One way to uncover potential value opportunities is to screen the market for stocks that are trading below their Graham Numbers, as such stocks could be trading at a discount to their intrinsic values. The Graham Number is calculated as the square root of "earnings per share times book value per share times 22.5."

Thus, investors could be interested in the following stocks, as they are trading below their Graham Numbers.

Popular Inc

The first stock investors could be interested in is Popular Inc. (BPOP, Financial), a Puerto Rico-based regional bank serving consumers and businesses through 172 branches and 619 ATMs in Puerto Rico, 23 ATMs in the Virgin Islands and 118 ATMs in the United States.

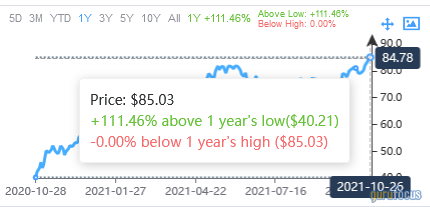

The stock price traded around $85.03 per share at close on Tuesday, which is below the Graham Number of $126.22 as of the June 2021 quarter, for a price-to-Graham-Number ratio of approximately 0.69.

The stock has risen by 111.46% over the past year for a market capitalization of $6.79 billion and a 52-week range of $38.05 to $85.59.

GuruFocus has assigned a score of 3 out of 10 for the company's financial strength and 5 out of 10 for its profitability.

On Wall Street, the stock has a median recommendation rating of buy with an average price target of $96.75 per share.

Berkshire Hathaway Inc

The second stock investors may want to consider is Berkshire Hathaway Inc (BRK.A, Financial) (BRK.B, Financial), an Omaha, Nebraska-based international conglomerate holding company.

At close on Tuesday, the price was $437,890 per share of Class A common stock and $290.85 per share of Class B common stock. The prices are below their respective Graham Numbers of $607,569.75 and $403.55 as of the June 2021 quarter. As a result, the price-to-Graham-Number ratio is 0.72 for class A shares and for class B shares. The market capitalization hovers around $658.49 billion.

The Class A share price has climbed 45.12% over the past 52 weeks, fluctuating between a low of $297,817 and a high of $445,000.

The Class B share price has climbed 44.92% over the past 52 weeks, fluctuating between a low of $197.81 and a high of $295.083.

GuruFocus has assigned a score of 5 out of 10 for the company's financial strength and 7 out of 10 for its profitability.

On Wall Street, the Class A common stock has a median recommendation rating of overweight with an average price target of nearly $437,890 per share, while the Class B common stock has a median recommendation rating of overweight with an average target price of $325.50 per share.

Principal Financial Group Inc

The third company investors may want to consider is Principal Financial Group Inc (PFG, Financial), a Des Moines, Iowa-based diversified insurer that provides businesses, individuals and institutional clients worldwide with asset management, retirement and insurance products and services.

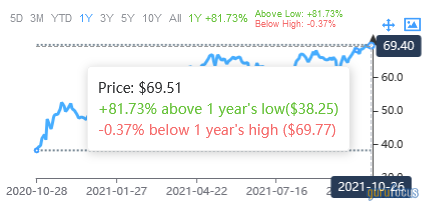

The stock traded around $69.51 per share at close on Tuesday, which is below the Graham Number of $78.63 as of the June 2021 quarter, for a price-to-Graham-Number ratio of 0.88.

The stock has risen 81.73% over the past year for a market capitalization of $18.66 billion and a 52-week range of $37.50 to $70.13.

GuruFocus has assigned a score of 3 out of 10 for the company's financial strength and 5 out of 10 for its profitability.

On Wall Street, the stock has a median recommendation rating of hold with an average price target of $72.30 per share.

Athene Holding Ltd

The fourth stock investors may want to consider is Athene Holding Ltd. (ATH, Financial), a Bermuda-based diversified insurer focusing on retirement savings products for individuals and institutions in the U.S. and Bermuda.

The stock price traded around $89.80 per share at close on Tuesday, which is below the Graham Number of $208.37 as of the June 2021 quarter, for a price-to-Graham-Number ratio of approximately 0.43.

The stock has risen by 191.6% over the past year for a market capitalization of $17.24 billion and a 52-week range of $30.05 to $91.26.

GuruFocus has assigned a score of 4 out of 10 for the company's financial strength and 5 out of 10 for its profitability.

On Wall Street, the stock has a median recommendation rating of overweight with an average price target of $72.61 per share.