The day after reporting a disappointing outlook for next year, online payments processor PayPal Holdings Inc. (PYPL, Financial) has seen its shares drop more than 11%. The company also missed analysts’ expectations for its third-quarter revenue, even as it posted an earnings beat.

Year over year, PayPal has gained 9%. However, the year-to-date picture shows a drop of 13% as investors have lost enthusiasm for so-called “pandemic stocks,” which are the companies that have benefitted greatly from the Covid-19 pandemic.

“Consumer confidence is weakened with the absence of stimulus payments,” CEO Dan Schulman said on the third-quarter earnings call. “And with the economy reopening, more people may be likely to do their holiday shopping in-store.”

However, despite slowdowns in certain areas, PayPal’s guidance still anticipates a year of strong growth. Even if that growth falls short of analysts’ lofty expectations, that doesn’t mean the company is going to decline.

The stock’s decline this year merely represents a reversion to a more appropriate valuation following a period of sustained overconfidence. It seems that PayPal is finally approaching value territory once again.

PayPal’s troubles

It’s undeniable that PayPal faces its share of headwinds going forward. Inflation is skyrocketing, government stimulus payments are no longer a factor, the money households saved during the pandemic has largely been spent, student loan payments are about to resume and more people might do their Christmas shopping in-store this year compared to last year.

Ever since the stock’s valuation has begun to deflate, investors have become more worried that PayPal’s results will underperform the market’s expectations. That’s probably why the stock fell so quickly following the earnings report - the mixed results and lackluster outlook were things that many were already afraid of, so when they became reality, investors were willing to sell at the drop of the hat.

That being said, growth stocks typically attract premium valuations based on how quickly they are growing. If PayPal’s growth rates begin to slow down, then the valuation could remain depressed going forward, even if the company’s top and bottom lines continue improving.

Strong growth targets

It’s not like PayPal is anticipating a big decline. In fact, following a third-quarter revenue jump of 13%, the company aims for a top line of $6.85 billion to $6.95 billion in the fourth quarter of 2021, which would be 11% higher than the fourth quarter of 2020 at the midpoint. Analysts were expecting a whopping $7.24 billion in revenue, which would represent an eye-popping 18% growth.

On the earnings front, the picture is a little less optimistic. PayPal’s earnings per share for the fourth quarter of 2020 was $1.32, but the company is only expecting to earn $1.12 per share in the comparable quarter of this year. Analysts had anticipated earnings of $1.28 on strong holiday spending, representing only a small decline from year-ago levels.

Even though these numbers are far outpacing the medians for the rest of the credit services industry, both still represent growth slowdowns compared to PayPal’s recent history. The company has achieved a three-year revenue per share growth rate of 19% and a three-year earnings per share without non-recurring items growth rate of 34%.

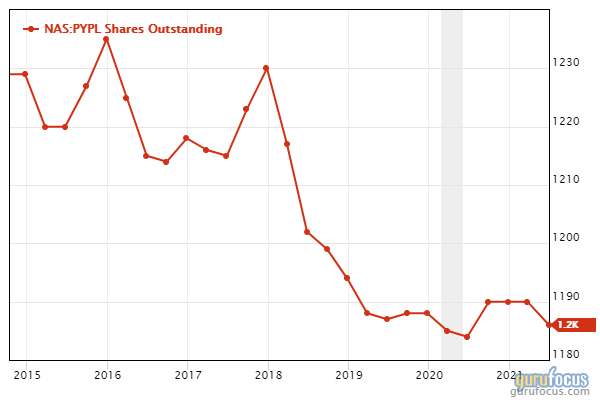

Per-share results have been aided by a strong share buyback program. As shown in the chart below, PayPal’s share count has been in a general downtrend in recent years, though there were spikes of net share issuance in 2015, 2018 and 2020.

It’s clear that the share buybacks have played a role in skewing growth numbers. If buybacks aren’t continuing at the same pace, then the company will need to grow faster in order to make up for it. Fortunately for investors, PayPal’s buyback program is still going, with the company repurchasing 1.27 million shares in the third quarter.

Looking further ahead to fiscal 2022, PayPal anticipates a return to growth levels that are close to its averages for the past few years. The company said revenue for fiscal 2022 will increase about 18%, which would equal full-year sales of close to $30 billion. Analysts, who had anticipated guidance of $31.6 billion, were disappointed yet again, realizing the stock might not deserve the valuation the market was giving it.

Partnerships

PayPal is preparing to bid farewell to contributions from its former owner and long-term e-commerce partner eBay Inc. (EBAY, Financial), which has slowly been transitioning sellers to its own payment system. After dropping 45% in the past quarter due to this change, PayPal’s revenue from eBay now represents only 4% of its total revenue.

When PayPal was spun out of eBay in 2015, it was agreed on that PayPal would continue managing its parent company’s payments processing for the next five years, so it comes as no surprise to investors that the two companies are finally ending their relationship of nearly two decades.

Alongside the ending of its eBay partnership, PayPal’s Venmo app announced a new partnership with Amazon.com Inc. (AMZN, Financial) on Monday. Through the deal, Amazon shoppers will be able to use Venmo as a checkout option.

“This [the Amazon deal] is obviously a very significant effort in our Venmo monetization efforts,” Schulman said in the earnings call. It “marks the beginning of an exciting journey with Amazon, now that we’re no longer constrained by the contractual obligations of the eBay operating agreement.”

Valuation

After its 11% drop on Tuesday, shares of PayPal traded around $203.78 for a market cap of $238.23 billion. The price-earnings ratio of 50.10 has fallen slightly below the company’s median historical price-earnings ratio of 51.19, though it is still significantly above the industry median of 13.84.

The GuruFocus Value chart now rates the stock as modestly overvalued compared to its previous rating of significantly overvalued:

Even if the earnings that PayPal is anticipating are slightly lower than what analysts were calling for, the company is aiming for 18% top-line growth next year, which would be in line with its average growth in recent years. The partnership with Amazon also shows promise. Venmo has been growing rapidly, marking a 36% year-over-year volume growth in the last quarter.

Now that the market has seen fit to drop PayPal’s stock down to more realistic levels, it seems the company could be back in value territory.