Catherine Wood (Trades, Portfolio) (Trades, Portfolio) is a growth stock investor who believes innovation and technology are the keys to great investing returns. Her flagship fund, the Ark Innovation ETF (ARKK, Financial), focuses on four main pillars:

- DNA Technologies and the “Genomic Revolution”

- Automation, Robotics and Energy Storage

- Artificial Intelligence and the “Next Generation Internet”

- Fintech Innovation

Source: Ark Invest's presentation materials

Wood was hailed as the “Queen of Growth Stocks” during the 2020 bull market and benefited hugely from having Tesla (TSLA, Financial) as the largest holding (10%) in the Ark Invest Growth ETF selection. Tesla's stock experienced astonishing returns and was up 700%+ in 2020 alone, but there were also other great bets, such as Block (SQ, Financial) (formerly Sqare), Zoom (ZM, Financial) and Teladoc (TDOC, Financial).

Ark Invest's performance

Ark Invest has had some incredible performances over the past few years. Let's take a look at the flagship fund, the Ark Innovation ETF. This fund returned an astonishing 152% for investors in 2020. In prior years, the performance was fantastic with 35% in 2019 and 87% in 2017.

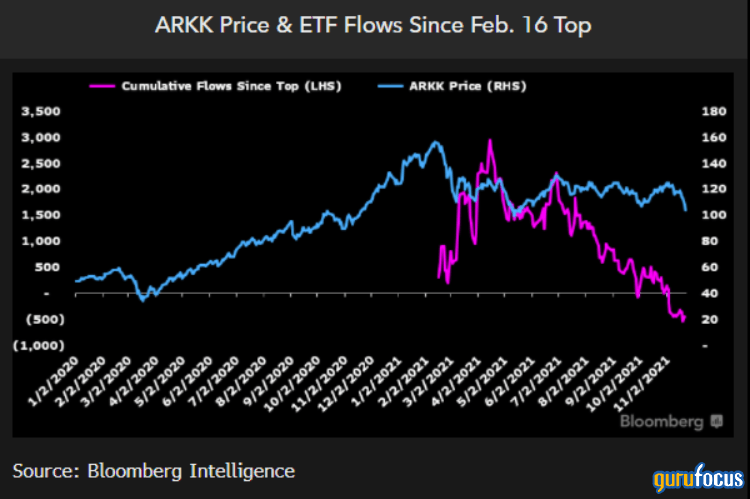

However, 2021 was a disaster for Ark Invest, and Wood's flagship fund ARKK is down 23% over the year!

It may seem like Ark Invest is sinking. The poor performance led to a mass of outflows over the 2021 period, with the Ark Invest ETF’s receiving outflows of $6.2 billion since February 2021. Overall assets under management fell a whopping 50% from the peak in February 2021.

At one point, the ARK Disruptive Innovation ETF saw its assets under manager grow to a huge peak of $28 billion. This has now fallen to approximately $14 billion (data from Koyfin.)

These outflows have caused a huge hit to Ark Invest's revenue. As the fund charges an expense ratio of 0.75%, the decline means a $105 million loss.

Why is Ark Invest down?

Ark Invest is underperforming because the macroeconomic environment has changed. In 2020, the environment was better for growth stocks, but in 2021, record high inflation and rising treasury yields began to impact growth stocks vastly more than value stocks. This is because when we try to estimate the intrinsic value of companies, we are estimating the present value of the future cash flows. As growth stocks have their value weighted disproportionally more towards the future, rising Treasury yields mean a higher discount rate, which impacts growth stocks hugely and causes their valuations to tank.

If it’s any consolation to growth investors, Wood’s investments have been performing fantastically as isolated businesses. However, the macro issues of a rising rate environment are impacting the valuation of all growth stocks. Goldman Sach (GS, Financial) even forecasted as many as five interest rate hikesby the U.S. Federal Reserve in 2022. This is needed to keep inflation from getting further out of control.

One sign that the shift away from growth stocks may be more than just short-term is the high insider selling going on in many of these companies.

Founders and senior managers of many of the companies held in Ark's funds have been selling their shares. According to data from StoneX, insiders overall sold $13.5 billion and bought just $11 million of their own companies' shares in the second half of 2021.

Will Ark bounce back?

Wood is extremely smart, forward thinking and a great technology investor. Ark Invest’s strategy has been negatively affected by macroeconomic issues such as high inflation and suspected interest rate hikes, but I'm not too worried about this; all investing strategies will have their ups and downs. Thus, I do believe her strategy is still sound in the long term. The fate of Ark Invest and all growth stocks will be ultimately determined by their long-term potential, not the short-term fluctuations of the market.

How long will inflation last?

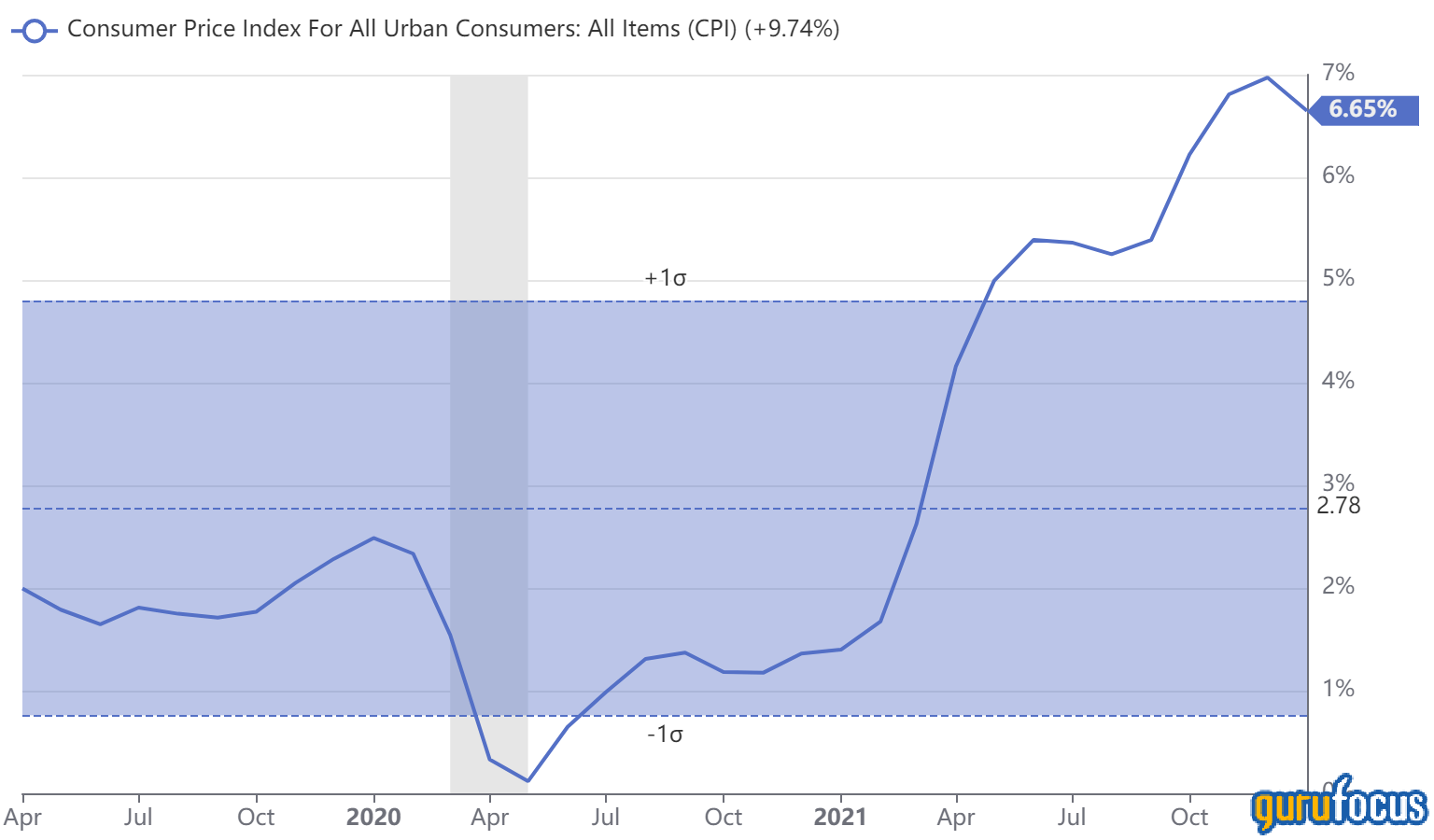

Inflation of the Consumer Price Index (CPI) is currently around 7%; this is vastly higher than the Fed’s 2% target and even pushes the 10-year average above 2% as well.

Now that we’ve established that inflation isn’t “transitory” as the Fed previously claimed in order to keep its easy money policies in place, Federal Reserve Chairman Jerome Powell has outlined a plan to curb inflation. Powell told Congress, “We will use our tools to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched.”

It's hard to predict things like inflation that have so many factors affecting them, but a rule of thumb is to expect a two-year time lag between a stricter monetary policy and inflation lowering. This is based on data from the International Journal of Central Banking, which conducted an analysis of 67 studies of the time lag. The study concluded that “The average transmission lag is twenty-nine months”

Thus, we can likely expect this 7% inflation to continue for approximately 2.5 years for beginning to subside. In the meantime, growth stocks will likely continue to be negatively impacted.

What can we learn from history?

The 1970’s inflation boom started to gain traction in 1973, when inflation doubled to 8.8%. By 1980, inflation was 14%. I interviewed a Wall Street Stock Investing veteran who said this situation now reminded him of the 1970’s.

Source: Inflation Data from Capital Professional Services, LLC

Now of course, we hope the Federal Reserve and economists have learned a lot since then, and we also have the benefit of technology and slowing population growth, which should produce a deflationary effect.

However, the fact is there are many unknowns to exactly when inflation will subside. It could be faster or slower. In the meantime, there is an opportunity cost for investors who are holding growth stocks.