Key Points

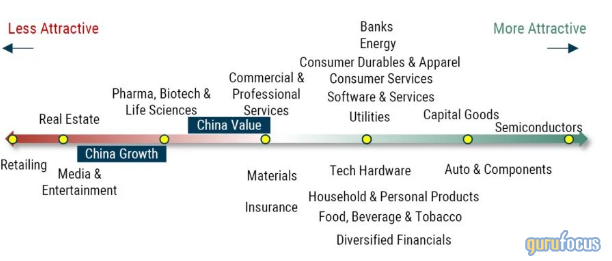

- When we apply our top-down lens to China, we see a method to their regulatory madness. So we created an analytical framework to identify the future winners and losers of Chinese government intervention. Based on our framework, we believe that the growthy sectors (e.g., retail, real estate, and entertainment) will be more negatively impacted, while the more value-oriented sectors (e.g., semiconductors, capital goods, and autos) are positioned to benefit.

GROWTH SECTORS MORE AT RISK THAN VALUE SECTORS

Source: GMO

- Our framework also suggests that it will be the ability to align with the government’s new strategic objectives, not pro- versus anti-capitalism sentiment, that will drive success. If done well, we think mid-to-small caps will flourish as mega caps are prevented from engaging in anti-competitive behaviors. If done poorly, it could sap the morale of entrepreneurs, and common prosperity may instead lead to common poverty.

- Many of our conversations with clients have revolved around two major themes: 1) They have too much China exposure, or 2) China is a lot riskier than they thought. Investors want exposure to the elements of emerging markets that they like, but without the baggage of a 35% (or more) allocation to China.

- Local economic forces have a greater impact on individual stock prices in emerging countries than they do in developed countries. We reflect this by incorporating country and sector specific signals, and by emphasizing country and sector allocation in our process. This top-down approach becomes particularly beneficial when the stock selection dimension shrinks. A bottom-up stock selection approach that excludes China will lose about 40% of its opportunity set (i.e., the proportion of EM stocks that are Chinese). A top-down approach, on the other hand, will lose just 1 of 27 opportunities along the country dimension and nothing along the sector dimension.

Continue reading here.

Also check out: