Value and growth are actually pretty similar

Value and growth stock investing are not as different as many people think, if executed correctly with a solid strategy. As growth in future cash flows is a portion of value, modern value investors don’t ignore growth, as some mistakenly think. The challenge for both value and growth investors lies in using the information available to predict growth in future cash flows, and this is uncertain because nobody can predict the future consistently.

As a general rule, a "value investor" may be more inclined to pay less for promised growth in future cash flows and thus focus more on historic and proven ability to generate cash flows. This tendency leads many traditional value investors to invest into companies late in the corporate life cycle. For example, Coca-Cola (KO, Financial) and Intel (INTC) are popular value stocks, as opposed to a young biotech company with lots of future growth potential that is currently not generating any revenue.

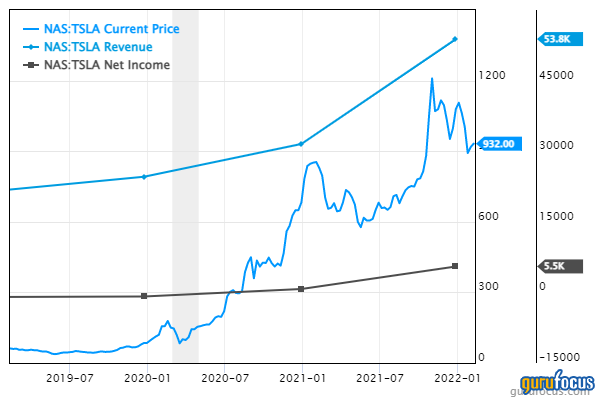

Growth stock investors such as Catherine Wood (Trades, Portfolio) of Ark Invest (an early-stage Tesla (TSLA, Financial) investor) may be more inclined to pay more for future cash flows as they have a higher conviction in the growth potential of the stocks they pick.

Historical value vs. growth performances

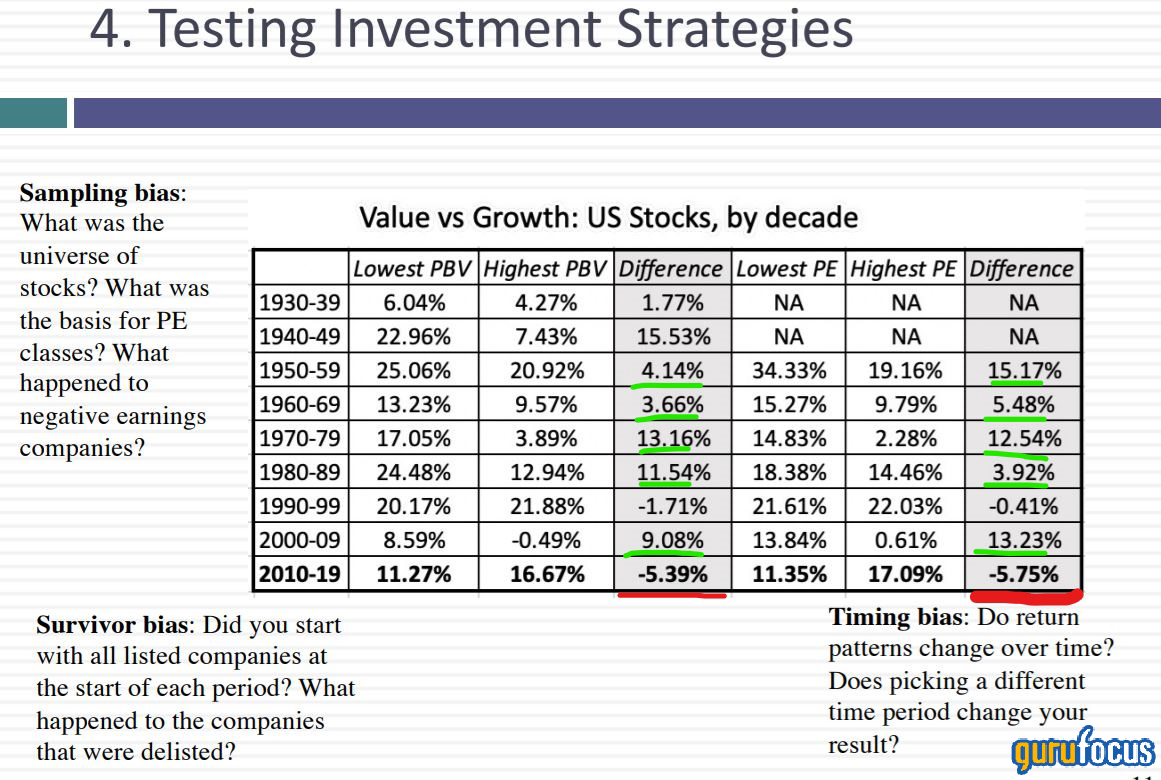

According to a study by a Professor of Valuation at New York University (2020) , a simplified value investing strategy of buying stocks with low price-earnings ratios and low price-to-book-value ratios would have underperformed a simplified growth investing strategy by approximately 5.75% between 2010 and 2019.

However, the study also found that value stocks outperformed growth stocks in most of the 70 years prior. The exception was the historic period between 1990 to 1999 when both strategies returned close to equal returns +/- 1.7%.

This data is from a back-test of four simple strategies, using extremely simplified measures of value. While there is much more to value investing than low earnings multiples, value strategies do put much more emphasis and priority on low valuations compared to growth strategies.

The four strategies of the backtest were as follows:

- Buy “cheap” value stocks with a low price-earnings ratio – simple value strategy

- Buy “cheap” value stocks with a low price-book ratio – simple value strategy

- Buy “expensive” growth stocks with a high price-earnings ratio – simple growth strategy

- Buy “expensive” growth stocks with a high price-book ratio – simple growth strategy

Is value investing dead??

Since value investing has underperformed growth investing over the past decade, this has lead many people to believe value investing is dead. However, they are all too quick to forget that in the 70 years prior, value almost always outperformed. We won't be in a bull market forever.

Value investing has agreater track record of outperformance historically. The strategy is as timeless as general common sense in the stock market. Buying cash flows cheaply, buying one dollar for 50 cents and buying below intrinsic value estimates are foundations of investing success.

Now of course, there are "value traps," and usually stocks are cheap for a reason. Sometimes this reason is justified and there is a fundamental issue with the business, whereas other times, this may be because of lack of perception and market fear. Volatility can equal opportunity for a value investor.

The hardest part of value investing is that you do not know when the gap will close between the cheap price and the stock's true value. This could be three years, five years or even 10+ years, if ever! Thus, many great value investors look for a catalyst for the market to re-assess the stock. This could be some favorable news or business decision which may accelerate the realization of value.

Are overvalued stocks doomed to crash?

Even if a stock is overvalued, it could stay that way for a very long time and may even grow into its valuation through the power of reflexitvity, a theory that was popularized by George Soros (Trades, Portfolio).

A great example of the theory of reflexivity is Tesla (TSLA, Financial). There is no doubt from many valuations that the stock was overvalued tremendously even back in the day (before 2019). However, various industry tailwinds, business fundamental improvements and a cult-like following behind the Electric Vehicle Messiah that is Elon Musk have led the company to grow into its past valuation, though whether the business can someday grow into its current valuation is another question entirely. Wood's Ark Innovation ETF (ARKK, Financial) certainly benefited from the 700%+ return in 2020 alone!

Conclusion

Value and growth investing are two strategies with a lot in common, as estimating the growth in future cash flows is a portion of valuing any company. Toignore value is to ignore reality,and it only makes sense for a short term momentum trader where fundamentals are irrelevant.

From studying the greatest investors of all time, I was not surprised to see that the vast majority identify themselves as “value investors,” although they have variations of style, from Buffett to Charlie Munger (Trades, Portfolio) (Trades, Portfolio), Michael Burry and many more.

I personally consider myself a combination of both a value and a growth investor. Some would call this a “modern day value investor” as I search for G.A.R.P (growth at a reasonable price). This was a term popularized by the legendary investor Peter Lynch. I have an open mind to valuing a business and shake off historic rules of thumb from the past.

I believe in embracing new valuation methods, as things like price-earnings ratios are no longer sufficient and “money losing” tech companies may actually be great investments (think Amazon (AMZN, Financial) here).

Growth stocks tend to be disportionally impacted by macroeconomic issues (such as rising inflation and interest rate hikes), as the future cash flows of a growth company are discounted more steeply during such times. Thus, value stocks may be safer in a rising rate environment.

Whatever your investing style, I wish you good luck on your journey to being a great investor!

Also check out: