Chinese investor Li Lu (Trades, Portfolio) has revealed his firm’s U.S.-based equity portfolio for the third quarter of 2021. During the quarter, Himalaya Capital Management established one new holding in Berkshire Hathaway Inc. (BRK.B, Financial), now its third-largest holding, and left its other holdings to maintain solid year-to-date gains.

The firm embraces the value investment principles of Benjamin Graham, Warren Buffett (Trades, Portfolio) and Charlie Munger (Trades, Portfolio). It focuses on publicly traded companies in Asia, with an emphasis on China. The firm aims to achieve superior returns with high-quality companies that maintain substantial economic moats, great growth potential and are run by trustworthy people.

Portfolio overview

At the end of the quarter, the firm’s portfolio contained seven stocks with one new holding in Berkshire Hathaway. It was valued at $2.15 billion and has seen a turnover rate of 11%. The largest holdings in the portfolio are Micron Technology Inc. (MU, Financial), Bank of America Corp. (BAC, Financial), Berkshire Hathaway, Alphabet Inc. (GOOG, Financial) and Meta Platforms Inc. (FB, Financial).

The top sectors represented in the portfolio are technology (42.92%), financial services (35.83%) and communication services (19.71%).

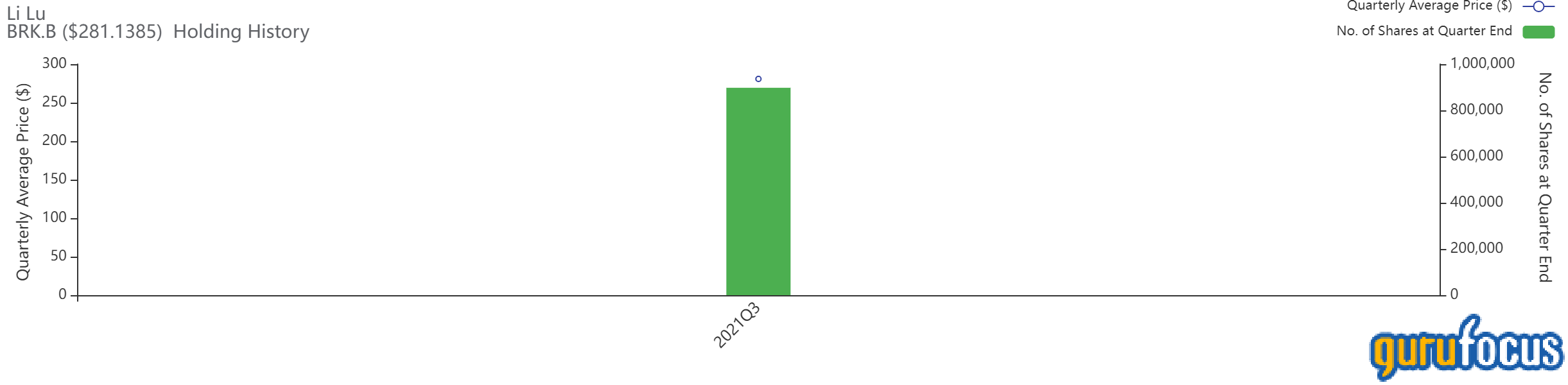

Berkshire Hathaway

Himalaya Capital established a new holding in Berkshire Hathaway (BRK.B, Financial) with the purchase of 897,749 shares. The shares traded at an average price of $280.85 throughout the quarter and the position now maintains an 11.41% weighting in the equity portfolio. GuruFocus estimates the holding has lost 0.12% since it was established.

Berkshire Hathaway is a holding company with a wide array of subsidiaries engaged in diverse activities. The firm's core business segment is insurance, run primarily through Geico, Berkshire Hathaway Reinsurance Group and Berkshire Hathaway Primary Group. Berkshire has used the excess cash thrown off from these and its other operations over the years to acquire Burlington Northern Santa Fe (railroad), Berkshire Hathaway Energy (utilities and energy distributors) and the companies that make up its manufacturing, service and retailing operations (which include five of Berkshire's largest noninsurance pretax earnings generators: Precision Castparts, Lubrizol, Clayton Homes, Marmon and IMC/ISCAR). The conglomerate is unique in that it is run on a completely decentralized basis.

On Nov. 18, the stock was trading at $280.50 per share with a market cap of $628.15 billion. According to the GF Value Line, the stock is trading at a fair value rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 7 out of 10 and a valuation rank of 5 out of 10. There is one severe warning sign issued for assets growing faster than revenue. The company’s cash-to-debt ratio of 0.61, below the 10-year median of 0.76, ranks worse than 76.61% of industry competitors.

Other top guru shareholders in Berkshire Hathaway (BRK.B, Financial) include Bill Gates (Trades, Portfolio), Diamond Hill Capital (Trades, Portfolio), Pioneer Investments, Tom Russo (Trades, Portfolio) and Hotchkis & Wiley.

Alphabet

While the firm did not make any changes to its Alphabet (GOOG, Financial) holding, it has performed exceptionally well with a year-to-date change of 70.17%. The holding was first established in the second quarter of 2020 and is yet to see any additions or reductions. The 85,900 shares were purchased at an average price of $1,345.56 per share and the holding shows a total estimated gain of 125%.

Alphabet is a holding company, with Google, the internet media giant, as a wholly-owned subsidiary. Google generates 99% of Alphabet's revenue, of which more than 85% is from online ads. Google's other revenue is from sales of apps and content on Google Play and YouTube, as well as cloud service fees and other licensing revenue. Sales of hardware such as Chromebooks, the Pixel smartphone and smart homes products, which include Nest and Google Home, also contribute to other revenue. Alphabet's moonshot investments are in its other bets segment, where it bets on technology to enhance health (Verily), faster internet access to homes (Google Fiber), self-driving cars (Waymo) and more. Alphabet's operating margin has been 25% and 30%, with Google at 30% and other bets operating at a loss.

As of Nov. 18, the stock was trading at $3,027.50 per share with a market cap of $2 trillion. The GF Value Line shows the stock trading at a significantly overvalued rating.

GuruFocus gives the company a financial strength rating of 8 out of 10, a profitability rank of 9 out of 10 and a valuation rank of 3 out of 10. There are two warning signs issued for a declining gross margin and a declining operating margin. The company has consistently increased revenue and net income over the last decade, with 2017 being the only year to see either figure fall.

Alphabet (GOOG, Financial) shares are also owned by Dodge & Cox, Pioneer Investments, Primecap Management, Baillie Gifford (Trades, Portfolio) and Al Gore (Trades, Portfolio).

Pinduoduo

The guru’s Pinduoduo (PDD, Financial) holding is the sore thumb of the portfolio, with a year-to-date loss of 49.47%. It was purchased in the fourth quarter of 2020 and has remained unchanged at 363,165 shares under ownership. The holding currently shows an estimated loss of 29.72% as share prices have fallen below the average price paid per share of $120.29.

Pinduoduo provides a platform for buyers with value-for-money merchandise and fun and interactive shopping experiences. The company mobile platform offers a comprehensive selection of priced merchandise, featuring a social shopping experience that leverages social networks as an effective and efficient tool for buyer acquisition and engagement. The company's whole revenue is derived from within China.

The stock was trudging at $84.52 per share with a market cap of $105.83 billion on Nov. 18. A significantly overvalued rating is given to the company by the GF Value Line.

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rank of 1 out of 10. There are currently no severe warning signs issued for the company despite the poor profitability rank. The company’s weighted average cost of capital has consistently overshadowed the return on invested capital, indicating capital efficiency issues.

Other gurus with Pinduoduo (PDD, Financial) positions include Baillie Gifford (Trades, Portfolio), Chase Coleman (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Ray Dalio (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies.