The Matthews Japan Fund (Trades, Portfolio) released its third-quarter portfolio earlier this week.

Part of San Francisco-based investment firm Matthews Asia, the fund is managed by Taizo Ishida and Shuntaro Takeuchi. It invests in Japanese companies that have sustainable growth in order to generate long-term capital appreciation.

Based on these criteria, the fund established 10 new positions during the three months ended Sept. 30, sold out of seven stocks and added to or trimmed a number of other existing holdings. The most notable trades for the quarter were a new stake in Yamato Holdings Co. Ltd. (TSE:9064, Financial), a reduction of the Advantest Corp. (TSE:6857, Financial) position and the divestment of Fanuc Corp. (TSE:6954, Financial), Marui Group Co. Ltd. (TSE:8252, Financial) and Sumitomo Mitsui Financial Group Inc. (TSE:8316, Financial).

Yamato Holdings

The Japan Fund invested in 1.14 million shares of Yamato Holdings (TSE:9064, Financial), allocating 1.73% of the equity portfolio to the stake. The stock traded for an average price of 3,041.84 yen ($26.73) per share during the quarter.

The company, which provides parcel delivery services, has a market cap of 1.06 trillion yen; its shares closed at 2,857 yen on Monday with a price-earnings ratio of 16.46, a price-book ratio of 1.83 and a price-sales ratio of 0.61.

The GF Value Line, which takes historical ratios, past performance and future earnings projections into consideration, suggests the stock is fairly valued currently.

Yamato’s financial strength and profitability were both rated 7 out of 10 by GuruFocus, driven by a comfortable level of interest coverage and a high Altman Z-Score of 3.67, which indicates it is in good standing. The return on invested capital also eclipses the weighted average cost of capital, meaning value is being created as the company grows.

The company is also being supported by an expanding operating margin, strong returns on equity, assets and capital that top a majority of competitors and a high Piotroski F-Score of 9 out of 9, which implies business conditions are healthy. As a result of consistent earnings and revenue growth, Yamato also has a predictability rank of 3.5 out of five stars. According to GuruFocus, companies with this rank return an average of 9.3% annually over a 10-year period.

The fund has the largest stake in Yamato among the gurus with 0.31% of its outstanding shares. The iShares MSCI ACWI ex U.S. ETF (Trades, Portfolio) also has a position in the stock.

Advantest

Impacting the equity portfolio by -1.72%, the fund trimmed its position in Advantest (TSE:6857, Financial) by 55.27%, selling 307,500 shares. During the quarter, shares traded for an average price of 9,684.29 yen each.

It now holds 248,900 shares total, accounting for 1.33% of the equity portfolio. GuruFocus estimates the fund has gained 49.63% on the investment since establishing it in the fourth quarter of 2020.

The company, which manufactures automatic test equipment for the semiconductor industry as well as measuring instruments for electronic systems, has a market cap of 1.93 trillion yen; its shares closed at 9,890 yen on Monday with a price-earnings ratio of 24.92, a price-book ratio of 6.82 and a price-sales ratio of 5.7.

According to the GF Value Line, the stock appears to be significantly overvalued currently.

GuruFocus rated Advantest’s financial strength 8 out of 10. In addition to adequate interest coverage, the robust Altman Z-Score of 10.34 indicates the company is in good standing even though assets are building up at a faster rate than revenue is growing. The WACC is also overshadowed by the ROIC, so value creation is occurring.

The company’s profitability scored a 7 out of 10 rating on the back of operating margin expansion, strong returns that outperform a majority of industry peers and a moderate Piotroski F-Score of 6, indicating conditions are typical of a stable company. Advantest also has a one-star predictability rank. GuruFocus says companies with this rank return an average of 1.1% annually.

The Japan Fund holds 0.13% of the company’s outstanding shares. The iShares exchange-traded fund also owns Advantest.

Fanuc

With an impact of -2.88% on the equity portfolio, the fund sold its 192,700 remaining shares of Fanuc (TSE:6954, Financial). The stock traded for an average per-share price of 25,361.3 yen during the quarter.

GuruFocus data shows the fund lost an estimated 9.36% on the investment, which was established in the first quarter of the year.

The robotics company, which provides manufacturers with factory automation products, computerized numerical control systems and compact machining centers, has a market cap of 4.4 trillion yen; its shares closed at 22,935 yen on Monday with a price-earnings ratio of 35.14, a price-book ratio of 3.07 and a price-sales ratio of 7.01.

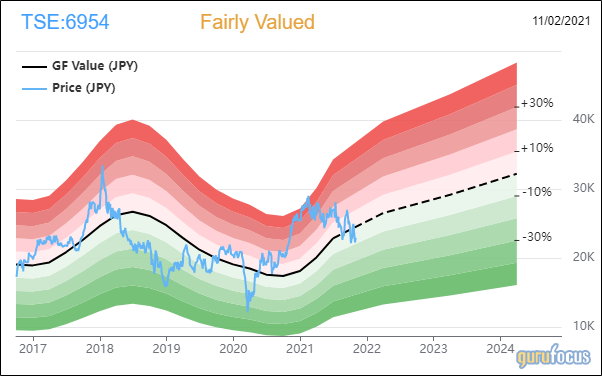

Based on the GF Value Line, the stock appears to be fairly valued currently.

Fanuc’s financial strength was rated 10 out of 10. In addition to a comfortable level of interest coverage, the company has a robust Altman Z-Score of 16.58. The ROIC also exceeds the WACC, so value is being created.

The company’s profitability also fared well with an 8 out of 10 rating. Although the operating margin is in decline, Fanuc is supported by strong returns that outperform over half of its competitor and a high Piotroski F-Score of 8. Despite recording a decline in revenue per share over the past five years, it still has a one-star predictability rank.

The Causeway International Value (Trades, Portfolio) Fund has the largest position in Fanuc with 0.26% of its outstanding shares. Other guru shareholders are the T. Rowe Price Japan Fund (Trades, Portfolio) and iShares ETF.

Marui Group

Matthews dumped its 1.43 million-share stake in Marui Group (TSE:8252, Financial), impacting the equity portfolio by -1.68%. The stock traded for an average price of 2,015.32 yen per share during the quarter.

According to GuruFocus, the fund gained 5% on the investment.

Operating a chain of department stores, the retailer has a market cap of 474.32 billion yen; its shares closed at 2,280 yen on Monday with a price-earnings ratio of 119.09, a price-book ratio of 1.71 and a price-sales ratio of 2.16.

The GF Value Lune suggests the stock is modestly overvalued currently.

GuruFocus rated Marui Group’s financial strength 2 out of 10 on the back of weak interest coverage and debt-related ratios that are underperforming versus its own history as well as other industry players. The ROIC is also being overshadowed by the WACC, indicating the company is struggling to create value.

The company’s profitability fared better with a 6 out of 10 rating despite having a declining operating margin and returns that underperform a majority of industry peers. It is supported by a moderate Piotroski F-Score of 5, however. The one-star predictability rank is on watch as a result of revenue per share declining over the past several years.

The iShares MSCI ACWI ex. U.S. ETF holds 0.01% of the company’s outstanding shares.

Sumitomo Mitsui Financial Group

The Japan Fund exited its 600,200-share holding of Sumitomo Mitsui Financial (TSE:8316, Financial), which had an impact of -1.29% on the equity portfolio. Shares traded for an average price of 3,830.08 yen each during the quarter.

GuruFocus estimates the fund lost 63.37% on the investment, which was established in the first quarter.

The bank has a market cap of 5.24 billion yen; its shares closed at 3,825 yen on Monday with a price-earnings ratio of 8.32, a price-book ratio of 0.44 and a price-sales ratio of 1.71.

According to the GF Value Line, the stock is modestly overvalued currently.

Despite having a comfortable level of interest coverage, Sumitomo Mitsui’s financial strength was rated 3 out of 10 by GuruFocus as a result of debt-related ratios underperforming compared to other players in the banking industry.

The company’s profitability did not fare much better with a 4 out of 10 rating. While margins and returns are underperforming versus competitors, Sumitomo Mitsui has a moderate Piotroski F-Score of 4. Although the bank has recorded a decline in revenue per share, it still has a one-star predictability rank.

Causeway is the bank’s largest guru shareholder with 0.17% of its outstanding shares. The iShares ETF also has a position in Sumitomo Mitsui.

Additional trades and portfolio performance

During the quarter, the Japan Fund also curbed its Pan Pacific International Holdings Corp. (TSE:7532, Financial) and TDK Corp. (TSE:6762, Financial) positions, sold out of SUMCO Corp. (TSE:3436, Financial) and established holdings in Nissan Chemical Corp. (TSE:4021, Financial) and Suntory Beverage & Food Ltd. (TSE:2587, Financial).

Matthews’ $1.67 billion equity portfolio, which is composed of 55 stocks, is largely invested in the technology sector, followed by smaller holdings in the health care and industrials spaces.

According to GuruFocus, the fund returned 29.82% in 2020, outperforming the MSCI Japan Index’s 14.91% return.

Also check out: