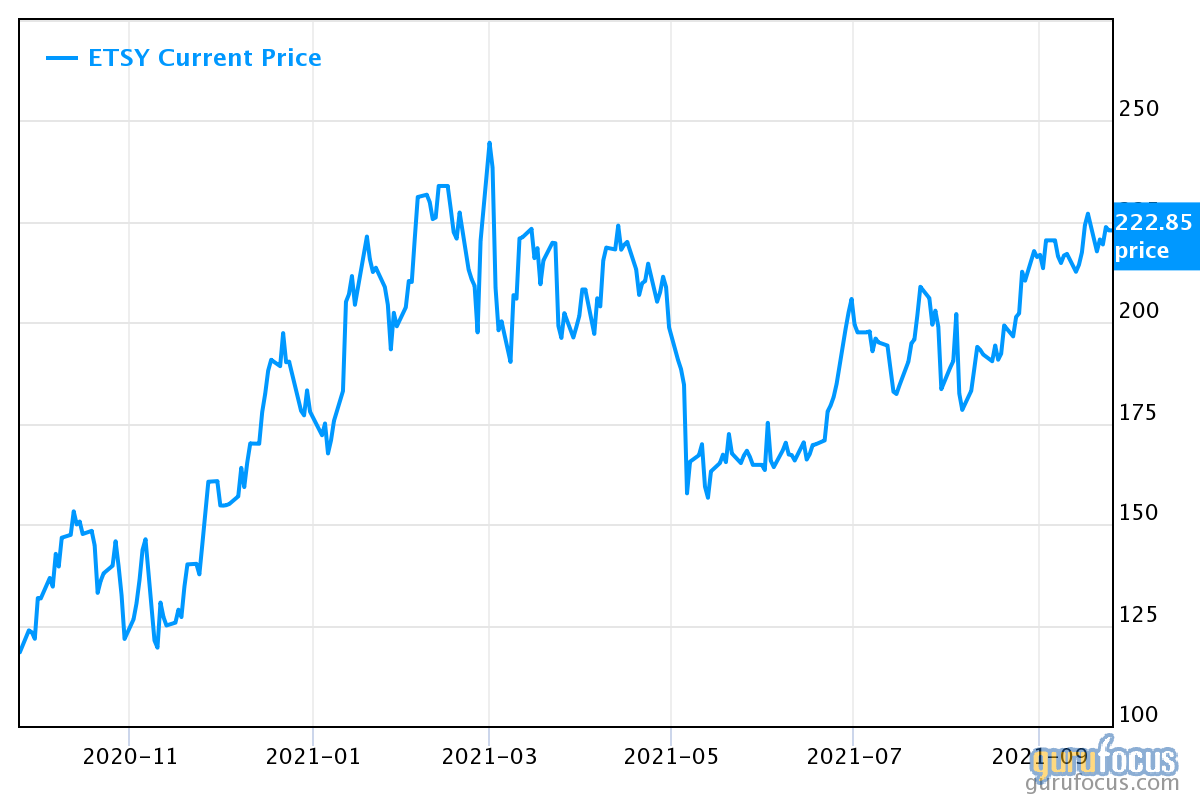

As we can see in the above chart, Etsy’s stock has had a rather volatile trajectory, but has shown a significant jump in the past year. While the Covid-19 pandemic certainly uplifted its business as people flocked to the website to make purchases rather than buying things in physical stores, it is worth highlighting that even before these tailwinds, Etsy’s revenue had increased by a staggering 318% from 2014 to 2019. In this pre-pandemic five-year period, the company was also able to convert its net loss of $15 million to a bottom-line profit of $96 million. Hence, it can easily be said that Etsy is far from being just a pandemic-fueled stock. With the e-commerce boom expected to continue, coupled with the high volatility of Etsy’s stock, I believe that a buy-on-dips approach could be suitable for Etsy’s stock, particularly with respect to e-commerce investors with an above-average risk appetite.