When the operating income margin continues to expand, it means a company is becoming more efficient in generating profits from its operating activities.

The operating income margin is a more effective measure than the net income margin when appraising whether a company can generate income, as the metric excludes those items on which it has no or limited control, but that could weigh on the net income notably in some years.

Thus, investors may want to consider the four stocks listed below, as their operating income margins have expanded in recent years.

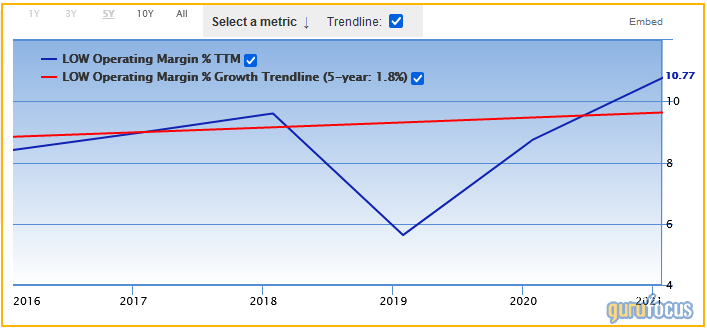

Lowe's Companies

The first stock that investors may want to consider is Lowe's Companies Inc. (LOW, Financial), a Mooresville, North Carolina-based home improvement retailer in North America and Mexico.

The company saw its trailing 12-month operating income margin (10.77% as of the most recent full fiscal year) grow by 1.8% on average every year over the past five years.

The share price increased by 193% over the past five years to close at $207.90 on Thursday for a market capitalization of $143.96 billion.

Lowe's Companies will pay a quarterly dividend of 80 cents per common share on Nov. 3 for a forward dividend yield of 1.53% as of Oct. 7.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $232 per share.

Vanguard Group dominates the group of top fund holders with 8.39% of shares outstanding. It is followed by BlackRock Inc. with 7.19% of shares outstanding and State Street Corp. with 4.36% of shares outstanding.

Charter Communications

The second stock that investors may want to consider is Charter Communications Inc. (CHTR, Financial), a Stamford, Connecticut-based telecommunications company.

The company saw its trailing 12-month operating income margin (17.6% as of the most recent full fiscal year) grow by 7.5% on average every year over the past five years.

The share price of $741.95 at close on Thursday has risen by 177% over the past five years for a market capitalization of $136.39 billion.

Currently, Charter Communications Inc does not pay dividends.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $840.85 per share.

TCI Fund Management Ltd is the leader in the group of top fund holders of the company with 5.65% of shares outstanding, followed by Capital International Investors with 5.59% of shares outstanding and VANGUARD GROUP INC with 5.35% of shares outstanding.

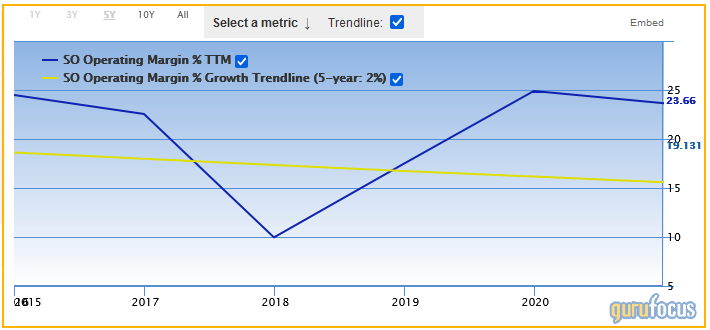

The Southern Co

The third stock that investors may want to consider is The Southern Co. (SO, Financial), an Atlanta, Georgia-based regulated gas and electric utility company.

The company saw its trailing 12-month operating income margin (23.66% as of the most recent full fiscal year) grow by 2% on average every year over the past five years.

The share price has risen by 26% over the past five years to trade at $62.67 at close on Thursday for a market capitalization of $66.36 billion.

The Southern Co paid a quarterly dividend of 66 cents per common share on Sept. 7 for a forward dividend yield of 4.2% as of Oct. 7.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $67.44 per share.

VANGUARD GROUP INC is the leader in the group of top fund holders with 8.52% of shares outstanding. It is followed by BlackRock Inc. with 7.09% of shares outstanding and STATE STREET CORP with 4.91% of shares outstanding.

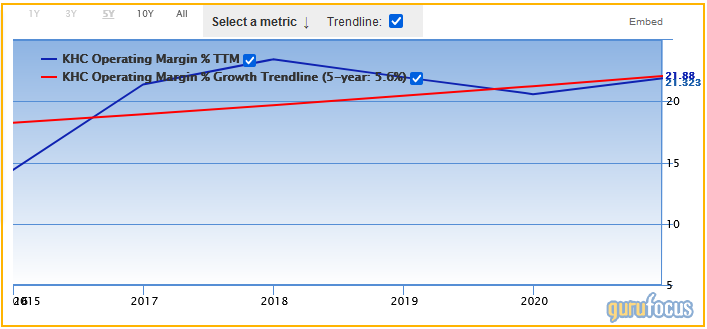

The Kraft Heinz Co

The fourth stock that investors could be interested in is The Kraft Heinz Co. (KHC, Financial), a Pittsburgh-based international manufacturer and marketer of food and beverage products.

The company saw its trailing 12-month operating income margin (21.88% as of the most recent full fiscal year) grow by 5.6% on average every year over the past five years.

The share price lost 58% over the past five years, but it is on the rise again over the past year, recovering 20%. It traded at $37.08 at close on Thursday for a market capitalization of $45.36 billion.

The Kraft Heinz Co paid a quarterly dividend of 40 cents per common share on Sept. 24 for a forward dividend yield of 4.33% as of Oct. 7.

On Wall Street, the stock has a median recommendation rating of hold with an average target price of $40.79 per share.

Warren Buffett (Trades, Portfolio) is the leader in the group of top fund holders with 26.62% of shares outstanding, followed by VANGUARD GROUP INC with 4.39% of shares outstanding and BlackRock Inc. with 3.65% of shares outstanding.

Disclosure: I have no positions in any securities mentioned in this article.

Also check out: