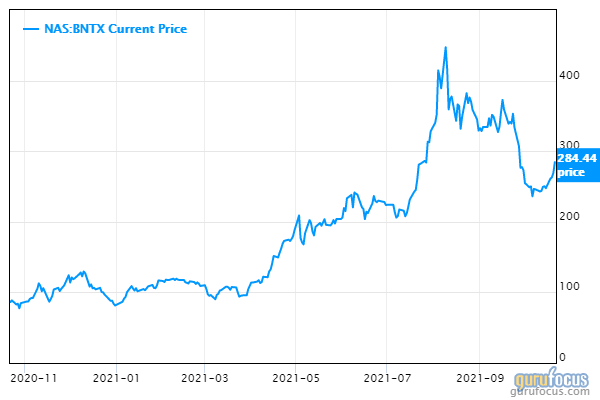

On the strength of the Covid-19 vaccine it co-developed with Pfizer Inc. (PFE, Financial), BioNTech SE (BNTX, Financial) shares rose about 200% in the past year, making it one of the top European biotech stocks cited by Labiotech.eu.

2021 has been a breakout year for Germany-based BioNTech, well-known in Europe for its work with a wide range of technologies. It gained worldwide recognition when, together with Pfizer, it became the first to market with an mRNA Covid-19 vaccine, gaining a high profile for RNA therapeutics.

BioNTech isn’t resting on its laurels. The company recently announced the first colorectal cancer patient has been treated with its individualized mRNA cancer vaccine in a phase 2 clinical trial. The trial assessed the efficacy of its vaccine compared to simply monitoring the patient’s status after surgery and chemotherapy. If successful, the vaccine would fulfill a dire need, considering colorectal cancer is the third-most common cancer diagnosed in both men and women each year in the United States, excluding skin cancer. This year, an estimated 150,000 adults in the U.S. will be diagnosed with the disease.

As a result of its surge over the past 12 months, BioNTech now sports a market cap of nearly $65 billion, putting it in the 25th position of all pharmaceutical companies as measured by valuation. Analysts have the stock—currently trading at over $268--between a buy and a hold with an average target price of $332 and a high of $450, reported Yahoo Finance.

Investors would be wise to consider biotechs operating outside the U.S. Europe continues to house world-class science compared with China and the U.S., according to a study by the international consulting firm McKinsey. Forty-three percent of the global top 100 life science universities are located in Europe, compared with 34% in the U.S.

McKinsey reported that from January 2020 until the end of May 2021, the growth rate of European biotechs outpaced those listed in the U.S., an increase of 22% compared to 2%. Both those percentages paled next to the nearly 100% gain of Chinese companies. As evidence of growing investor interest in Europe’s biotechs, financing increased markedly over global benchmarks in 2020.

Other publicly traded European biotechs cited by Labiotech are:

| Company | 1-year % increase/decrease in share price | Market Value ($ billions) |

| AB Science S.A. (ABSCF) | +23% | $638 million |

| argenx SE (ARGX, Financial) | +19% | $1.6 billion |

| Carbios SAS (ALCRB.PA) | +27% | $578 million |

| COMPASS Pathways plc (CMPS, Financial) | -7% | $1.5 billion |

| CureVac N.V. (CVAC, Financial) | -17% | $7.5 billion |

| CRISPR Therapeutics AG (CRSP, Financial) | +8% | $7.4 billion |

| DBV Technologies S.A. (DBVT, Financial) | +250% | $619 million |

| Exscientia plc (EXAI, Financial) | Recently listed | $2.5 billion |

| Freeline Therapeutics Holdings plc (FRLN, Financial) | -82% | $116 million |

| Genmab A/S (GMAB.CO) | +32% | $30 billion |

| Orchard Therapeutics plc (ORTX, Financial) | -50% | $369 million |

| Oryzon Genomics S.A. (ORY.MC) | Flat | $218 million |

| SOPHiA GENETICS SA (SOPH, Financial) | Recently listed | $1.2 billion |