The Smead Value Fund (Trades, Portfolio) recently disclosed its portfolio updates for its fiscal third quarter of 2021, which ended on Aug. 31.

The fund operates under Smead Capital Management. Its contrarian investing strategy is based on large-cap stocks that meet the following criteria: serve an economic need, have a strong competitive advantage, have a long history of profitability and strong operating metrics, generate high levels of free chase flow, are undervalued, have a strong balance sheet, show insider ownership and have a history of friendly relations between management and shareholders. The fund is managed by lead portfolio manager Bill Smead, along with co-portfolio managers Tony Scherrer, CFA and Cole Smead, CFA.

Based on its investing criteria, the fund’s top buys for the quarter were Occidental Petroleum Corp. (OXY, Financial) and Continental Resources Inc. (CLR, Financial), while its biggest sells were The Walt Disney Co. (DIS, Financial) and Walgreens Boots Alliance Inc. (WBA, Financial).

Occidental Petroleum

The fund took a new stake of 2,404,771 shares in Occidental Petroleum (OXY, Financial) after selling out of its previous holding in the stock in the first quarter of 2020. The stock now has a 2.57% weight in the equity portfolio. During the quarter, shares traded for an average price of $27.68.

Occidental is an oil and gas exploration and production company with facilities in the United States, the Middle East, Latin America and Africa. Among major fossil fuel producers, Occidental ranks first in terms of CO2 EOR (carbon sequestration and reuse) projects.

On Nov. 2, shares of Occidental traded around $34.26 for a market cap of $31.96 billion. According to the GuruFocus Value chart, the stock is modestly undervalued.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 5 out of 10. The Altman Z-Score of 0.5 indicates the company is at risk of bankruptcy, though the current ratio of 1.34 suggests in can at least keep meeting debt payments in the short term. The operating margin and net margin returned to the positive range in the most recent quarter, so it seems the company is back on the path to becoming profitable.

Continental Resources

The fund upped its stake in Continental Resources (CLR, Financial) by 831,195 shares, or 22.6%, for a total of 4,509,431 shares. The trade had a 1.36% impact on the equity portfolio. Shares traded for an average price of $36.03 during the quarter.

Continental Resources is an independent petroleum and natural gas exploration and production company based in Oklahoma City. With reserves in North Dakota and Oklahoma, the company produces and sells its products exclusively in the U.S. and has one of the “best deep oil inventories in the industry.”

On Nov. 2, shares of Continental Resources traded around $49.33 for a market cap of $18.10 billion. According to the GF Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. The cash-debt ratio of 0.03 is lower than 90% of industry peers, but the Piotroski F-Score of 8 out of 9 implies a healthy financial situation. The return on invested capital is consistently lower than the weighted average cost of capital, meaning the company is not creating value.

Walt Disney

The fund sold out of its 207,540-share investment in Walt Disney (DIS, Financial), which had a -1.79% impact on the equity portfolio. Shares traded for an average price of $177.03 during the quarter.

Disney is an iconic mass media company and one of the largest producers of entertainment in the U.S. Based in Los Angeles, the company produces movies and shows, owns and operates theme parks and provides streaming services such as ESPN+, Hulu and Disney+.

On Nov. 2, shares of Disney traded around $169.31 for a market cap of $307.51 billion. According to the GF Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. The Piotroski F-Score of 5 out of 9 and Altman Z-Score of 2.36 indicate a stable financial situation. The three-year revenue per share growth rate is 1.2%, but the three-year Ebitda per share growth rate is -35.5%.

Walgreens Boots Alliance

The fund also exited its 573,172-share position in Walgreens Boots Alliance (WBA, Financial) merely a quarter after acquiring it, impacting the equity portfolio by -1.46%. During the quarter, shares traded for an average price of $49.54.

Walgreens Boots Alliance is a pharmacy company involved in the retail, wholesale and distribution of pharmaceutical and adjacent products. Headquartered in Chicago, the company is the owner of the Walgreens pharmacy chain in the U.S. and the U.K.-based health and beauty retailer Boots.

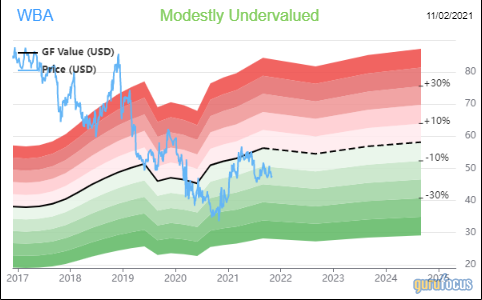

On Nov. 2, shares of Walgreens traded around $47.62 for a market cap of $41.01 billion. According to the GF Value chart, the stock is modestly undervalued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. The Piotroski F-Score of 7 out of 9 and Altman Z-Score of 2.75 indicate a stable financial situation. The WACC and ROIC are pretty even on average, so it seems the company is neither creating nor destroying value as it grows.

Portfolio overview

As of the quarter’s end, the Smead Value Fund (Trades, Portfolio) held common stock positions in 26 companies valued at a total of $2.40 billion, with a turnover rate of 15% for the period.

The top holdings were Continental Resources with 7.38% of the equity portfolio, Target Corp. (TGT) with 6.37% and Lennar Corp (LEN) with 6.05%.

In terms of sector weighting, the fund was most invested in the consumer cyclical, financial services and energy industries.