American e-commerce giant Amazon.com Inc. (AMZN, Financial) has been one of those stocks that turned many small-time investors into millionaires and made those who were already rich even more wealthy. Over the past decade, the stock has achieved cumulative growth of 1,560% with a compound annual growth rate of 31%. The 20-year CAGR is even higher at 35%.

Normally when companies get this big, they reach a level where even a significant gain in earnings can represent a relatively small percentage gain. As a result, shares stagnated in 2019 before being catapulted higher by business growth from the Covid-19 pandemic.

The stock now appears to have reached a plateau again, trading in a relatively tight range from late 2020 through the present day. Short of another global crisis that causes a sharp increase in e-commerce demand, it seems unlikely that Amazon will enjoy such a strong bull run again.

That’s not to say that Amazon won’t continue growing. The e-commerce trend is likely to continue accelerating, and analysts predict that Amazon’s earnings per share will double between 2021 and 2023. At a price-earnings ratio of 68.23, Amazon is fairly valued according to the GuruFocus Value chart. As long as the company’s valuation metrics remain the same, the stock could achieve a CAGR of about 50% over the next couple of years if it meets analysts’ expectations.

However, using the same valuation method for other e-commerce companies results in some interesting findings. In particular, e-commerce favorites that operate in countries where online shopping is not yet as popular as it is in the U.S. seem to offer the most attractive growth opportunities.

JD.com

JD.com Inc. (JD, Financial), also known as Jingdong and formerly called 360buy, is one of the two largest business-to-consumer e-commerce companies in China in terms of transaction volume and revenue, the other being Alibaba’s (BABA, Financial) Tmall. The majority of its revenue is derived from online direct sales.

Compared to Alibaba, JD’s business structure is simpler and has better first-party logistics foundations. While Alibaba is focusing on expanding its lower-margin retail businesses and its currently unprofitable cloud and digital media segments, JD is focusing on its high-margin first-party logistics platform and its (also unprofitable at the moment) cloud business. Because of its narrower focus, JD also faces less regulatory scrutiny than Alibaba.

JD.com has a three-year revenue per share growth rate of 24.8% and a three-year Ebitda per share growth rate of 118.1%. The price-earnings ratio of 23.11 is below the 10-year median of 34.59. According to the GF Value chart, the stock is modestly overvalued.

Analysts estimate that JD.com’s earnings per share will grow from 55 cents in 2021 to $2.23 in 2023, which would be a 305% cumulative gain. Provided the company meets analysts’ expectations and trades with similar valuation metrics, it could gain 152% per year over the next two years. If its valuation multiples were to increase along with sustained higher growth in the future, gains could be even more outsized.

However, JD.com’s earnings per share have varied greatly due to non-recurring items, so it could be more accurate to use earnings per share without non-recurring items. Analysts are expecting the company’s earnings without NRI to grow from $1.22 in 2021 to $3.01 in 2023, representing the potential for 146% cumulative growth over the next two years, or 73% per year.

MercadoLibre

MercadoLibre Inc. (MELI, Financial) is an Argentinian online marketplace company that operates e-commerce and online option websites, including mercadolibre.com. It is headquartered in Buenos Aires, but is incorporated in the U.S.

The company's largest markets are Brazil, Argentina and Mexico. As of 2021, its site is by far the most-visited e-commerce site in all of Latin America with an average of 667 million monthly visits. This far outpaces the second-most visited e-commerce site in Latin America, which is none other than Amazon itself with 167 million average monthly visits.

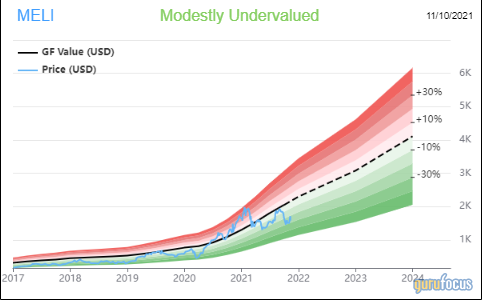

The three-year revenue per share growth rate for MercadoLibre is 42.6%. Meanwhile, the three-year Ebitda per share growth rate is 28.9%. The price-earnings ratio of 1,030 is above the 10-year median of 53.44. According to the GF Value chart, the stock is modestly undervalued.

Analysts estimate that MercadoLibre’s earnings per share will grow from $3.45 in 2021 to $20.22 in 2023, which would be a 486% cumulative gain. Provided the company meets analysts’ expectations and trades with similar valuation metrics, it could gain 243% per year over the next two years. If its price-earnings ratio were to decline back to the 10-year median, then the stock could grow closer to 12.5% per year, which wouldn't be much; this is definitely a stock that will rely on mega-growth valuations.

The company’s growth could be even more impressive when taking non-recurring items out of the picture. Analysts expect MercadoLibre’s earnings per share without NRI to be $3.22 in 2021 and $21.64 in 2023, representing 572% cumulative growth, or 286% per year (14% per year if valuation multiples drop to the historical median).

Sea

Singapore-based Sea Ltd. (SE, Financial) is a global consumer internet company that operates through three main segments: digital entertainment (Garena), e-commerce (Shopee) and digital payments and financial services (SeaMoney).

Sea has carved out a dominant e-commerce position in Southeast Asia by leveraging the synergy of its business segments. The company is also expanding outside of Asia, with a focus on the Latin America region, where it will compete with MercadoLibre. While the Shopee e-commerce site still trails far behind MercadoLibre in terms of traffic with only 40.7 million average monthly visits, it is interesting to note that the popularity of its Free Fire game and advertising partnership with soccer megastar Cristiano Ronaldo have helped it become the most-downloaded shopping app in Latin America.

The three-year revenue per share growth rate for Sea is 65.8%. However, the three-year Ebitda per share growth rate is in the red at -1.1%, since the company is focusing on aggressive growth over profits. The company doesn’t have a price-earnings ratio because it is currently not profitable. According to the GF Value chart, the stock is significantly overvalued.

Analysts estimate that Sea will report a loss per share of $2.21 in 2021. By 2023, however, they are expecting earnings per share of 46 cents. Since this company is not profitable, we can turn to the top line for stock growth estimates. Analysts project Sea will bring in revenue of $9.8 billion in 2021, which should grow to $18.4 billion in 2023, representing 87% cumulative growth, or 43% year over year.

However, if Sea were to begin turning a profit in the future, it could cause the stock to skyrocket. Amazon was not profitable for the first six years of its publicly traded life, and neither was JD.com. MercadoLibre became profitable after just three years on the stock market, but it posted net losses from 2018 through 2020 as it began focusing on growth again.