Charlie Munger (Trades, Portfolio), the vice chairman of Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial), disclosed in a regulatory portfolio update this week that his Daily Journal Corp. (DJCO, Financial) nearly doubled its Alibaba Group Holding Ltd. (BABA, Financial) stake during the fourth quarter of 2021. During the past three months, shares of Alibaba tumbled approximately 14.37%.

About Munger

Munger studied mathematics at the University of Michigan and attended Harvard Law School. The vice chairman of Berkshire discussed in his book “Poor Charlie’s Almanack” the concept of elementary, worldly wisdom as it relates to business and finance.

Munger inspired Buffett to invest in high-quality companies for the long term. Berkshire seeks good companies using a four-criteria investing approach: understandable business, favorable long-term prospects, honest and competent management and attractive valuation.

As of Dec. 31, the Daily Journal’s $259 million equity portfolio, which Munger manages, contains five stocks, with no new positions and a quarterly turnover ratio of 14%. The top three sectors in terms of weight are financial services, consumer cyclical and basic materials, with weights of 72.13%, 27.65% and 0.22%, respectively.

Aside from the decline with Alibaba's stock price, Munger’s other four holdings produced mixed results during the past three months. While Bank of America Corp. (BAC, Financial) and Wells Fargo & Co. (WFC, Financial) posted gains, U.S. Bancorp (USB, Financial) and POSCO (PKX, Financial) posted losses during the three-month period.

Alibaba

The Daily Journal's only reported portfolio change on its latest 13F holding revealed that it purchased 300,000 shares of Alibaba (BABA, Financial), boosting the position by 99.32% and its equity portfolio weight at the Daily Journal by 13.78%.

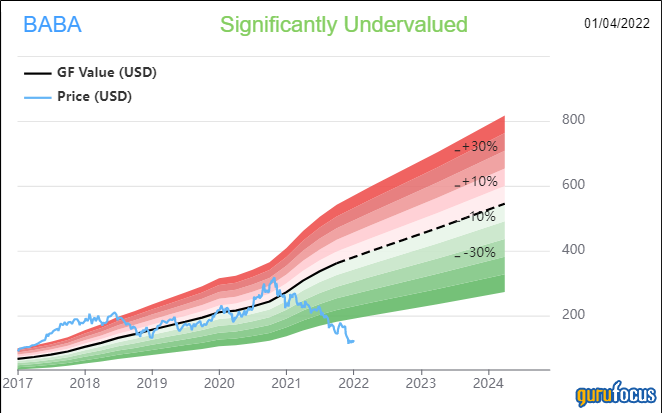

While shares of Alibaba averaged $145.10 during the fourth quarter, the stock traded around $126.36 on Wednesday, down approximately 14.37% over the past three months. The stock is significantly undervalued based on Wednesday’s price-to-GF-Value ratio of 0.33.

GuruFocus ranks the Chinese e-commerce giant’s profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank, a high Joel Greenblatt (Trades, Portfolio) return on capital and a three-year revenue growth rate that outperforms more than 95% of global competitors.

Other gurus with holdings in Alibaba include PRIMECAP Management (Trades, Portfolio), Ken Fisher (Trades, Portfolio) and Baillie Gifford (Trades, Portfolio).

Bank of America

Daily Journal owns 2.3 million shares of Bank of America (BAC, Financial), giving the position 39.56% weight in the equity portfolio.

Shares of Bank of America averaged $45.61 during the fourth quarter. The stock gained approximately 11.21% during the past three months and is significantly overvalued based on Wednesday’s price-to-GF-Value ratio of 1.41.

Other gurus with holdings in Bank of America include Berkshire and Dodge & Cox.

Wells Fargo

Daily Journal owns 1,591,800 shares of Wells Fargo (WFC, Financial), allocating 29.53% of its equity portfolio to the stake.

Shares of Wells Fargo averaged $49.28 during the fourth quarter. The stock gained approximately 12.61% over the past three months and is modestly overvalued based on Wednesday’s price-to-GF-Value ratio of 1.13.

Other gurus with holdings in Wells Fargo include PRIMECAP Management (Trades, Portfolio) and Chris Davis (Trades, Portfolio)’ Davis Select Advisors.

U.S. Bancorp

The Daily Journal owns 140,000 shares of U.S. Bancorp (USB, Financial), dedicating 3.04% of equity portfolio space to the holding.

Shares of U.S. Bancorp averaged $59.09 during the fourth quarter. The stock dipped 2.15% over the past three months yet is fairly valued based on Wednesday’s price-to-GF-Value ratio of 1.04.

POSCO

Daily Journal owns 9,745 shares of POSCO (PKX, Financial), giving the position a 0.22% equity portfolio weight.

Shares of POSCO averaged $61.97 during the fourth quarter. The stock tumbled 12.04% over the past three months yet is fairly valued based on Wednesday’s price-to-GF-Value ratio of 1.07.