Viking Global Investors leader Andreas Halvorsen (Trades, Portfolio) disclosed earlier this week he boosted his stake in Guardant Health Inc. (GH, Financial) by 4.65%.

The guru's Greenwich, Connecticut-based hedge fund takes a long-term, research-intensive approach to investing. The firm selects stocks based on its understanding of the company’s fundamentals, business model and management team, while also taking cyclical and secular industry trends into consideration. Halvorsen was a former protégé of Tiger Management's Julian Robertson (Trades, Portfolio).

According to GuruFocus Real-Time Picks, a Premium feature, Halvorsen invested in 227,559 shares of the Redwood City, California-based health care company on Jan. 6, impacting the equity portfolio by 0.6%. The stock traded for an average price of $90.24 per share on the day of the transaction.

The investor now holds 5.12 million shares total, which represent 1.29% of the equity portfolio. GuruFocus estimates he has lost 16.26% on the investment since establishing it in the third quarter of 2019.

The medical diagnostics and research company, which provides blood tests for detecting cancer and analytics for clinical and research use, has a $7.5 billion market cap; its shares were trading around $73.81 on Wednesday with a price-book ratio of 11.22 and a price-sales ratio of 22.97. GuruFocus noted these metrics are all approaching multiyear lows.

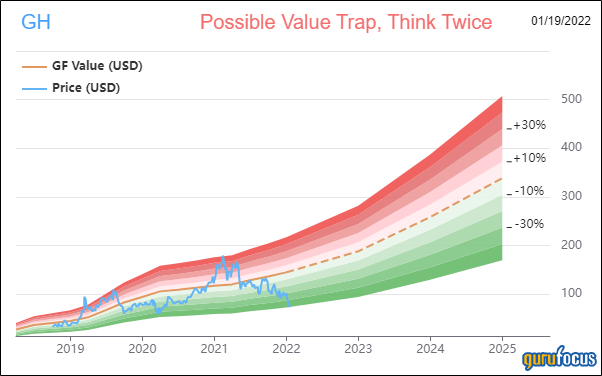

Based on historical ratios and an adjustment for past performance and future earnings projections, the GF Value Line suggests the stock is a possible value trap currently. As a result, potential investors should do thorough research into the company before making a decision.

The company disclosed its third-quarter 2021 results in November. Guardant posted a net loss of $107.5 million, or a loss of $1.06 per share, on $94.8 million in revenue. While sales grew 27% from the prior-year quarter, the net loss widened over the same period.

Guardant is working to develop a blood test that will be effective in detecting a wide number of early-stage cancers in order to help save lives. In a statement, co-founder and Co-CEO Helmy Eltoukhy provided an update on the initiative.

“We have continued our strong cadence of data supporting our Guardant360 products and are making solid progress towards our multi-cancer goal for MRD with the initiation of our ORACLE study,” he said. “We are dedicated to offering health care providers a complete portfolio of oncology products that will provide clinically actionable information to guide patient care.”

Co-founder and Co-CEO AmirAli Talasaz also commented on the company’s progress.

“Guardant’s differentiated core technology platform has the potential to significantly improve our ability to detect many cancers at their earliest stages,” he said. “Successful readouts of ECLIPSE and SHIELD, as well as future studies, will unlock the tremendous opportunity for blood-based cancer screening.”

GuruFocus rated Guardant Health’s financial strength 3 out of 10. In addition to debt-related ratios that are underperforming versus competitors as well as its own history, the Altman Z-Score of 2.91 indicates the company is under some pressure.

The company’s profitability fared even worse, scoring a 1 out of 10 rating on the back of negative margins and returns on equity, assets and capital that are underperforming a majority of industry peers. Guardant also has a low Piotroski F-Score of 2 out of 9, suggesting operations are in poor shape.

Of the gurus invested in Guardant Health, Halvorsen has the largest stake with 5.04% of outstanding shares. He is not the only one who sees value in the stock, however. During the third quarter, Philippe Laffont (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio) and Lee Ainslie (Trades, Portfolio) also added to their holdings. Ron Baron (Trades, Portfolio) and Ray Dalio (Trades, Portfolio) curbed their positions, while Catherine Wood (Trades, Portfolio) left her investment unchanged.

Insiders do not seem as optimistic, however, with selling activity exceeding buying over the past year.

Portfolio composition

More than half of Halvorsen’s $35.94 billion equity portfolio, which was composed of 95 stocks as of the end of the third quarter of 2021, was invested in the health care and technology sectors.

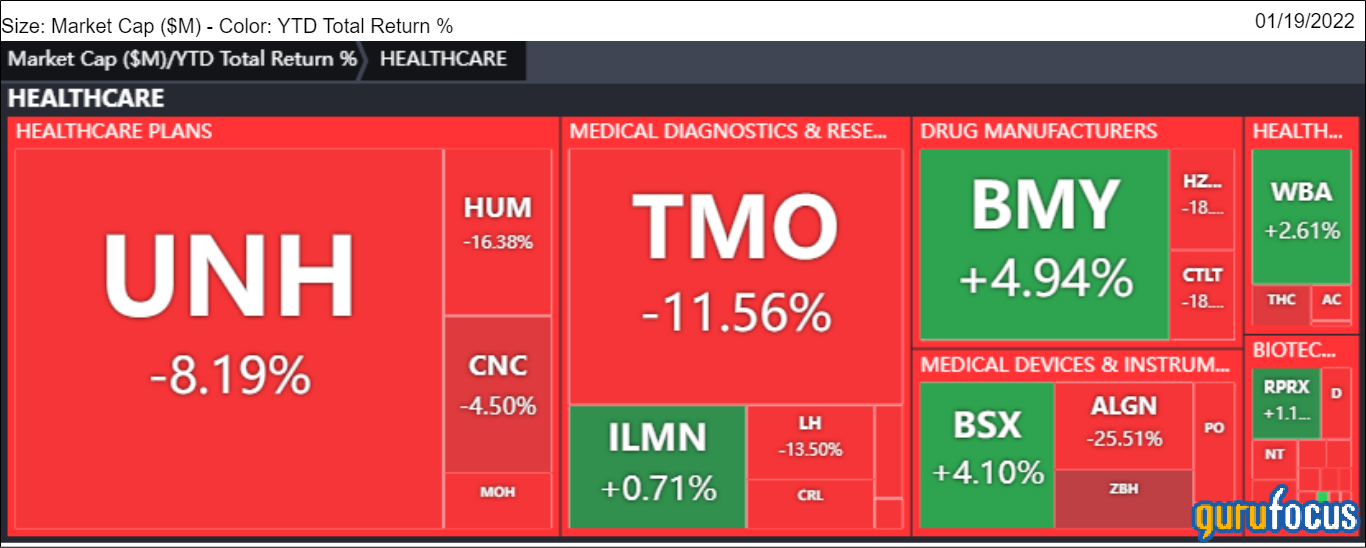

Other companies in the medical diagnostics and research space Viking Global had positions in as of Sept. 30 included Laboratory Corp of America Holdings (LH, Financial), Thermo Fisher Scientific Inc. (TMO, Financial), Charles River Laboratories International Inc. (CRL, Financial), Illumina Inc. (ILMN, Financial) and Pacific Biosciences of California Inc. (PACB, Financial).

Also check out: