According to the All-in-One Screener and guru portfolio statistics, two of GuruFocus’ popular Premium features, Chase Coleman (Trades, Portfolio)’s Tiger Global Management has five technology holdings that have outperformed the Standard & Poor’s 500 benchmark by more than 65% over the past six months: Asana Inc. (ASAN, Financial), Atlassian Corp. PLC (TEAM, Financial), DigitalOcean Holdings Inc. (DOCN, Financial), Cloudflare Inc. (NET, Financial) and Datadog Inc. (DDOG, Financial).

Tech shares sour as Treasury yields increase

On Monday, the tech-heavy Nasdaq Composite Index closed at 14,969.97, down 77.73 points from the previous close of 15,047.70.

Tech shares were pressured as Treasury yields increased on economic optimism and inflation fears: The 10-year Treasury constant maturity rate stood at 1.47%, close to a three-month high and up from the August high of 1.36%.

Economic optimism stemmed from declining new U.S. coronavirus cases: According to Johns Hopkins University statistics, the seven-day average of new cases stood at approximately 120,000 last week, down from the early September peak of 166,000 cases.

Tiger Global’s portfolio contains several high-performing tech stocks

A former protégé of Tiger Management leader Julian Robertson (Trades, Portfolio), Coleman established Tiger Global as an investment firm that primarily focuses on small caps and technology stocks. The New York-based firm seeks to invest in high-quality companies with strong management teams and the potential to benefit from powerful secular growth trends.

As of June 30, Tiger Global’s $53.76 billion equity portfolio has a 46.43% weight in technology, its largest sector in terms of portfolio weight.

According to the Aggregated Statistics chart, a new feature of GuruFocus, Coleman’s technology holdings have a median six-month total return of 5.12%, with a mean of 5.80%.

Asana

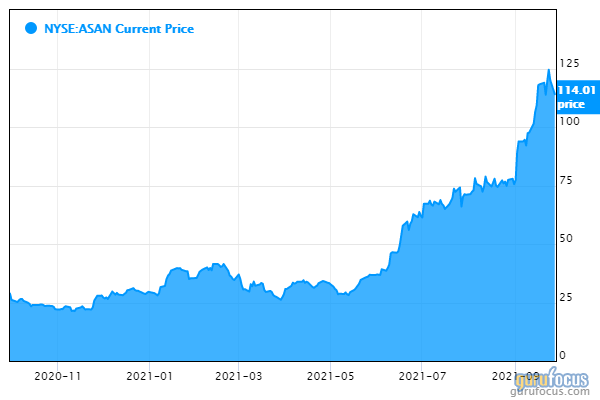

Shares of Asana Inc. (ASAN, Financial) traded around $115.92, up approximately 326.66% over the past six months and outperforming the S&P 500 benchmark by approximately 311.36%.

The San Francisco-based software company provides a platform for work management, allowing teams to orchestrate daily tasks. According to GuruFocus, the company’s cash-to-debt ratio of 1.49 underperforms approximately 63% of global competitors.

Other gurus with holdings in Asana include Al Gore (Trades, Portfolio)’s Generation Investment Management and Paul Tudor Jones (Trades, Portfolio)’ Tudor Investment.

Atlassian

Shares of Atlassian (TEAM, Financial) traded around $391.44, up approximately 96.70% over the past six months and outperforming the S&P 500 by approximately 81.40%.

GuruFocus ranks the Australian software company’s financial strength 5 out of 10 on the back of debt ratios underperforming more than 90% of global competitors despite the company having a double-digit Altman Z-score.

DigitalOcean

Shares of DigitalOcean (DOCN, Financial) traded around $81.06, up approximately 94.21% over the past six months and outperforming the S&P 500 by approximately 78.91%.

GuruFocus ranks the New York-based cloud computing company’s financial strength 7 out of 10 on several positive investing signs, which include no long-term debt and a double-digit Altman Z-score.

Cloudflare

Shares of Cloudflare (NET, Financial) traded around $122.82, up approximately 92.19% over the past six months and outperforming the S&P 500 by approximately 76.89%.

GuruFocus ranks the San Francisco-based cloud software company’s financial strength 5 out of 10 on the back of cash-to-debt and equity-to-asset ratios languishing around the industry median ratios.

Datadog

Shares of Datadog (DDOG, Financial) traded around $141.49, up approximately 81.29% over the past six months and outperforming the S&P 500 by approximately 65.99%.

GuruFocus ranks the New York-based monitoring and analytics software company’s financial strength 5 out of 10 on the back of cash-to-debt ratios underperforming more than 54% of global competitors despite the company having a double-digit Altman Z-score.