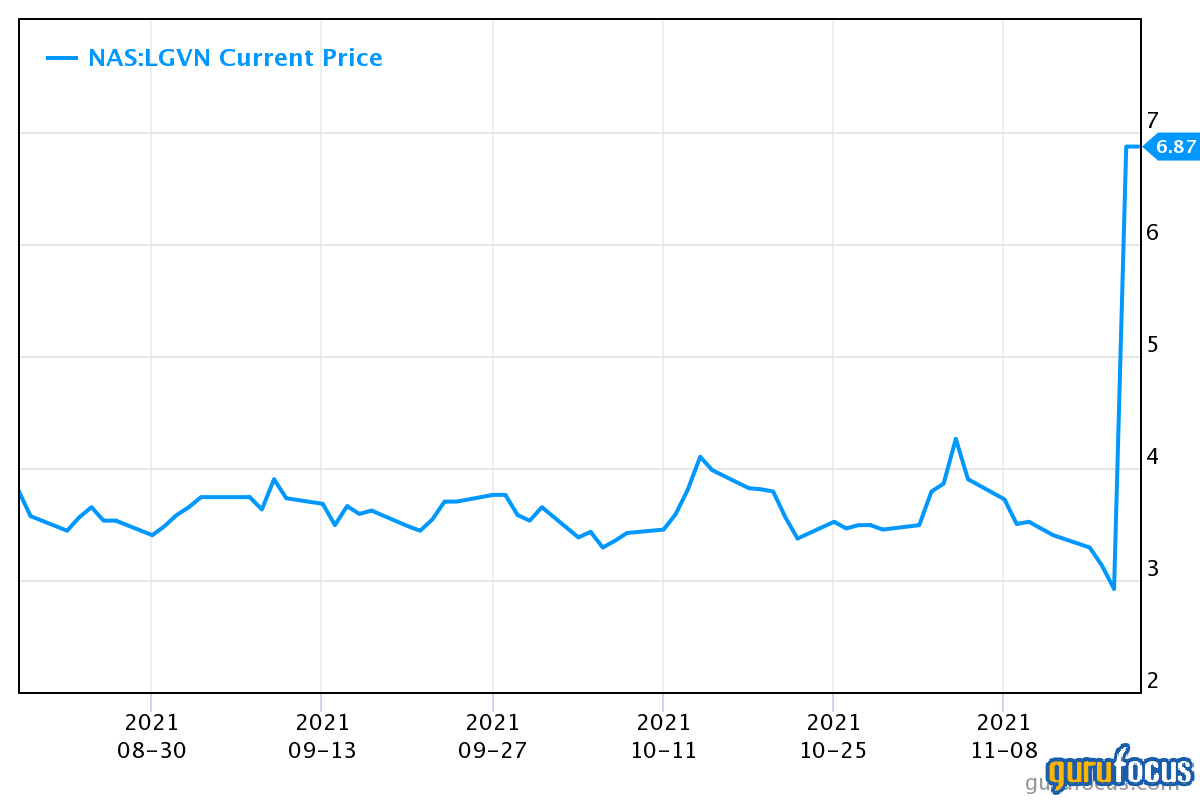

Biotechnology player Longeveron Inc. (LGVN, Financial) more than doubled in value from a single trading session after a major U.S. FDA announcement. The clinical-stage biotech player, which is engaged in research and development using stem cell research to develop therapies to combat heart diseases, aging, frailty, Alzheimer's disease and other neurological disorders, recently received an encouraging update from the FDA in regards to one of its treatments, marking a key step on the path to profitability.

Company overview

Longeveron is a clinical-stage biotechnology firm that is advancing cellular treatments for age-associated and life-threatening diseases. The company's lead candidate is Lomecel-B, a cell-based therapy acquired from medicinal signaling cells derived from young, healthy adult donors' bone marrow. Longeveron's research attempts to address a wide range of ailments, including aging frailty, Alzheimer's disease and related dementias (ADRD) and metabolic syndrome (MetS).

It is a well-known leader in regenerative medicine and aging research and is conducting one of the most advanced multicentre interventional clinical studies for aging frailty. Moreover, the company has its own manufacturing facility with eight clean rooms, two R&D laboratories and warehousing that it uses for product development and contract manufacturing. Longeveron's facilities are staffed by a team of experienced scientists and production specialists who specialize in biomarker analysis, potency assays, product characterization, quality control and quality assurance.

What is Lomecel-B?

Lomecel-B is a cellular therapy and the core output of Longeveron’s research to date. It is made from special living cells called Medicinal Signaling Cells (MSCs), separated from fresh bone marrow tissue donated by adult donors aged 18 to 45. The company's primary business strategy is to become a world-leading regenerative medicine company by developing and commercializing novel cell therapy products such as Lomecel-B, focusing on aging-related indications.

As of early 2021, over 250 subjects have received Lomecel-B via direct injection, and no serious adverse events were reported that were thought to be related to the product candidate.

The Japanese Pharmaceutical and Medical Devices Agency recently approved Lomecel for a Phase 2 Aging Frailty clinical trial (PMDA). The National Heart, Lung, and Blood Institute (NHLBI) has awarded a $4.5 million multi-year grant to the Lomecel-B Phase 2 HLHS program.

Special designation causes stock to soar

As we can see in the above chart, Longeveron’s stock price showed a huge jump in a single session. This took place after the company announced that the U.S. FDA had granted Rare Pediatric Disease (RPD) designation for Lomecel-B to treat Hypoplastic Left Heart Syndrome (HLHS), a rare congenital heart disease in which the left ventricle remains underdeveloped in an infant, impairing the heart's ability to pump blood throughout the body. Without surgical intervention, HLHS is often fatal. Three surgical procedures are performed over a five-year period to allow the right ventricle to be configured to pump blood to the body.

Longeveron has been analyzing the safety of injecting Lomecel-B into the right ventricle during the second surgery (which is done between four to six months of age), as well as the impact on cardiac function and other health status terminuses. The company recently reported clinical results from its Lomecel-B Phase I clinical study in HLHS patients. When cardiac surgeons inoculated Lomecel-B directly into the infants' hearts during surgery, the cells were well endured, with no significant adverse cardiac events or infections linked to the investigational treatment. Crucially, all 10 of the infants enrolled in the Phase 1 trial were alive and had not needed a transplant between two to three and a half years after surgery. Other indicators of the infants' health, such as weight gain and growth pattern, were consistent with normal healthy infants.

The U.S. FDA may allow RPD designation for diseases that mostly affect children aged 18 or younger and affect fewer than 200,000 people in the United States. Under this program, if the FDA approves Lomecel-B for the treatment of HLHS, Longeveron may be eligible for a priority review voucher (PRV) if the application submitted for the product meets certain conditions and is approved before Sept. 30, 2026, as required by the current law.

If a drug company receives a PRV, any subsequent drug or biologic application can be reviewed and a decision made in six months instead of the standard 10 months, potentially reducing time to market, or the PRV can be sold to another company. The PRV accelerated review is for patients who have severe conditions and want access to potentially life-saving or life-changing treatment as soon as possible. Additionally, companies can potentially go to market with their product faster and start generating product revenue as a result. This is why it is a major update for Longeveron and why the stock price jumped. The management also expects positive results from the aging trials.

Final thoughts

Unlike most clinical-stage biotech companies, Longeveron has not required a significant capital infusion through equity issuances as it earned over $4.5 million from grant revenues and contract manufacturing revenues. The company has a decent cash position and is well-positioned to cover the expenses and capital requirements for the next couple of years.

The company has Lomecel-B going through trials in a variety of different ailments, and with the designation described above, it appears to be only a matter of time before Longeveron starts generating licensing revenues. It could even become a potential acquisition target for big pharma.