Barrick Gold Corp. (GOLD, Financial) has struggled in recent years, but restructurings could resurrect results and subsequently drive the share price higher.

What has changed

Barrick's transition started in 2019, when it merged with Randgold and brought in Mark Bristow as the new CEO. The gold miner has improved its revenue ever since with a current three-year compound annual growth rate of 17.93%.

Shortly after the Randgold merger, Barrick entered a joint-venture with Newmont Corp. (NEM, Financial) to form Nevada Gold Mines. Barrick owns 68% of the project, which focuses on deep-pit and open-cast gold mining in northern Nevada.

The Nevada Gold Mines venture was hit with maintenance earlier this year after operations got halted in 2020. The emphasis is on greenfield and brownfield exploration; the mine is thought of by many as a potential cash cow for Barrick, which could see the company become the world's leading gold producer.

Key metrics

Barrick has delivered its balance sheet significantly in recent years, while also managing to improve on its cost of capital and return on invested capital ratios.

The ROIC is usually an indicator of competitive advantage, so the company has clearly been climbing in recent times.

With a lower debt-to-equity ratio, Barrick's stock will have a better pass through to equity holders who are demanding residual.

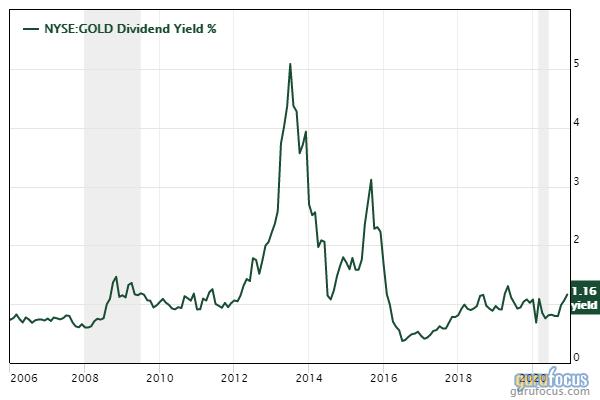

Furthermore, a rising dividend yield is a consequence of the improvement in investor residual. It is thought of by many analysts as beneficial to have a high dividend-paying value stock in your portfolio going into 2022 with rising yields on the horizon.

Valuation

Barrick Gold’s price-earnings ratio of 13.46 is currently trading 53.34% below its five-year average and 16.18% below the sector average. If you couple this with 48.28% year-over-year growth in levered free cash flow, you would be able to conclude that a one-year decline in stock price of roughly 35% is very much unjustified.

From an absolute valuation vantage point, you’d find that an asset-based valuation will present you with a fair stock value of $22.71, roughly 26% above its current market price.

Michael Jalonen of Bank of America set a price target of $29 on Barrick Gold's stock. Most Wall Street analysts expect the stock to reach significant heights and at least test the $26 handle within the next 12 months.

Final word

Barrick Gold is a great value play at the moment; the company has restructured well with its Randgold merger and Nevada Gold Mines exploits. A 35% decrease over the past year is entirely unjustified, so the miner is a genuine dip-buying opportunity.