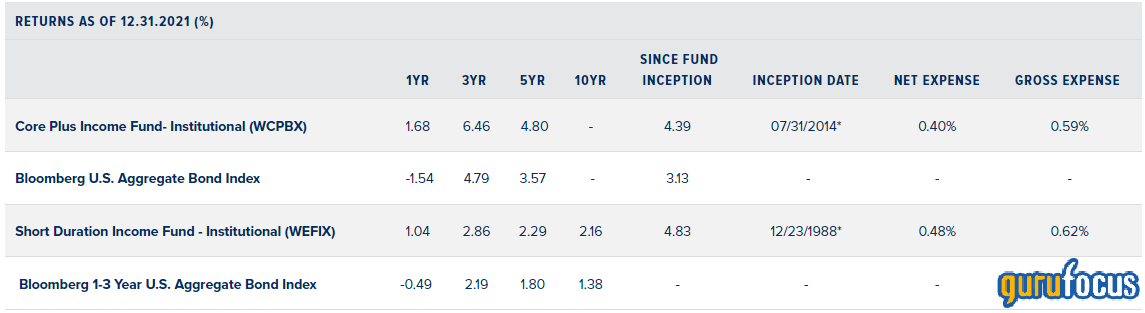

In a year where broad-based bond indexes (like those below) posted negative returns, positive performance is more than welcome — and returns for the Short Duration and Core Plus Income funds are particularly satisfying to report. Low nominal returns are not overly exciting, but black ink when indexes were in the red made 2021 fulfilling. Security and sector selection, conservative duration positioning, and our flexible mandates were the principal drivers of performance. Further detail about contributors to results can be found in each fund's quarterly commentary.

*Denotes the Fund's inception date and the date from which Since Inception performance is calculated.

Data quoted is past performance and current performance may be lower or higher. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. All investments involve risks, including possible loss of principal.

Please visit weitzinvestments.com for the most recent month-end performance.

Additionally, please see the latest Value Matters from Wally and Brad and the equity portfolio managers' commentaries for detailed analyses of the Weitz equity and conservative allocations funds.

Fixed-Income Market Update

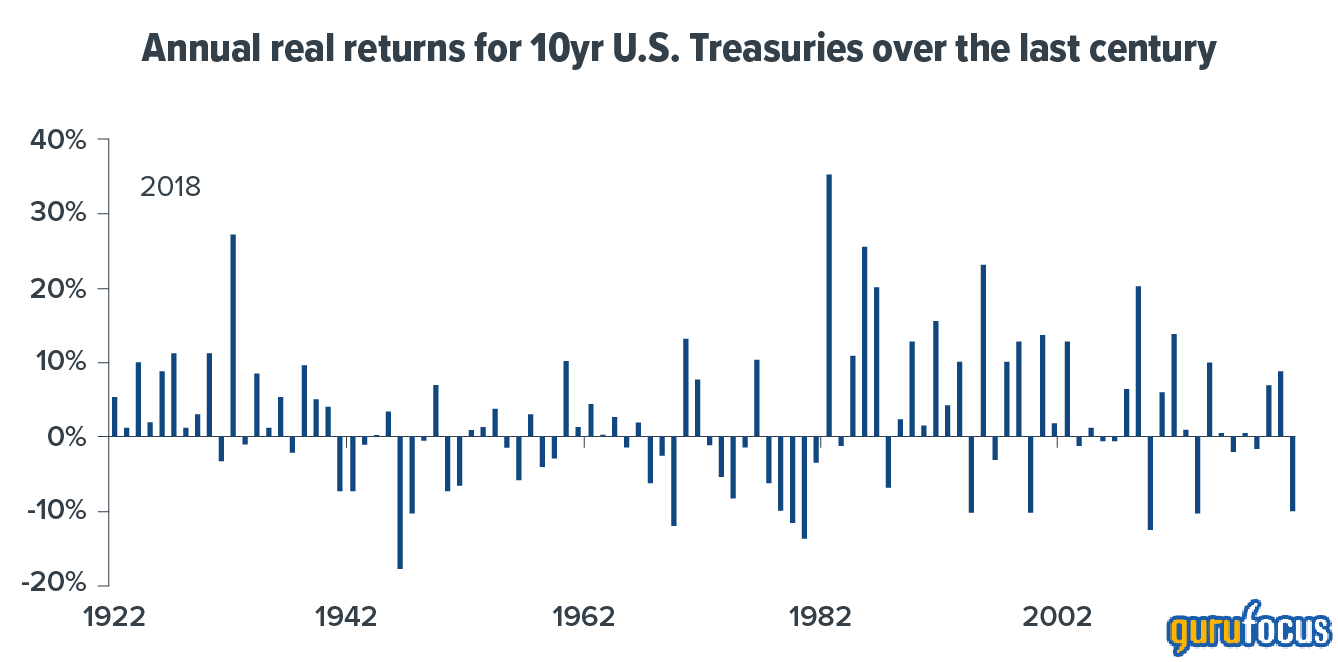

A Goldman Sachs strategist well summarized the past year when stating that 2021 began with the marriage of fiscal and monetary policy — the likes of which the world had never seen — and ended with the failure of a signature fiscal bill championed by the White House and the Federal Reserve (Fed) acting quickly to get out of the bond buying business to end quantitative easing. The tinder was lit, though, as record stimulus and the economic growth it helped foster were met with supply chain issues and employment challenges, leading to a rise in inflation unlike anything seen in decades. Year-over-year inflation of 1.4% at the end of 2020 (as measured by the consumer price index) rose to 7.0% by the last report of 2021. Negative nominal returns for most bond market segments were, therefore, made even more negative in “real” (after inflation) terms. The 10-year Treasury rose approximately 60 basis points (0.6%) in 2021 — not too dramatic in historical terms. But when combined with the effect of inflation, 2021 will be well within the 10-year Treasury's top-ten worst annual real-return years for the past century. Hopefully 2021 doesn't ultimately go down as a replay of 1946 — the worst real-return year of the past 100 years — as 1946 was followed by a sustained period of phenomenally negative real returns in government bonds. Given the large global debt pile, no longer “transitory” inflation may be met with further financial and interest rate repression.

Source: GFD, Deutsche Bank

Note: 2021 figure to mid-December

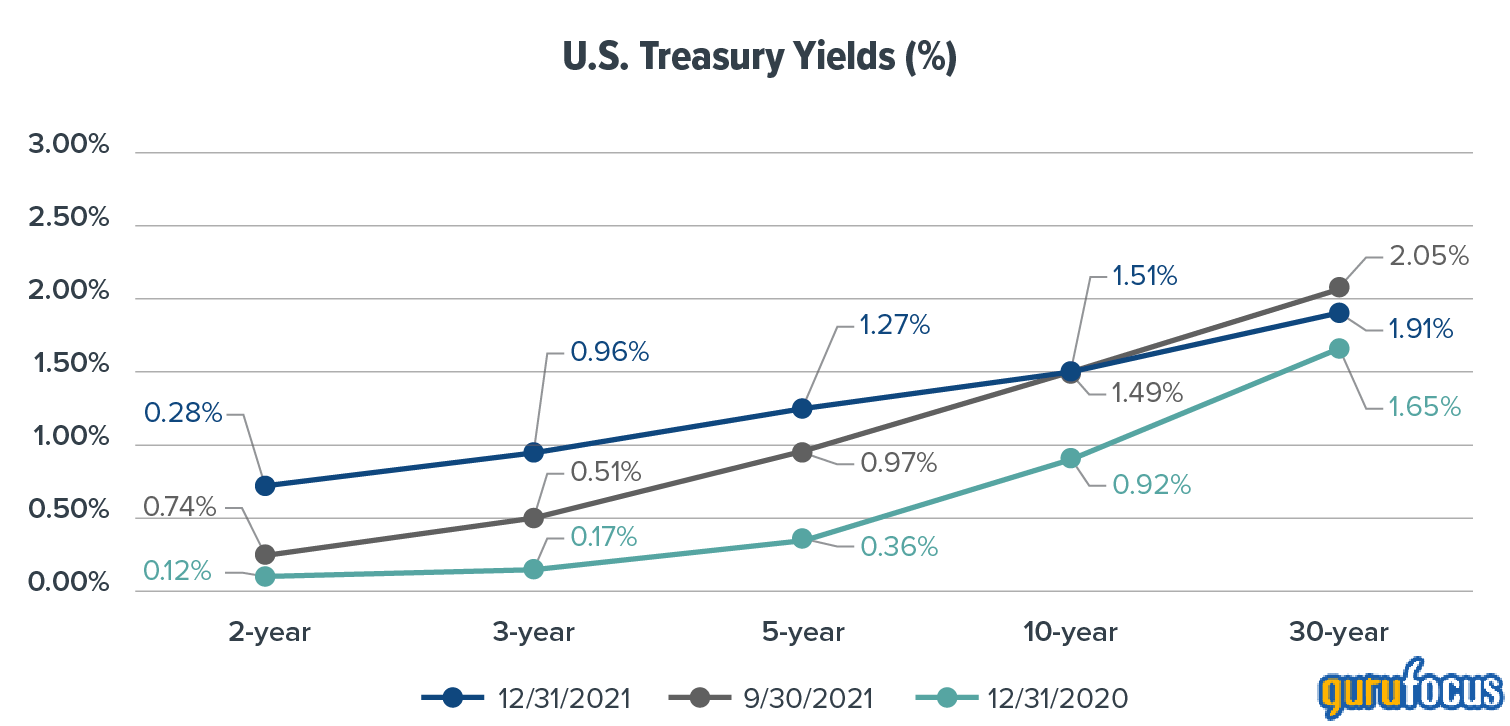

The graph below shows the changes of select Treasury rates during the fourth quarter and full-year 2021.

The Treasury curve began to anticipate a future Fed tightening cycle with shorter rates rising much more than longer-term rates. 2- and 3-year Treasury rates rose 46 and 45 basis points in the fourth quarter, respectively, while the 30-year Treasury rate declined 14 basis points. The result was a further 'flattening' of the curve, with the difference between 2- and 30-year Treasury rates declining to 117 basis points on December 31, 2021, from 177 on September 30, 2021.

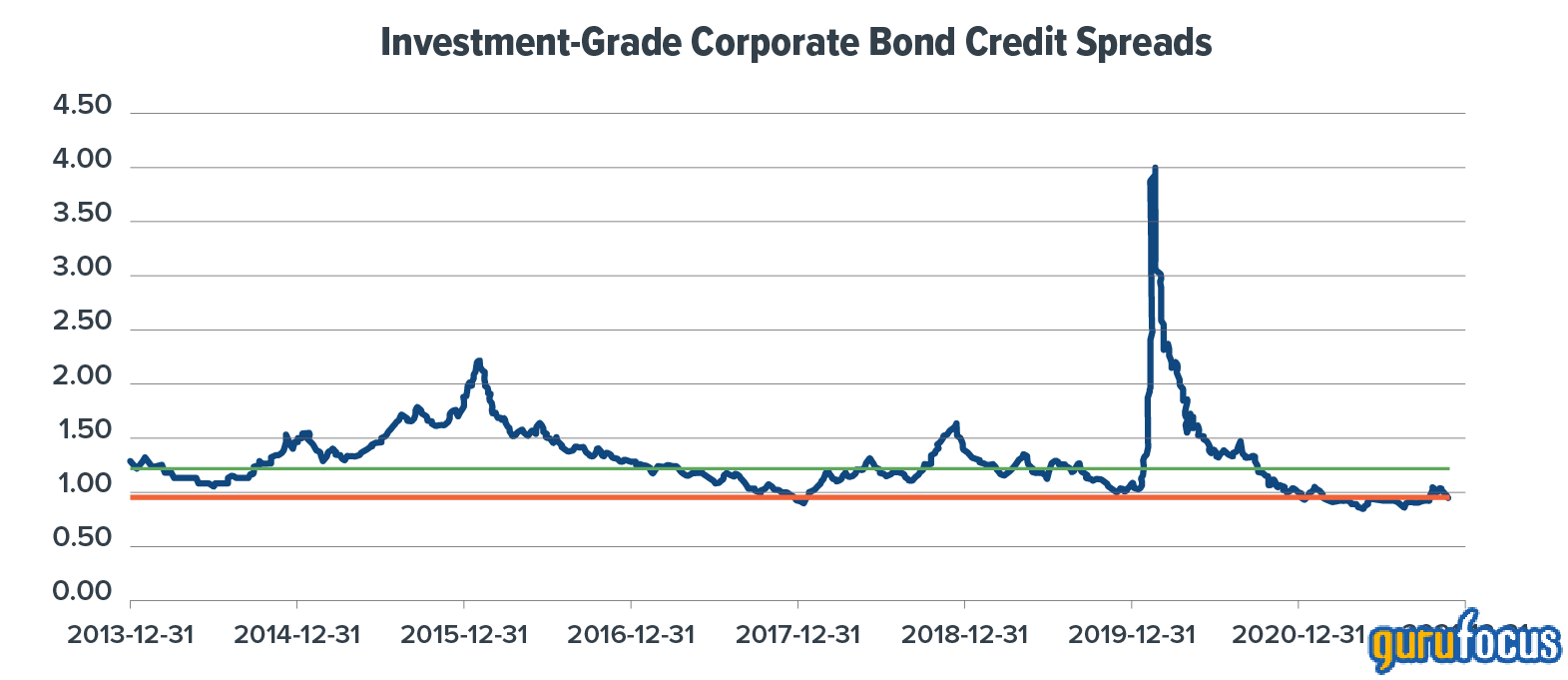

Spreads on corporate bonds widened in the fourth quarter. A broad measure of investment-grade corporate bond spreads, compiled by ICE BofA, increased to 98 basis points on December 31, 2021, from 89 basis points on September 30, 2021. The chart below depicts the path of investment-grade corporate bond credit spreads for the past five years (blue line) against the one- (orange) and five-year (green) averages.

Source: Federal Reserve Economic Data (FRED) - St. Louis Fed

For the full year, investment-grade corporate bond credit spreads declined from 103 to 98 basis points and, once again, remain below their five-year average while only marginally above their one-year average. With longer-term (10- and 20-year) credit spread averages of 138 and 161 basis points for investment-grade corporate bonds, sub-100 at year-end 2021 suggests a “Hakuna Matata” (no worries) mentality among investors. High yield credit spreads even registered many 10-year lows throughout 2021. Maybe the next 5, 10, or 20 years will be sanguine for credit investors. But history is not supportive, as so many recurring crises have painfully taught.

Inflation — the 'dog' is barking….and biting

A year ago we wrote about inflation being the dog that didn't bite… rarely rising much above the Fed's long-term target of 2%. Twelve months later, inflation is barking loudly and biting everyone's cost of living, especially hurting lower income families and those living on a fixed income.

Nobel Prize-winning American economist Milton Friedman remarked in 1963, “Inflation is always and everywhere a monetary phenomenon…” In the same speech, he argued that he could not find inflation anywhere in the world that was not caused by a prior increase in the supply of money or its growth. Many Keynesian economists (those who subscribe to the ideas of British economist John Maynard Keynes) disputed this and are having similar debates to this day.

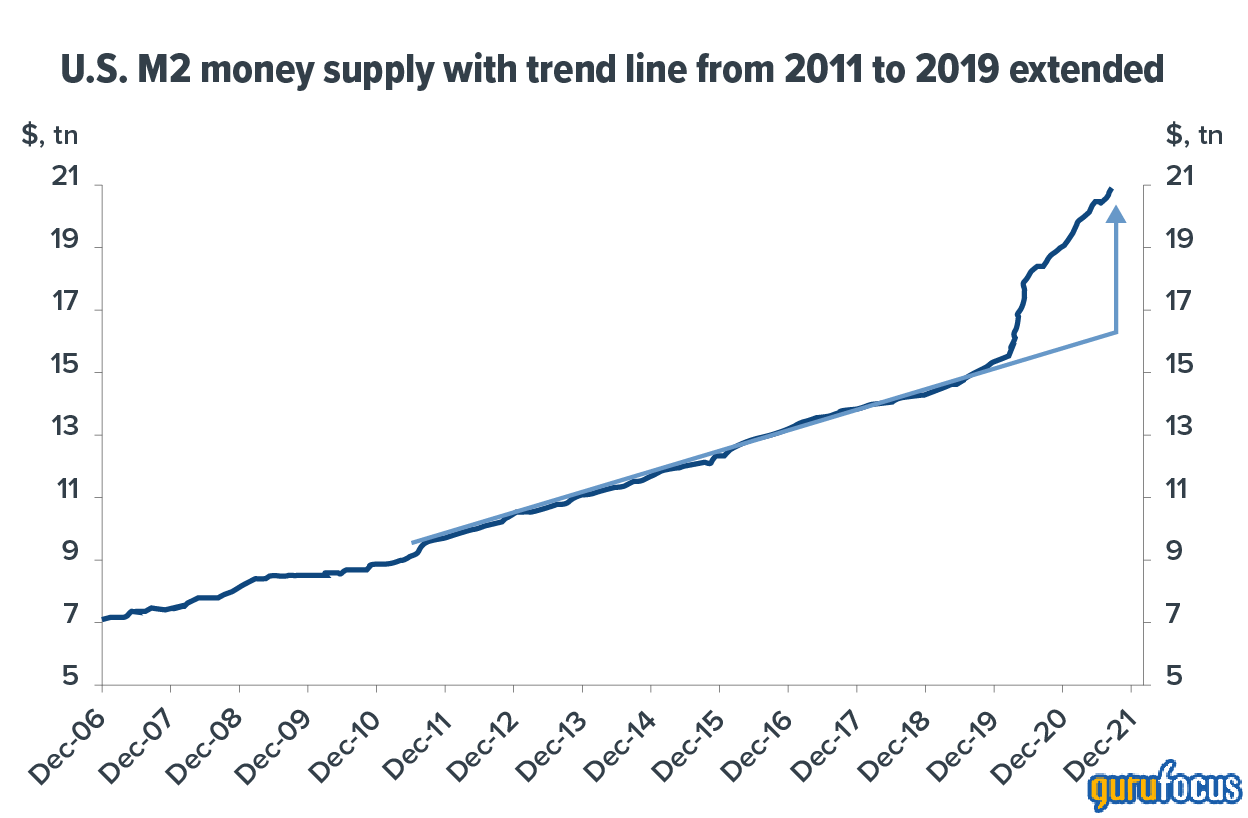

Below is a chart that highlights the hangover of liquidity (as measured by money supply) that has grown well above trend since the start of the COVID pandemic. Many investors' views about inflation have been largely informed by the low levels of inflation since the 2008 financial crisis — but the money supply was subdued even after the extraordinary stimulus to combat that crisis. Supply-side issues are arguably an ingredient to today's inflation challenge — but nearly $4 trillion in above-trend money supply growth has added fuel to the now barking (and biting) inflation “dog.”

Source: Federal Reserve, Bloomberg Finance LP, Deutsche Bank

Taper, Tighten, and Shrink

As mentioned, the Fed is finally getting out of the bond buying business. Namely, it expects to stop adding to its balance sheet by March — faster than previous expectations of mid-2022. The Fed cited the rapid gains in employment and persistent inflation as key reasons for accelerating the “taper.” And as outlined in minutes from the Fed's December meeting, “Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.” So, 2022 appears to be the year we can leave zero-interest-rate policy (ZIRP) behind. That will be a welcome relief for many savings investors and short-term bond investors, like our Ultra Short and Short Duration Income funds.

The same December Fed minutes also hinted at the need to shrink the Fed's nearly $9 trillion balance sheet, up from $4 trillion in 2019. While all of this could make for a bumpy 2022 and beyond, letting the markets fend for themselves would be a welcome development.

The “Non-Outlook” market prediction… “they will fluctuate”

Despite the dour charts and discussion, we're excited for the “adventure” Wally and Brad described in Value Matters. Our firm's nearly 40-year experience, and certainly the events of the last several years, reinforce our view that the best prediction for the future — credited to the elder JP Morgan in Ben Graham's famous “The Intelligent Investor” — regarding the markets is: “they will fluctuate.” Our job has been and remains to have a general sense of where we are in the economic cycle, continue to seek out the most advantageous risk/reward opportunities, take advantage of our flexible mandates, and always maintain adequate liquidity to take advantage of the one investment constant — namely, change.

The opinions expressed are those of Weitz Investment Management and are not meant as investment advice or to predict or project the future performance of any investment product. The opinions are current through the publication date, are subject to change at any time based on market and other current conditions, and no forecasts can be guaranteed. This commentary is being provided as a general source of information and is not intended as a recommendation to purchase, sell, or hold any specific security or to engage in any investment strategy. Investment decisions should always be made based on an investor's specific objectives, financial needs, risk tolerance and time horizon.

Investment results reflect applicable fees and expenses and assume all distributions are reinvested but do not reflect the deduction of taxes an investor would pay on distributions or share redemptions. The Weitz Short Duration Income Fund - Institutional Class's Expense Ratios and the Weitz Core Plus Income Fund - Institutional Class's Expense Ratios are as of each Fund’s most recent prospectus. Certain Funds have entered into fee waiver and/or expense reimbursement arrangements with the Investment Advisor. In these cases, the Advisor has contractually agreed to waive a portion of the Advisor’s fee and reimburse certain expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to limit the total annual fund operating expenses of the Class’s average daily net assets through 07/31/2022 (and in the case of the Core Plus Fund Institutional Class, through 07/31/23).

Portfolio composition is subject to change at any time. Current and future portfolio holdings are subject to risk.