Azvalor Blue Chips FI (Trades, Portfolio) disclosed its third-quarter portfolio through regulatory portfolio filings, revealing that its top five trades included a new position in Civitas Resources Inc. (CIVI, Financial), new holdings in Chesapeake Energy Corp. (CHK, Financial) and New Gold Inc. (NGD, Financial), a boost to its holding in Canadian Natural Resources Ltd. (CNQ, Financial) and the closure of its stake in Coterra Energy Inc. (CTRA, Financial).

The fund, part of Spain-based AzValor Asset Management, seeks long-term capital appreciation by investing in the stocks of large-cap companies that are trading below the fund’s estimate of fair value.

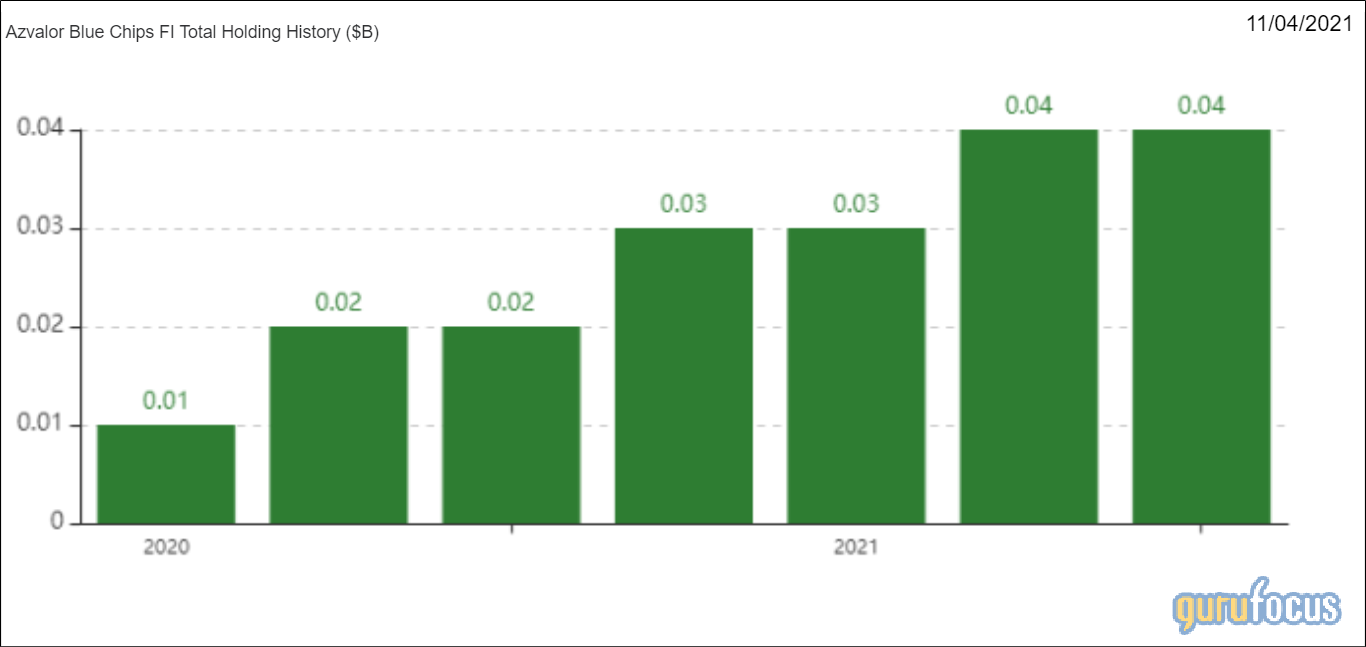

As of Sept. 30, the fund’s $37 million equity portfolio contains 38 stocks, with four new positions and a turnover ratio of 19%. The top two sectors in terms of weight are energy and basic materials, representing 49.94% and 41.37% of the equity portfolio.

Civitas Resources

The fund gained 36,985 shares of Civitas Resources (CIVI, Financial), impacting the position by 210.37% and its equity portfolio by 4.07%.

Shares of Civitas averaged $41.06 during the third quarter; the stock is overvalued based on Friday’s price-to-GF Value ratio of 1.31.

On Monday, Bonanza Creek Energy Inc. and Extraction Oil & Gas Inc. (XOG, Financial) announced the closing of their merger and the subsequent acquisition of Crestone Peak Resources. The combined company, which is rebranded as Civitas, started trading under stock ticker CIVI on Tuesday.

The Denver-based energy company operates in Colorado’s Denver-Julesburg Basin and produces carbon-neutral crude oil, natural gas and natural gas liquids. GuruFocus ranks the company’s financial strength 5 out of 10 on the back of cash-to-debt ratios underperforming over 64% of global competitors despite interest coverage and debt-to-equity ratios topping more than 69% of global energy companies.

Chesapeake Energy

The fund purchased 20,738 shares of Chesapeake Energy (CHK, Financial), giving the position 2.94% equity portfolio weight. Shares averaged $56.09 during the third quarter.

The Oklahoma City-based energy company resumed trading on Feb. 10 following its emergence from bankruptcy and subsequent restructuring. GuruFocus ranks the company’s financial strength 4 out of 10 on the back of a low Altman Z-score of 0.75 despite debt-to-equity ratios outperfomring more than half of global competitors.

New Gold

The fund purchased 825,483 shares of New Gold (NGD, Financial), giving the position 2% equity portfolio space. Shares averaged $1.38 during the third quarter; the stock is modestly overvalued based on Friday’s price-to-GF Value ratio of 1.17.

GuruFocus ranks the Toronto-based gold mining company’s financial strength 4 out of 10 on several warning signs, which include interest coverage and debt ratios that underperform more than 60% of global competitors.

Canadian Natural Resources

The firm purchased 27,591 shares of Canadian Natural Resources (CNQ, Financial), boosting the position by 69.97% and its equity portfolio by 2.31%.

Shares of Canadian Natural Resources averaged $33.69 during the third quarter; the stock is modestly overvalued based on Friday’s price-to-GF Value ratio of 1.20.

GuruFocus ranks the Calgary, Alberta-based energy company’s profitability 6 out of 10 on the back of profit margins and returns outperforming more than 70% of global competitors despite three-year earnings growth rates underperforming more than 60% of global energy companies.

Coterra Energy

The fund sold 79,695 shares of Coterra Energy (CTRA, Financial), impacting the equity portfolio by -3.30%.

Shares of Coterra averaged $17.17 during the third quarter; the stock is significantly undervalued based on Friday’s price-to-GF Value ratio of 0.70.

GuruFocus ranks the Houston-based energy company’s profitability 6 out of 10 on the back of a moderately low Piotroski F-score of 4 despite profit margins and returns outperforming more than 76% of global competitors.