Hey... this is not supposed to happen. We're talking the impervious high end consumer...

Despite fantastic earnings growth of 63% year over year, a 'miss' in guidance versus the analysts $1.63 (TIF forecasted $1.48 to $1.58) has the stock down some 9%. The stock currently sits at about 18x year end (Jan 2012) estimates, post selloff.

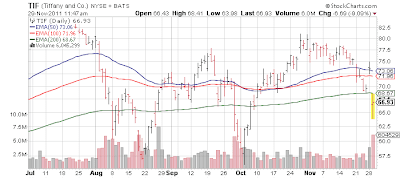

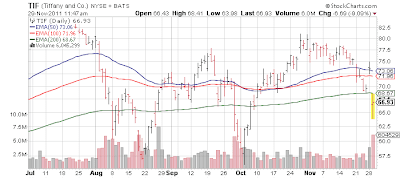

The last 2 times Tiffany (TIF, Financial) broke support, buyers were quick to come in bargain hunting.

Via Reuters:

No position

Despite fantastic earnings growth of 63% year over year, a 'miss' in guidance versus the analysts $1.63 (TIF forecasted $1.48 to $1.58) has the stock down some 9%. The stock currently sits at about 18x year end (Jan 2012) estimates, post selloff.

The last 2 times Tiffany (TIF, Financial) broke support, buyers were quick to come in bargain hunting.

Via Reuters:

- Concerns about slowing sales momentum took some of the luster off Tiffany & Co's stock amid signs that European and U.S. economic distress are weighing on luxury consumers. The upscale jeweler, a stock market darling for how fast its international business has grown, reported third-quarter earnings that beat analysts' estimates but gave a holiday-quarter profit and sales outlook that missed Wall Street expectations.

- Chief Executive Michael Kowalski said in a statement there had been "recent sales weaknesses in Europe and in the eastern part of the U.S."

- And the company said there is reason to be cautious. Chief Financial Officer Pat McGuiness told analysts on a conference call that Tiffany is "cognizant of the challenging economic conditions and uncertainties in a number of markets."

- Globally, Tiffany's sales in the third quarter were up 17 percent in the third quarter, excluding the impact of currency translation. But that is below the 19 percent pace of the first three quarters combined.

- The slowdown was limited to the Americas and Europe, which together make up nearly 60 percent of Tiffany's business. In Japan, its second biggest market, and elsewhere in Asia, the pace picked up.

- Another concern is that gross margin, a measure of profitability on jewelry sold, slipped, Swinand said. Tiffany's gross margin edged down 0.6 point to 57.9 percent in the third quarter, largely because it sold more pricey jewelry, which the company said has lower margins. The markup of very-high-end jewelry is typically lower, analysts said. (that is a shocker to me - one would think the markup on very high end jewelry would be the best, as those consumers are least price sensitive)

- Tiffany expects sales to rise at a low-teens percentage rate for the holiday quarter. In the third quarter, sales at stores open at least a year, excluding the effect of currency translations, rose 16 percent.

- Tiffany said it expects fourth quarter earnings per share of $1.48 to $1.58, below the $1.63 Wall Street analysts were expecting, according to Thomson Reuters I/B/E/S.

- Tiffany reported net income of $89.7 million, or 70 cents per share, for the third quarter ended Oct. 31, up from $55.1 million, or 43 cents per share, a year earlier and above the 61 cents a share that analysts were expecting, according to Thomson Reuters I/B/E/S.

No position