GuruFocus had the pleasure of hosting another presentation from Dave Sather, the president of Sather Financial Group.

Sather Financial was founded in 1999 as a fee-only RIA. The firm now manages approximately $1.3 billion in separately managed accounts.

In addition to his work with Sather Financial, he developed and leads the Bulldog Investment Company internship at Texas Lutheran University. The student managed investment fund has averaged more than 19% per year over the last 12 years. Sather also chairs the investment committee, is a member of the Business Department's executive advisory council and the board of regents.

Watch the full presentation here:

Key takeaways

Sather kicked off his presentation with a brief introduction to Sather Financial Group, which is in its 23rd year of operations. The firm offers fee-only investment management and strategic planning services and has grown organically through word of mouth over the years.

He then turned to a review of the last 18 months and laid out some of the realizations that have come out of the pandemic. Here he discussed his idea of good companies versus “battleships.” He explained that these battleship companies are those that can weather the hardships of the pandemic without going under. He continued to say that he sold multiple good companies during the pandemic that were subject to new risks.

From there he transitioned to the current market and his thoughts on inflation and currencies. His first target was inflation, which he explained has drastically different impacts for clients in different parts of their lives. For example, a young family looking to buy a house has different concerns about inflation than someone who is retired.

Sather’s conclusions on inflation came down to the simple idea that there is no way to accurately predict it. Instead, he prefers to allocate capital to companies that he knows have the ability to offset inflation and will do well over time.

He also took a moment to dive into the question of debasement of the U.S. dollar, which he said is often asked by clients. He explained that the dollar has lost value over time consistently, but that the world is not going to end and the dollar will not cease to be worth anything. The majority of transactions around the world are finalized in dollars and many companies with international operations also utilize the dollar for their financials. Sather concluded that the dollar is going to hang tough and continue to be used around the world.

The second half of Sather’s presentation smashed through the majority of topics that have dominated headlines over the last few months. He hit on cryptocurrencies, blockchain, antitrust lawsuits, electric vehicles, China, ESG initiatives and the ongoing debate of active versus passive management.

He concluded his presentation materials by summarizing the firm’s disciplined approach to long-term investments and the benefits of living in rural Texas, where he has the privilege of easily tuning out the noise from the rest of the world.

Stocks

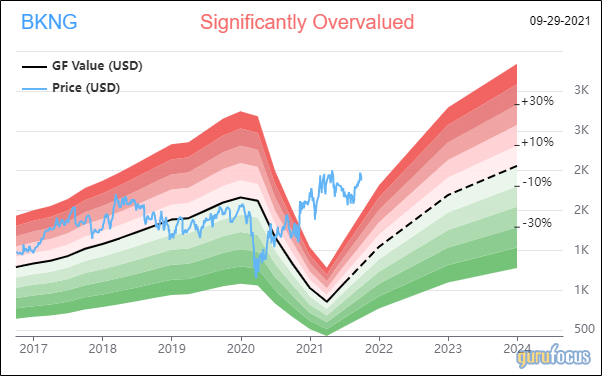

Sather used stock examples throughout his presentation to drive home his key points. During his 18-month review, he highlighted Booking Holdings Inc. (BKNG, Financial) and The Walt Disney Co. (DIS, Financial) as two companies that the firm sold during the pandemic. Both of these companies saw increased Covid-related risks that could affect them over short and long-term periods.

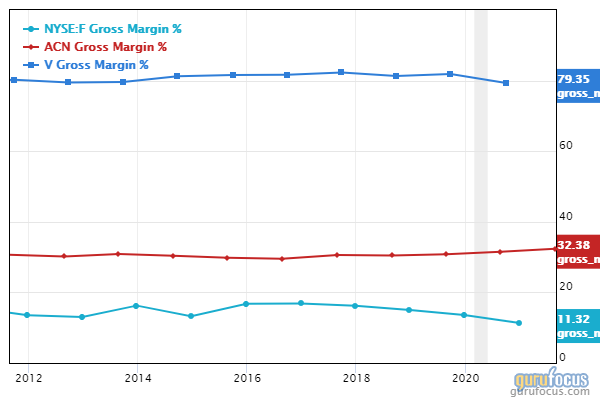

While speaking on inflation, Sather hit on the gross margin differences between Ford Motor Co. (F, Financial), Accenture PLC (ACN, Financial) and Visa Inc. (V, Financial). He explained that both Accenture and Visa have maintained stable gross margins that show him they can offset the effects of inflation.

Questions

One question asked Sather if there were any stocks he was excited about and he immediately jumped into Lockheed Martin Corp. (LMT, Financial). He explained that the entire aerospace and defense industry has sentimental ties for him as his roommate from college works for Lockheed and his dad developed rocket systems for Raytheon Technologies Corp. (RTX, Financial).

He explained that Lockheed operates in a unique space as a manufacturing company and a technology company. The business is also lucky enough to maintain contracts that last upwards of 30 years, which has created a massive moat and incredibly long runways.

Lockheed also has an unseen advantage through its ties to other nations that are allied with the United States. While the U.S. has phased out certain aircraft like the F16, updated versions are sold around the globe with a stamp of approval from the U.S. for its allies. Sather concluded that these agreements are never seen in the balance sheet of Lockheed, but will drive sales for decades to come.