Catherine Wood (Trades, Portfolio), founder and manager of ARK Investment Management, disclosed in regulatory portfolio filings that her firm’s top four trades during the third quarter included a reduction to its holding in Tesla Inc. (TSLA, Financial), new buys in Robinhood Markets Inc. (HOOD, Financial) and Experience Investment Corp. (EXPCU, Financial) and a boost to its holding in UiPath Inc. (PATH, Financial).

Wood founded the New York-based firm to focus solely on disruptive innovation while adding new dimensions to research. ARK Investment applies an iterative investment process that combines top-down and bottom-up research and seeks to capitalize on innovation opportunities to unlock shareholder value.

As of Sept. 30, ARK Investment’s $53.73 billion equity portfolio contains 284 stocks, with 19 new positions and a turnover ratio of 17%. The firm’s top four sectors in terms of weight are health care, technology, communication services and consumer cyclical, representing 34.52%, 26.15%, 19.90% and 11.46% of the equity portfolio.

Firm discloses reduction in Tesla as CEO Elon Musk continues selling spree

ARK Investment sold 1,481,410 shares of Tesla (TSLA, Financial), discarding 27.26% of the position and 1.87% of its equity portfolio.

Shares of Tesla averaged $706.10 during the third quarter; the stock is significantly overvalued based on Friday’s price-to-GF Value ratio of 4.01.

Shares of Tesla sank approximately 3.43% on Friday on the back of CEO Elon Musk selling 639,737 shares of the stock, continuing his trust’s unloading of more than $5 billion worth of shares earlier in the week.

GuruFocus ranks the Palo Alto, California-based electric vehicle giant’s financial strength 6 out of 10 on the back of a high Piotroski F-score of 7 and a double-digit Altman Z-score despite interest coverage and debt-to-equity ratios underperforming more than half of global competitors.

Other gurus with holdings in Tesla include Baillie Gifford (Trades, Portfolio), Ron Baron (Trades, Portfolio)’s Baron Funds and PRIMECAP Management (Trades, Portfolio).

Robinhood

The firm purchased 9,876,801 shares of Robinhood (HOOD, Financial), giving the position 1% weight in its equity portfolio. Shares averaged $45.44 during the third quarter.

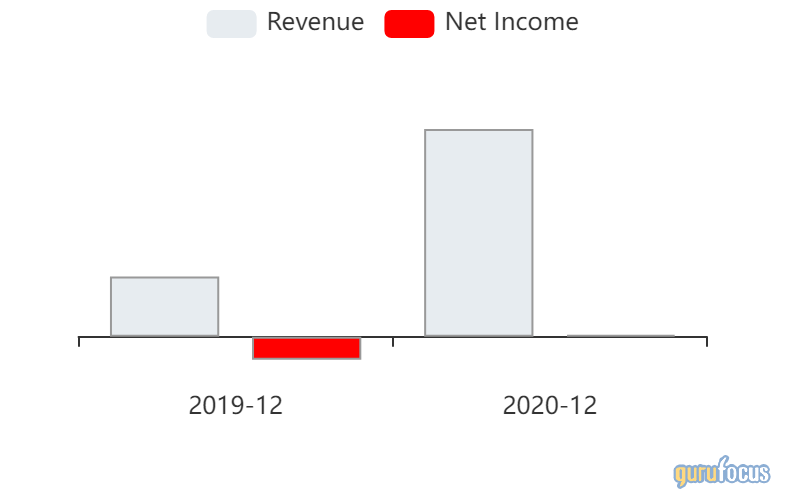

The Menlo Park, California-based financial services software company said third-quarter net revenue of $365 million increased from the prior-year quarter revenue of $270 million. Monthly average users of 18.9 million increased from the prior-year quarter users of 10.7 million.

Experience Investment

The firm purchased 7,021,803 shares of blank-check company Experience Investment (EXPCU, Financial), giving the position 0.12% weight in the equity portfolio.

UiPath

The firm added 12,057,982 shares of UiPath (PATH, Financial), boosting the position by 101.53% and its equity portfolio 1.52%.

GuruFocus ranks the New York-based software company’s financial strength 7 out of 10 on several positive investing signs, which include a double-digit Altman Z-score of 39.32 and a cash-to-debt ratio that outperforms more than 80% of global competitors.