Shareholders of Teva Pharmaceutical Industries (TEVA, Financial) thave now taken a multi-year beating. Since the company hit an all-time high in 2015 and bit off more than it can chew, over-paying for the Actavis acquisition, the company has gone from bad to worse. It got caught up in a generic price fixing scandal, then the opioid scandal. Also, Copaxone, Teva's flagship patented product, was genericized. The generic market has also changed with the FDA approving generics faster and large buying groups consolidating power to drive down prices faster after a drug product loses exclusivity.

The company now appears to finally be turning the corner. Well, at least the stock price has stabilized, even though many of the key metrics are still heading south. Are there any green shoots? Let’s take a closer look.

About the company

Teva Pharmaceutical Industries is an Israeli company doing business globally. Its core business is generic drugs, which is low-margin, but it has patented some of its own drugs in the past, and it is trying mightily with some success to move into more patented and higher-margin products.

It reports in four segments - North America, Europe, International and Other Activities. The following chart shows the sales for the four segments further broken down by product type. Generics constitute about 65% of Teva's total revenue.

Copaxone is Teva's flagship drug for multiple sclerosis which has now been genericized. It once had annual sales of $4 billion, which is now down to $1 billion and declining. Copaxone is a synthetic protein made up of a combination of four amino acids that chemically resemble a component of myelin (the insulating material that protects nerves and helps them work properly). Copaxone induces the production of immune cells that are less damaging to myelin.

Sales from Bendeka, Teva's drug for chronic lymphocytic leukemia, are declining due recent FDA approval of Eagle Pharmaceuticals' (EGRX) Belrapzo, which will likely become the physicians' preferred treatment over Teva's Bendeka because Belrapzo takes less time to administer, making it more convenient for both patients and physicians. Unlike Teva's Bendeka, it can be used in tubes or syringes containing Acrylonitrile Butadiene Styrene or "ABS," a polymer plastic used in disposable medical tubing, thus not restricting the hospital's usual consumable choices.

Teva has some more proprietary drugs like Austendo for Huntington's disease, but it is also expected to face generic completion soon. Ajovy, a migraine medication, which is a biologic (fully humanized monoclonal antibody), is growing well. Teva has launched an auto-injector for Ajovy, which should help sales with patients being able to self-inject. However, Teva and Eli Lilly (LLY, Financial) are litigating patents associated with the technology.

In 2018, the FDA also approved Celltrion (XKRX:068270, Financial) licensed rituximab biosimilar Truxima (rituximab-abbs). The biosimilar, referencing Rituxan, has been approved to treat adults with CD20-positive, B-cell non-Hodgkin lymphoma (NHL) either as monotherapy or in combination with chemotherapy. Truxima has reached 24% market share by end of 2020 and is the only rituximab biosimilar also indicated for rheumatoid arthritis (RA). Kare Shultz, Teva's CEO, has identified biosimilars as key plank for Teva going forward. Teva has 11 biosimilar opportunities in its pipeline, including a Humira biosimilar under regulatory review (Humira is the highest grossing drug in the world). Biosimilars are much more profitable than small molecule generics, since they are difficult to develop, and many cases require full blown phase 3 pivotal clinical trials to get regulatory approvals.

The chart below uses a starting point of 2016 (indexed at 100) and follows the various metrics over time to the present, a period of 4.5 years. Revenue (red line) has dropped from an index of 100 to 65, representing a drop of 35%. So has total debt - which is about the only good thing. All other metrics like book value (BV), Operating Cash Flow (OCF) and Free Cash Flow (FCF) are still heading down, while GAAP earnings are so far down in the basement that they are not even worth charting, However, the stock price (green line) appears to have stabilized at an index of around 25. Since markets are forward-looking, it appears that investors are anticipating that things are about to stop getting worse.

One thing to note is that the company is working hard to get long term debt under control and has paid down over $10 billion in debt, going from debt of $32.5 billion in 2016 to about $21.6 billion now. The company is paying down debt at a rate of over $2 billion a year.

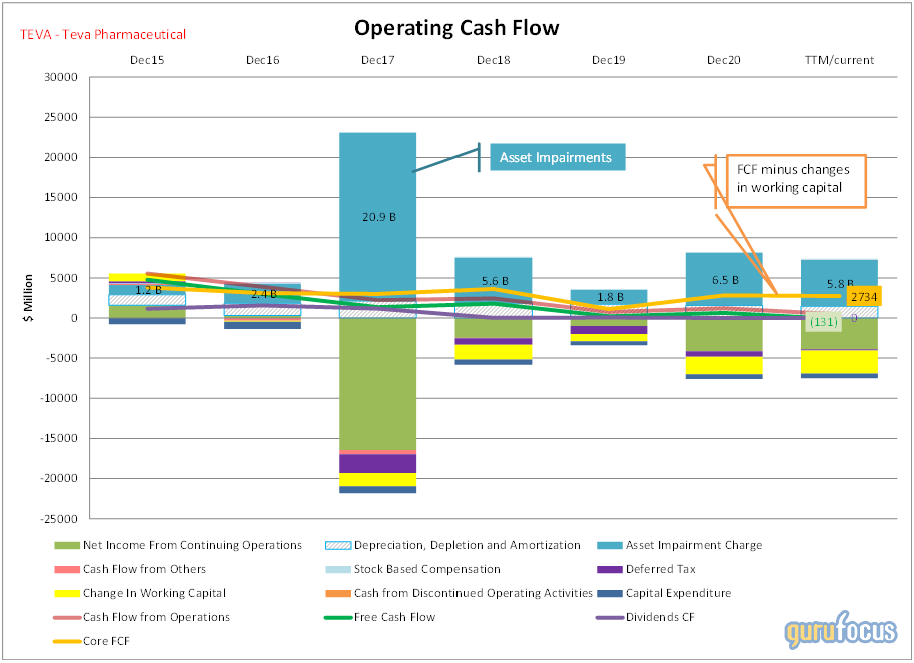

The company has been taking massive asset impairment charges over the last five years, as seen in the operating cash flow chart given below. Asset Impairment is shown as teal bars. However, the company's core free cash flow (Core FCF), shown by the orange line, is quite healthy. I calculate Core FCF as "FCF minus changes in operating working capital and deferred taxes." That means that once we get rid of all the "noise" of asset impairment and changes in working capital, etc., the core free cash flow is quite healthy. That explains why the company can pay down the debt at such a healthy pace.

While asset impairment charges are certainly not good, and a result of bad decisions in the past or changed business circumstances, they represent write-off of "sunk costs." It does not have much effect on future earnings and cash flows and for our big picture exercise, we will just ignore this elephant. Following is another index chart similar in concept to the chart above. Here I have shown revenue and stock price and added Core FCF. As we can see, Core FCF (orange line) is strong despite declining revenue and a deeply discounted stock price.

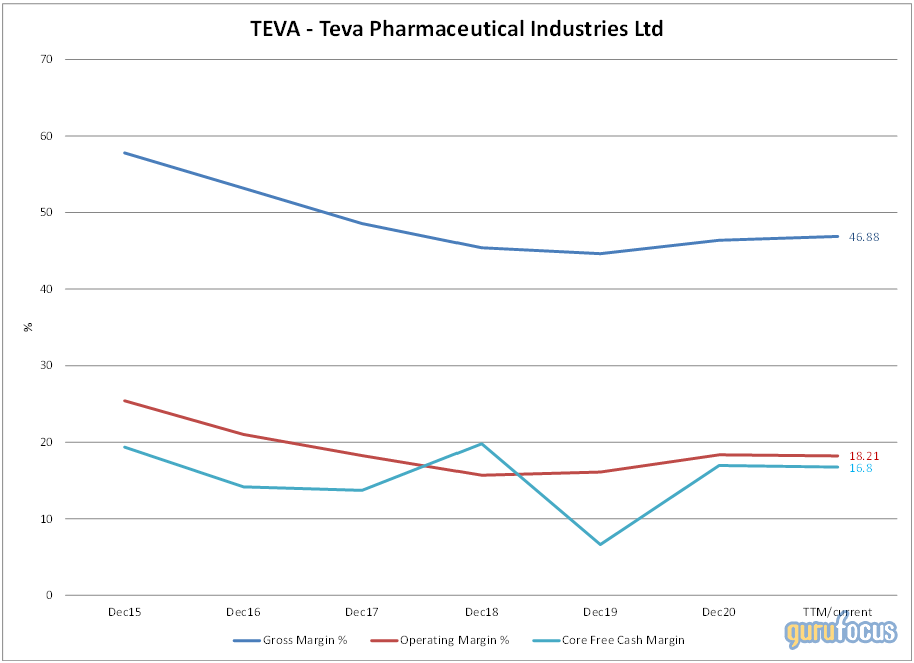

Another metric to watch is the comparison of the gross margin, operating margin and core FCF margin. They are all stabilizing and improving. Note that the operating margins given below are from unadjusted numbers calculated from GuruFocus data and are different from the adjusted numbers reported in the company's press releases.

Two prominent gurus who have taken large positions in Teva at much higher costs are still waiting patiently for recovery. The most famous is of course Warren Buffett (Trades, Portfolio). The presence of these gurus are a great endorsement for us ordinary investors. David Abrams (Trades, Portfolio) is a renowned deep value investor known for taking large, concentrated positions in carefully selected securities. He is known to take positions in beaten down companies with a known catalyst which can in future lead to a re-rating of the stock price.

| Guru | Current No of Shares | % of Shares outstanding | % of Total Assets Managed | Position established in | Average cost |

| Warren Buffett (Trades, Portfolio) | 42,789,295 | 3.88 | 0.14% | 2017 Q4 | $17.62 |

| David Abrams (Trades, Portfolio) | 24,046,356 | 2.18 | 5.29% | 2017 Q3 | $20.97 |

Conclusion

Teva is not a stock for the faint hearted. It's still has a heavy debt load and is quite volatile. But certain key metrics like Core FCF and operating margins are showing that it is coming out of the woodshed, sadder but wiser, minus a limb or two.

In terms of valuation, given the lack of GAAP earnings, I think GuruFocus' Projected FCF method appears to be reasonable. The projected FCF method, which uses 80% of book value plus the present value of six-years normalized Free Cash Flow, is showing a value of ~$22 for the stock. I think the stock should be able to attain that in the next 12 to 18 months. In three to five years, the value could be $30 to $40. This stock has multi-bagger potential, and, like Buffett and Abrams, I am content to take a position and wait it out.