Francisco Garcia Parames (Trades, Portfolio), manager of Cobas Asset Management, disclosed this week that his firm’s top five trades during the third quarter included a boost to its holding in International Seaways Inc. (INSW, Financial), new holdings in GasLog Partners LP (GLOP, Financial), BW Offshore Ltd. (OSL:BWO, Financial) and EnQuest PLC (LSE:ENQ, Financial), and the closure of its position in Porsche Automobil Holding SE (XTER:PAH3, Financial).

Parames, who managed Bestinfond (Trades, Portfolio) until 2014, applies value strategies taught by legends like Benjamin Graham, Peter Lynch and Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial) CEO Warren Buffett (Trades, Portfolio). Cobas invests approximately 80% of its assets in international securities with at most 40% weight in emerging markets.

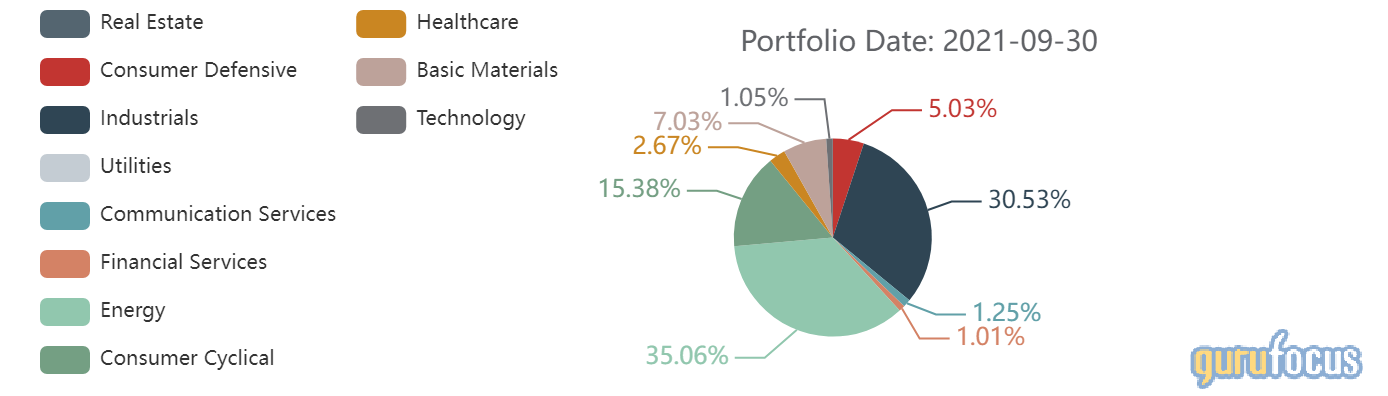

As of Sept. 30, Cobas’ $682 million equity portfolio contains 57 stocks, with three new positions and a turnover ratio of 8%. The top three sectors in terms of weight are energy, industrials and consumer cyclical, representing 35.06%, 30.53% and 15.38% of the equity portfolio.

International Seaways

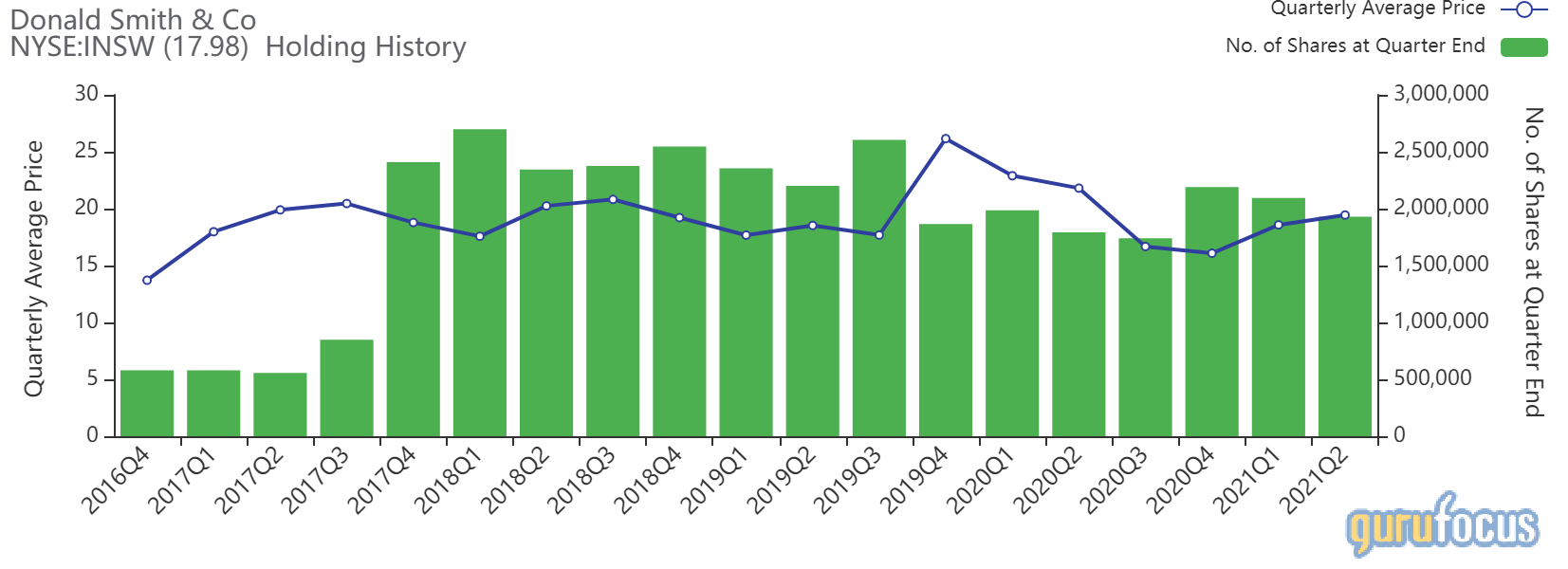

The firm owns 1,788,385 shares of International Seaways (INSW, Financial), up 500,918 shares or 38.91% from the prior-quarter holding. The transaction impacted the portfolio by 1.14%.

Shares of International Seaways averaged $17.12 during the third quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 1.08.

GuruFocus ranks the New York-based marine transportation company’s financial strength 3 out of 10 on several warning signs, which include a low Altman Z-score of 0.72 and a debt-to-equity ratio that outperforms just over 55% of global competitors.

Other gurus with holdings in International Seaways include Donald Smith & Co. and Azvalor Internacional FI (Trades, Portfolio).

GasLog Partners

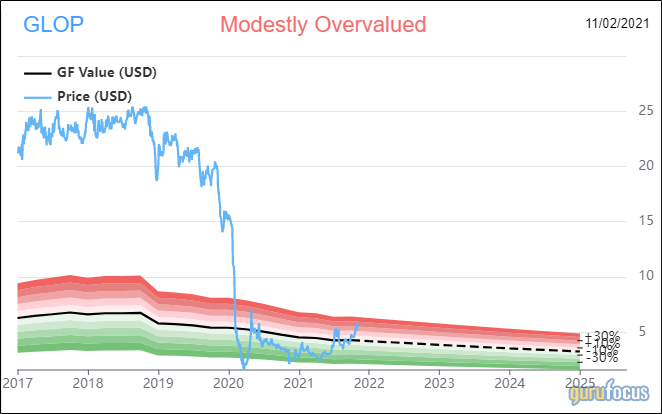

Cobas owns 1,877,428 shares of GasLog Partners (GLOP, Financial), giving the position 1.13% equity portfolio weight.

Shares of GasLog traded around $5.45, showing the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 1.17.

GuruFocus ranks the Greek energy company’s profitability 6 out of 10 on the back of a high Piotroski F-score of 7 and profit margins that outperform more than 85% of global competitors despite three-year revenue and earnings growth rates underperforming more than 60% of global energy companies.

BW Offshore

The firm owns 2,395,851 shares of BW Offshore (OSL:BWO, Financial), giving the position 1.01% equity portfolio space.

Shares of BW Offshore averaged 28.73 Norwegian kroner ($3.37) during the third quarter; the stock is significantly overvalued based on Tuesday’s price-to-GF Value ratio of 1.65.

GuruFocus ranks the energy company’s profitability 5 out of 10 on the back of returns languishing around the industry median despite having operating margins outperforming more than 80% of global competitors.

EnQuest

The firm owns 24,305,468 shares of EnQuest (LSE:ENQ, Financial), giving the position 0.99% weight in the equity portfolio. Shares averaged 23 pence (31 cents) during the third quarter; the stock is significantly overvalued based on Tuesday’s price-to-GF Value ratio of 2.25.

GuruFocus ranks the U.K.-based energy company’s financial strength 1 out of 10 on several warning signs, which include a low Piotroski F-score of 3 and interest coverage and debt ratios that underperform more than 90% of global competitors.

Porsche

Cobas exited its stake in Porsche (XTER:PAH3, Financial), impacting its portfolio by -1.07%. Shares averaged 88.06 euros ($101.99) during the third quarter; the stock is significantly undervalued based on Tuesday’s price-to-GF Value ratio of 0.48.

GuruFocus ranks the German automobile maker’s financial strength 7 out of 10 on several positive investing signs, which include a double-digit Altman Z-score and little or no long-term debt.