Bestinfond (Trades, Portfolio), which is part of Spanish investment firm Bestinver, recently disclosed its portfolio updates for the third quarter of 2021, which ended on Sept. 30.

Managed by Beltran de la Lastra, the fund’s strategy seeks long-term capital appreciation through value opportunities in the markets, following in the footsteps of Benjamin Graham, Peter Lynch and Warren Buffett (Trades, Portfolio). It also utilizes the Austrian theory of economic cycles, which views cycles as a consequence of the artificial expansion of monetary supply and manipulation of interest rates by central banks or fractional reserve banks.

Based on its investing criteria, the fund’s top five buys for the quarter were Siemens Energy AG (XTER:ENR, Financial), Just Eat Takeaway.com NV (XAMS:TKWY, Financial), Royal Dutch Shell PLC (LSE:RDSA, Financial), Harley-Davidson Inc. (HOG, Financial) and SUMCO Corp. (TSE:3436, Financial).

Siemens Energy

The fund established a new holding of 880,246 shares in Siemens Energy (XTER:ENR, Financial), giving the stock a 1.24% weight in the equity portfolio. During the quarter, shares traded for an average price of 23.91 euros ($27.71).

Based in Munich, Germany, Siemens Energy is a global energy company that has operations in nearly every part of the energy value chain. The company’s products include gas turbines, steam turbines, generators, transformers and compressors, and it has a 67% stake in Siemens Gamesa Renewable Energy.

On Nov. 1, shares of Siemens Energy traded around 24.82 euros for a market cap of 17.76 billion euros. Shares have gained 12.8% since the company spun off from its parent company, Siemens AG (XTER:SIE, Financial), on Sept. 28, 2020.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 3 out of 10. The cash-debt ratio of 1.91 and Piotroski F-Score of 6 out of 9 indicate the balance sheet is stable. The operating margin of -3.13% and net margin of -3.17% indicate the company’s operations are not currently profitable.

Just Eat Takeaway.com

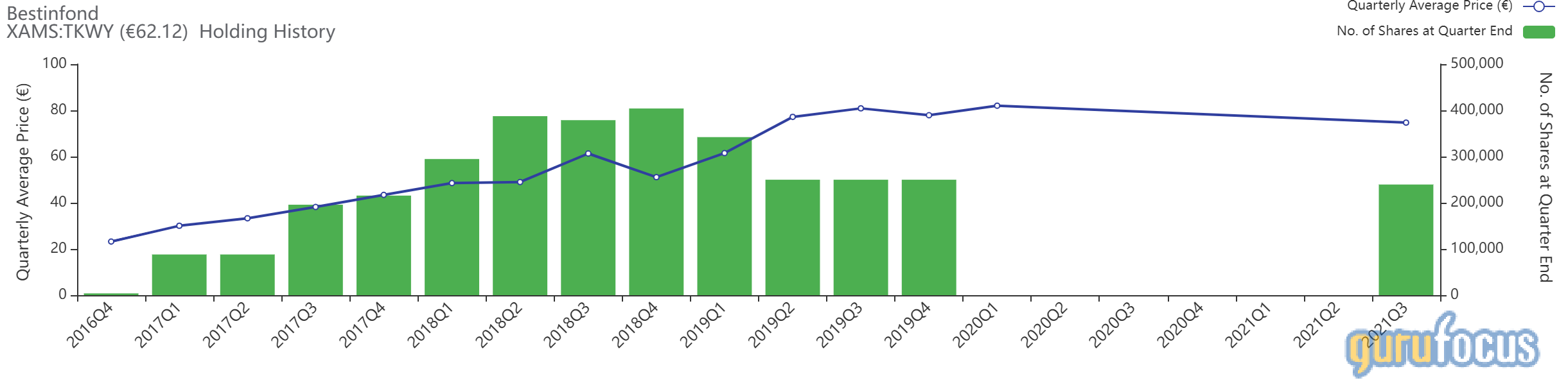

The fund also took a new stake of 239,467 shares in Just Eat Takeaway.com (XAMS:TKWY, Financial) after selling out of its previous holding in the stock in the first quarter of 2021. The stock has a weight of 0.90% in the equity portfolio. Shares traded for an average price of 74.69 euros during the quarter.

Just Eat is the leading European online food delivery company. Headquartered in the Netherlands, the company provides a platform to connect consumers and restaurants in Western Europe, Australia, Canada and several other countries. It has also entered into the U.S. market with its recent acquisition of Grubhub.

On Nov. 1, shares of Just Eat traded around 62.12 euros for a market cap of 13.21 billion euros. According to the GuruFocus Value chart, the stock is a possible value trap since the price is so far below the intrinsic value estimate.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 3 out of 10. The Piotroski F-Score of 6 out of 9 and Altman Z-Score of 4.4 show the company is not likely to encounter liquidity issues. The revenue has been increasing steadily, but the net income has been plunging further into the negatives as the company focuses on expansion over profitability.

Royal Dutch Shell

The fund upped its stake in Royal Dutch Shell PLC (LSE:RDSA, Financial) by 884,137 shares, or 159.44%, for a total of 1,438,671 shares, which had a 0.87% impact on the equity portfolio. During the quarter, shares traded for an average price of 14.55 British pounds ($19.87).

Commonly known as Shell, this British-Dutch multinational oil and gas giant is headquartered in the Netherlands and incorporated in the U.K. It is involved in the exploration, production, refining, transport, distribution, marketing, power generation and trading aspects of the industry.

On Nov. 1, shares of Shell traded around 16.81 pounds for a market cap of 130.24 billion pounds. According to the GF Value chart, the stock is modestly overvalued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10. While the interest coverage ratio of 1.57 is worryingly low, the Piotroski F-Score of 8 out of 9 is typical of a healthy financial situation. The return on invested capital is consistently lower than the weighted average cost of capital, indicating the company is not creating value as it grows.

Harley-Davidson

The fund added 330,555 shares, or 31.82%, to its investment in Harley-Davidson (HOG, Financial) for a total of 1,369,383 shares. The trade had a 0.62% impact on the equity portfolio. Shares traded for an average price of $40.41 during the quarter.

Headquartered in Milwaukee, Harley-Davidson is a beloved American motorcycle brand that was established all the way back in 1903. It holds 31% of the U.S. motorcycle market. In addition to gas-powered motorcycles, it also offers electric models.

On Nov. 1, shares of Harley-Davidson traded around $39.65 for a market cap of $6.09 billion. According to the GF Value chart, the stock is modestly overvalued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. While the Altman Z-Score of 1.18 suggest the potential of bankruptcy within two years, the Piotroski F-Score of 6 out of 9 is typical of a stable financial situation. The company has a three-year revenue per share growth rate of -6.9% and a three-year Ebitda per share growth rate of -41.3%.

SUMCO

The fund took a 578,128-share stake in SUMCO (TSE:3436, Financial), giving the stock a 0.58% weight in the equity portfolio. During the quarter, shares traded for an average price of 2,483.33 Japanese yen ($21.79).

SUMCO is a Japanese semiconductor company that manufactures high-quality electric-grade silicon wafers for semiconductor manufacturing customers worldwide.

On Nov. 1, shares of SUMCO traded around 2,197.00 yen for a market cap of 649.12 billion yen. According to the GF Value chart, the stock is modestly overvalued.

The company has a financial strength rating of 6 out of 10 and a profitability rating of 7 out of 10. The interest coverage ratio of 39.7 and Altman Z-Score of 3.19 suggest the company has its debt well covered. The three-year revenue per share growth rate is 4%, while the three-year Ebitda per share growth rate is 9.5%.

Portfolio overview

As of the quarter’s end, the fund held shares in 70 common stocks valued at a total of $1.68 billion. The turnover for the quarter was 8%.

The top holdings were GlaxoSmithKline PLC (GSK) with 3.42% of the equity portfolio, HelloFresh SE (XTER:HFG, Financial) with 3.13% and HeidelbergCement AG (XTER:HEI, Financial) with 2.97%. In terms of sector weighting, the fund was most invested in consumer cyclical and industrials, followed distantly by basic materials and communication services.