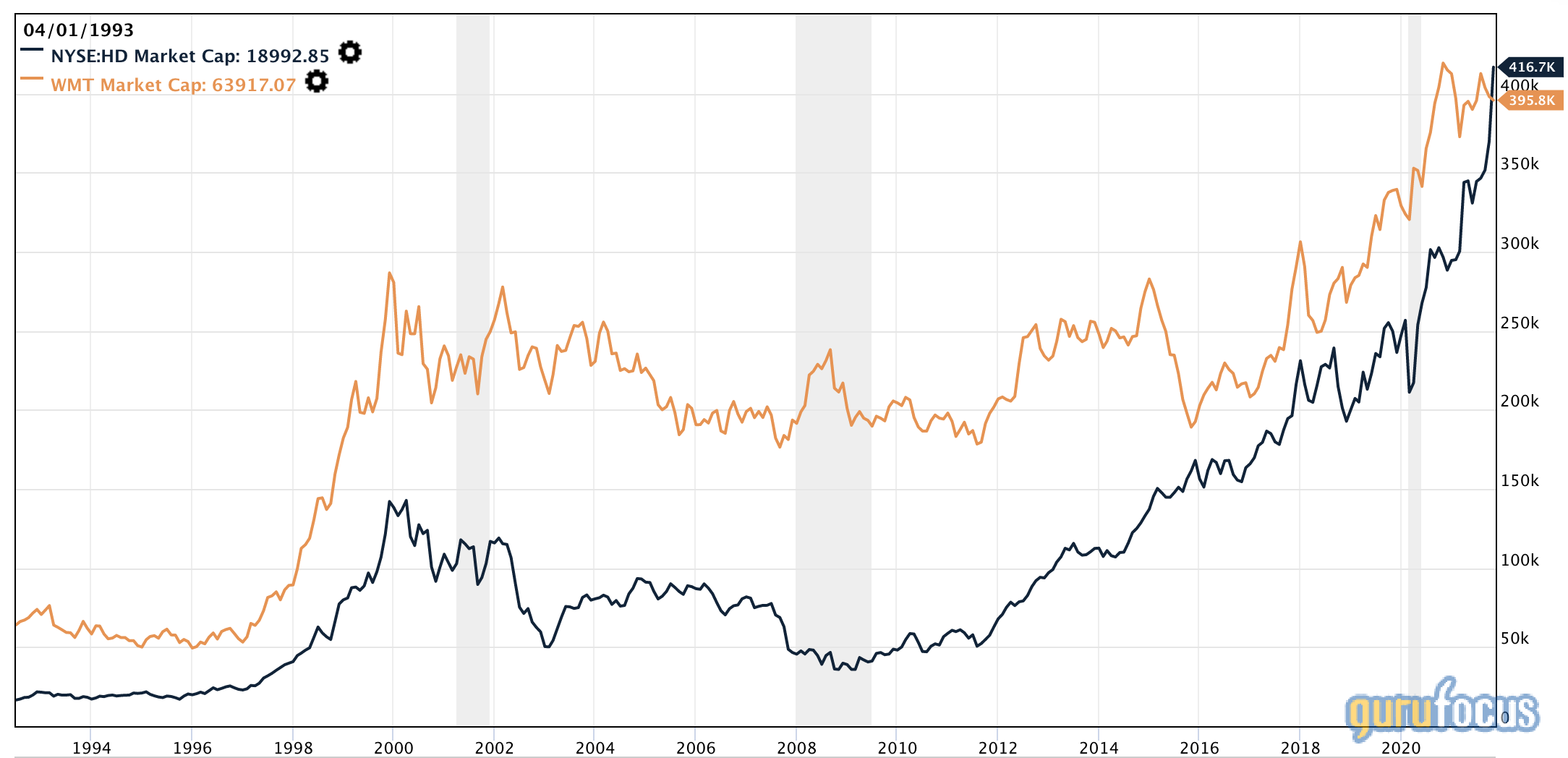

The Home Depot Inc. (HD, Financial) recently surpassed Walmart Inc. (WMT, Financial) in total market cap for the first time. Home Depot has risen by more than 6% over the past five trading days, fueled by a strong third quarter earnings report.

However, Walmart also has a lot going for it, and there is an ongoing argument regarding which of these two stocks is the better buy. Here's my take.

Economic support

It's fair to say that both these companies are operating a cost-leadership strategy, selling goods at a significant discount to their competitors due to their superior supplier negotiating power, cost-cutting efforts and customer loyalty.

I expect the sustained GDP growth in the U.S. (+3.9% expected for 2022) to provide linear support to consumer goods stores such as Home Depot and Walmart. However, it should be noted that if inflation surpasses GDP growth, then real GDP growth could turn negative, which would not be good for the economy.

Key metrics

Home Depot is operating at a larger operating margin than Walmart, suggesting that the business is operating more efficiently in its existing form and that Home Depot could have greater ability to reduce costs if it becomes necessary.

Furthermore, Home Depot has a better diluted EPS number than Walmart; diluted EPS usually provides a solid lead indicator to a stock's future price, and Home Depot's looking in good shape.

Valuation

Valuation metrics indicate something other than the operating margins and diluted EPS figures. According to both stocks' price-earnigns ratios, Home Depot is 90.81% overvalued relative to the sector, while Walmart is only overvalued by 19.79% compared to its sector peers.

Furthermore, Home Depot's price-sales ratio is trading at a 119.89% sector premium, while Walmart's is trading at a 51.82% sector discount.

Investors should note that current economic variables will most likely cause both these stocks to trade above their average ratios for some time to come.

Final word

Although I understand that these two companies sell different products, both belong to the consumer staples/discretionary sector, which makes them part of the same peer group.

Although Home Depot has shown significant improvement in operating costs and dominates Walmart in that respects, it needs to be considered that margins will probably revert to below the 10% level in a non-stimulus world. In contrast, Walmart's heavier reliance on consumer staples will likely ensure it sustains its current margins.

Walmart has the better valuation multiples, and I see Home Depot as more of a cyclical stock. I thus consider Walmart as undervalued at the moment, while Home Depot is at the top of a cyclical boom and quite overvalued.