Ammo Inc. (POWW, Financial) is a small company, but it operates in the global ammunition market and has been increasing its market share by providing high-quality, precision rounds for military and defense operations as well as for sports and personal security users.

As per Grand View Research, the global ammunition market was around $21.38 billion in 2020 and is expected to grow at a CAGR of 3.6% from 2021 to 2028 on account of the rising popularity of shooting-related sports and various other factors such as rising global political tensions.

Ammo has a strong position in this market and has been recognized by the U.S. Department of Defense for developing and manufacturing ballistically matched multipurpose and signature-on-target rounds. It has a multi-channel distribution, a vertically integrated setup, a scalable model and various patented technologies that help the company stay competitive.

Company overview

Ammo is a firearms manufacturer that designs, develops, manufactures and sells ammunition and component products for long guns and handguns in the U.S. and across the globe. Their products are designed for sports and athletic shooters, hunters, people looking for home security or personal security, as well as law enforcement and military agencies.

With the help of their STREAK Visual Ammunition, the company allows shooters to see the path of their bullets clearly. Not only that, but they also offer One Precise Shot ammunition, which is designed to meet the needs of law enforcement officers in a variety of situations. Furthermore, Ammo has produced Stealth Subsonic ammunition, which is designed primarily for suppressing handguns. Jesse James ammunition, a jacketed hollow point bullet, is available for self-defense. The company also sells thick armor-piercing incendiary rounds and ammunition casings for pistol and rifle ammunition. In addition, they also provide patented biodegradable shotgun shells.

Ammo also owns GunBroker.com, which is an online marketplace where third-party sellers sell firearms, shooting, hunting and other related products. Ammo is based in Scottsdale, Arizona and was founded in 1990.

Innovative product offerings

As described above, Ammo has a diverse product line that caters to both commercial and defense markets. This helps to give it an edge against competitors.

Some of its strong product lines include the Signature Line, Sealth or Subsonic Ammunition, Streak visual ammunition and Signature Blackline. The company also manufactures defense ammunition, which is used by the U.S. task force and defense military. This ammunition is made with cutting-edge, One-Way Luminescent (O.W.L.) technology and is extremely effective and accurate. They are bullets that have been fully optimized to pierce hard and large targets. Since the bullet leaves visible traces to improve hitting accuracy, the shooter can see the bullet's precise path.

The company also has a patent on biodegradable shotgun shells for hunting and sports shooting. In addition, during the R&D process, the company created complementary biodegradable pistols, as well as small and large rifle ammunition.

Their products are currently sold in over 20 countries as well as their home market in the U.S. TÜV Austria, one of the world's leading bioplastics certification authorities, has scientifically tested and approved its ammunition. The company was recently awarded a contract by the Irregular Warfare Technical Support Directorate (IWTSD) to design and manufacture Signature-on-Target (SoT) rounds in support of military operations. Furthermore, the Irregular Warfare Technical Support Directorate (IWTSD) also awarded Ammo a contract to design and manufacture Ballistically Matched Multi-Purpose Rounds (BM-MPR) rounds in support of military operations.

The Gunbroker acquisition

GunBroker.com is the world's largest online marketplace for firearms, hunting, shooting and related items, recognized as a licensed firearms dealer and transfer agent. It was founded in 1999 as a safe and informative marketplace for buying and selling firearms, bullets, archery equipment, hunting gear, knives and swords, air guns and other items.

Ammo recently acquired GunBroker.com and some of its affiliates, converting them into wholly-owned Ammo subsidiaries. The merger was worth $240 million in total. The company paid $50 million in cash, $50 million in debt assumption and repayment and an additional 20 million shares of common stock issuance as consideration to purchase GunBroker.com.

It is worth highlighting that Gunbroker.com has reached a critical mass of users, allowing the company to operate at a higher profit margin. It has also amassed a network of over 25,000 Federal Firearms License (FFL) partners, and its service has become ingrained in these dealers' marketing platforms. Ammo now has the opportunity to reach out to the global customers of the world's largest online firearms marketplace as a result of this merger. Gunbroker generated approximately $60 million in revenue and a staggering $40 million in Ebitda in 2020. The acquisition is expected to immediately boost Ammo’s earnings per share. After this acquisition, management has set a goal of generating $250 million in revenue by the end of the fiscal year in March 2022.

The company's vision for this massive purchase was that it would open up a slew of new opportunities and help it compete with other ammunition manufacturers such as General Dynamics Corp (GD, Financial), B.A.E. Systems PLC, Vista Outdoor Inc. (VSTO, Financial) and Northrop Grumman Corp (NOC, Financial). The management believes that the acquisition of Gunbroker is a significant step forward in Ammo's vertical integration process, as it gives it access to Gunbroker's robust IT infrastructure. Gunbroker.com created its own proprietary source code, allowing the marketplace website to run on a highly scalable system that their small team of technical engineers can easily maintain. It also has a strong track record with the ATF and FBI, the two main regulatory bodies in the firearms industry.

Final thoughts

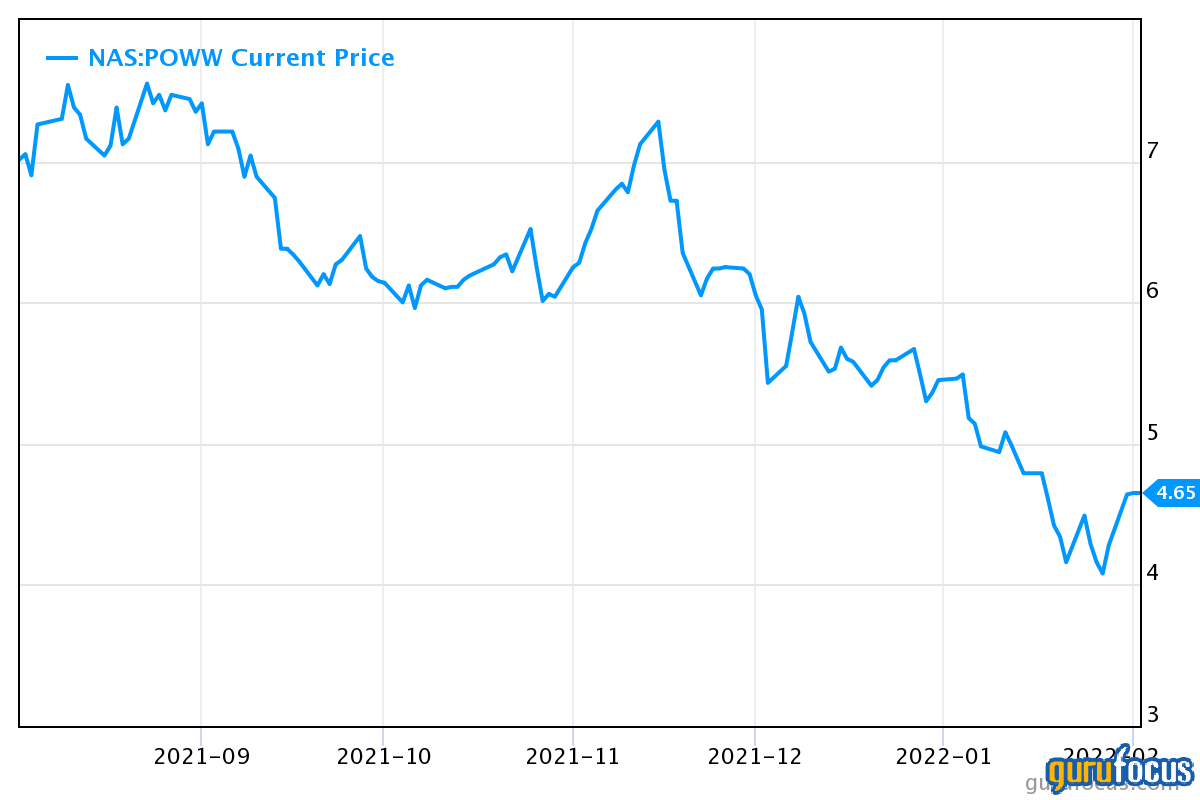

Ammo has done well financially by capitalizing on military opportunities as well as its online marketplace acquisition, but its stock price trajectory has remained more or less flat for the past few months. This is despite the Gunbroker acquisition and its trailing 12-month revenues more than doubling.

The company’s forward price-earnings ratio is as low as 9.69 and its enterprise-value-to-Ebitda multiple of 15.35 also appears to be cheap. Ammo has a seasoned management team that can ensure a continuous growth trajectory in the firearms market. Overall, I am very optimistic about Ammo and I believe that the company could generate excellent returns through a combination of revenue growth and multiples expansion.