CommScope Holding Co Inc. (COMM, Financial) is a highly leveraged telecom infrastructure equipment and home network and video equipment supplier which is very cheaply priced. The reason investors have marked it down appears to be high debt and some recent business slowdown due to semiconductor shortages and supply chain issues. But peeking under the balance sheet’s hood, don't appear to be too bad, and the stock could even have multi-bagger potential.

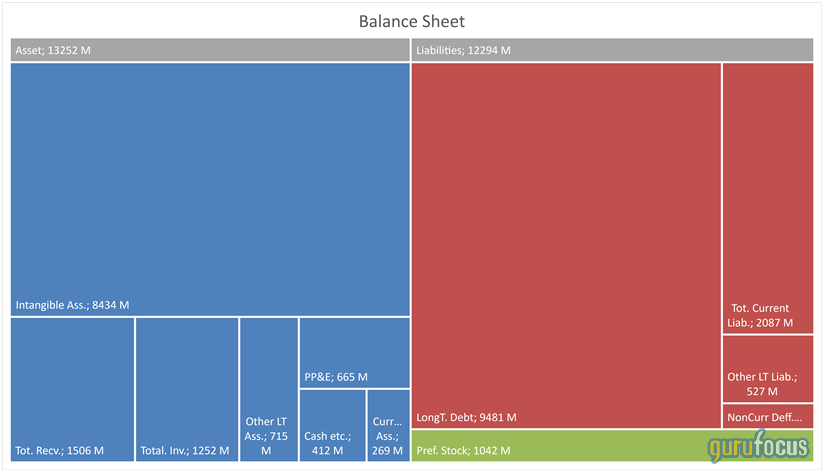

First the bad news: the balance sheet is quite ugly with a huge chunk of long-term debt (about $9.5 billion). Equity is but a thin sliver. On the asset side there is a huge chunk of intangible assets. This is goodwill from previous acquisitions. Goodwill had a bad habit of disappearing into thin air, so investors are rightly sceptical. Overall, the company is structured like a private equity LBO (leveraged buyout) entity but is publicly traded.

CommScope started in 1975 as a product line of Superior Continent Cable company. After various ownership changes, Commscope, as it exists today, was the result of a spinout from a company which no longer exists, General Instrument, which, in 1997, was split into three independent publicly traded companies: CommScope, General Semiconductor, and NextLevel Systems.

NextLevel Systems, which adopted the General Instrument name a year after the split, was then acquired by Motorola in 2000 for $17 billion and ultimately renamed to Home and Networks Mobility as a division within Motorola. The Home and Networks Mobility division ended up as a business unit in Google after Alphabet's (GOOG, Financial)(GOOGL, Financial) acquisition of Motorola Mobility in 2011 for $12.5 billion,

Then in 2013, ARRIS bought Motorola Mobility's Home unit from Google for $2.3 billion. CommScope's acquisition of ARRIS in 2019 for $7.4 billion brings it full circle and reunites two of former General Instrument's companies 22 years after the split in 1997. Now CommScope is spinning out the Home unit (more on this below).

CommScope completed its acquisition of Arris (which included Ruckus) in 2019, which greatly expanded CommScope’s product portfolio. It combined Arris’ position as a major cable industry supplier of customer premise equipment, video and broadband infrastructure and cloud software with CommScope’s fiber and network infrastructure portfolio for wired and wireless networks. Arris also brought Ruckus Networks and ICX Switch, which serve the enterprise network space (Arris had previously acquired those businesses from Broadcom (AVGO, Financial)).

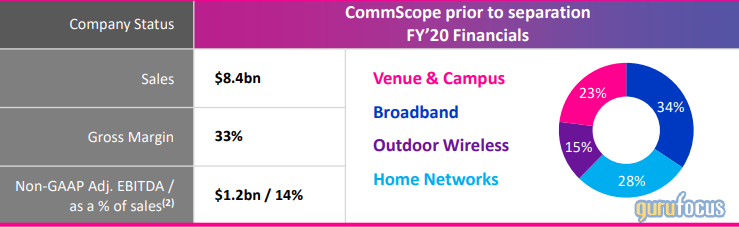

The company currently has four business segments:

-Home Networks is the largest of the four segments. This segment focuses on the connected home and devices inside the home and CommScope’s broadband gateways (coaxial, fiber and wireless), video set-tops and in-home devices. CommScope is planning to spin out this business to shareholders in a tax-free transaction in 2022.

-Broadband Networks is the second-largest segment by revenue. The segment combined CommScope’s existing network cable and connectivity business with its network and cloud business.

-Venue and Campus Networks is its third-largest segment. This segment will include Ruckus Networks as well as CommScope’s Enterprise and Distributed Coverage and Capacity (DCCS) businesses: distributed antenna systems, licensed and unlicensed small cells, and Wi-Fi and switching as along with enterprise fiber and copper wired infrastructure.

-Outdoor Wireless Networks is the segment which focuses on macro and metro cells, including base station antennas, microwave antennas, radio frequency filters, tower connectivity, metro cells, cabinets and accessories, as well as Comsearch and its Spectrum Access System.

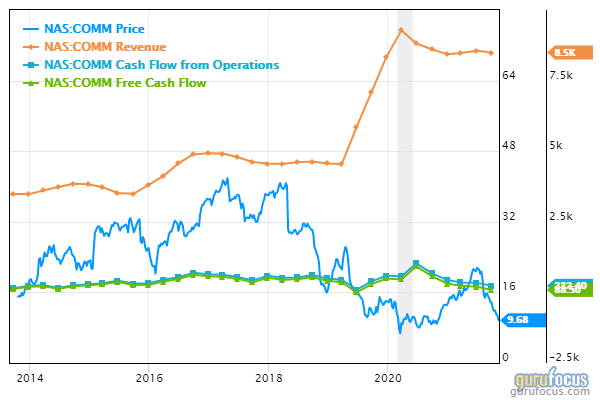

CommScope's stock price with revenue and cash flow is provided below. Its appears CommScope is still in the process of integrating the Arris acquisition with revenue and cash flow down since 2020. Now things are up in the air again with the separation of the Home Network segment.

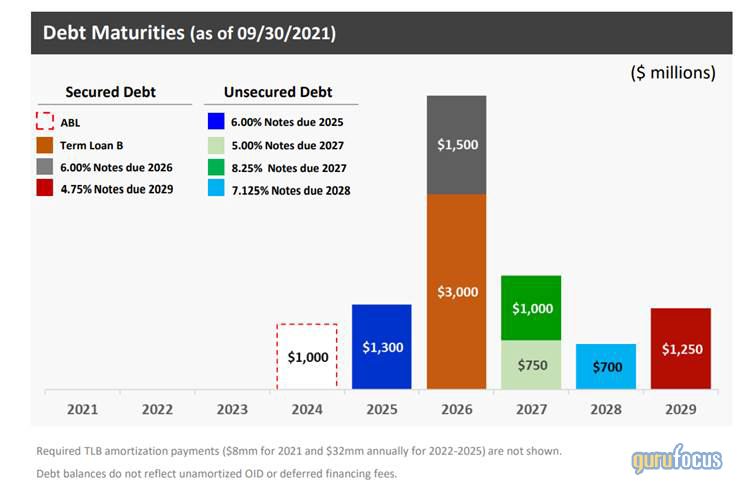

Debt is high but the maturities are spread out with the first large maturity in 2025. Thus the company has time to deleverage and get its house in order as long as the economy cooperates.

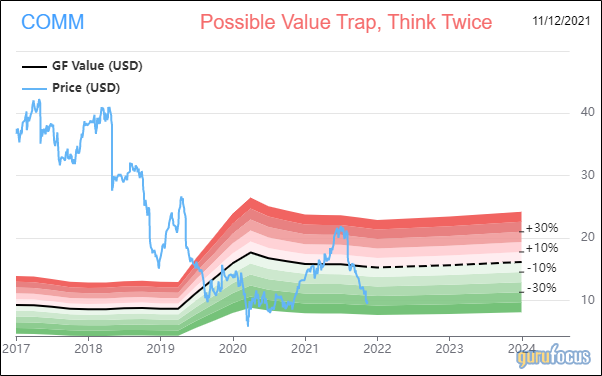

Valuation

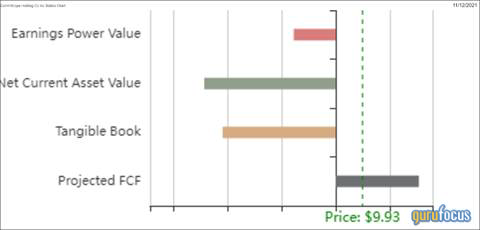

In terms of valuation, the GF Value line is showing a fair value of around $16 per share for the company. I think that is about right when I look past short-term issues. However, the system is also triggering a warning of a "value trap." I believe that this warning is a false positive as it does not take into consideration qualitative issues discussed above. Value trap warnings are triggered when a stock price is too far below the intrinsic value estimate.

The other valuation method I consider good for this stock is the Projected FCF method. Designed by GuruFocus for companies with erratic earnings, this method uses normalized free cash flow, a growth factor plus 80% of book value. The method is showing a value of $30, which is optimistic. I also consultedValue Line, which provides a three to five year value in that range.

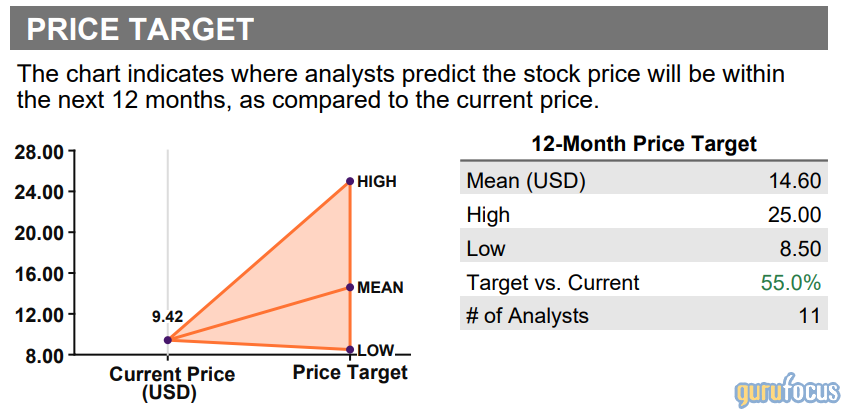

According to Refinitiv, the mean 12-month price target of 11 surveyed analysts is $14.60.

Conclusion

CommScope is a difficult stock to like with its high debt and erratic cash flow. It operates in highly competitive industries with long sales cycles where customers have a lot of power to extract concessions.

In its favour is the big spending unleashed by governments to recover from the pandemic. Some of this money will find its way to telecom equipment suppliers like CommScope. Most of all, I think most of the pessimism is already in the price. Debt maturities are spread out. The company is spinning out its slow growth business and should be able to deleverage with its ample cash flow.

Investing in this stock is like investing in an LBO. A leveraged Buyout or LBO is the acquisition of a company, where the acquisition amount is primarily funded by debt. In a typical Leveraged Buyout situation, the acquiring company borrows up to 90% of the transaction cost but the liability is on the acquired company. The acquired company is then reorganized to increase free cash flows and to repay debt. The challenge for CommScope is now ramp up FCF so that debt can be paid down.

I think the odds are decent that it will be able to do that. The upside is multi-bagger potential, the downside is of course a zero for equity holders. This is not a stock for widows and orphans.