Elfun Trusts (Trades, Portfolio), part of Boston-based State Street Global Advisors, disclosed this week in a regulatory portfolio update that its top five trades during the fourth quarter of 2021 included new holdings in Charles Schwab Corp. (SCHW, Financial) and Marriott International Inc. (MAR, Financial) and the closure of its positions in PepsiCo Inc. (PEP, Financial), Corning Inc. (GLW, Financial) and ServiceNow Inc. (NOW, Financial).

William Sandow and Christopher Sierakowski took over as fund managers following David Carlson stepping down in 2019. The fund seeks long-term capital appreciation by investing in the stock of companies based on the merits of individual companies. Emphasis is placed on companies that have the potential to pay dividends.

As of December 2021, the fund’s $3.95 billion equity portfolio contains 41 stocks with a quarterly turnover of 8%. The top three sectors in terms of weight are technology, financial services and communication services, representing 27.05%, 18.37% and 14.25% of the equity portfolio.

Charles Schwab

The fund purchased 853,400 shares of Charles Schwab (SCHW, Financial), allocating 1.82% of its portfolio to the position.

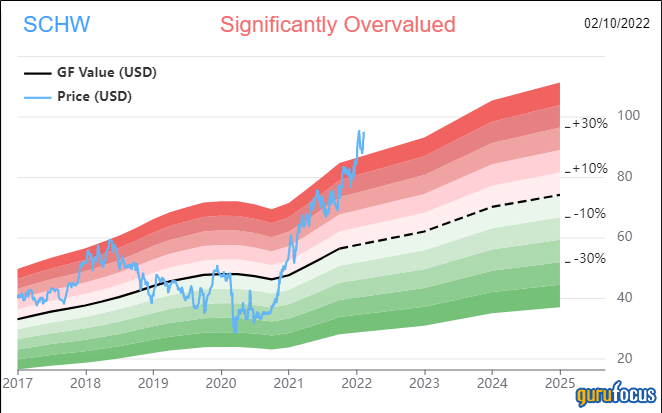

Shares of Charles Schwab averaged $81.09 during the fourth quarter; the stock is significantly overvalued based on Thursday’s price-to-GF Value ratio of 1.63.

GuruFocus ranks the Westlake, Texas-based brokerage company’s financial strength 3 out of 10 on the back of cash-to-debt and debt-to-equity ratios underperforming more than 55% of global competitors despite the company having a high Piotroski F-score of 7.

Other gurus with holdings in Charles Schwab include Dodge & Cox and Al Gore (Trades, Portfolio)’s Generation Investment Management.

Marriott

The fund invested in 287,900 shares of Marriott (MAR, Financial), giving the position 1.20% equity portfolio weight. Shares averaged $157.45 during the fourth quarter; the stock is significantly overvalued based on Thursday’s price-to-GF Value ratio of 1.86.

GuruFocus ranks the Bethesda, Maryland-based hospitality company’s profitability 6 out of 10 on the back of profit margins and returns outperforming more than 68% of global competitors despite three-year revenue decline rates outperforming just over half of global travel and leisure companies.

Other gurus with holdings in Marriott include Spiros Segalas (Trades, Portfolio) and PRIMECAP Management (Trades, Portfolio).

PepsiCo

The fund sold all 375,200 shares of PepsiCo (PEP, Financial), trimming 1.50% of its equity portfolio.

Shares of PepsiCo averaged $163.63 during the fourth quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 1.04.

GuruFocus ranks the Purchase, New York-based food and beverage company’s profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank and profit margins and returns that are outperforming more than 71% of global competitors.

Corning

The fund sold all 1,461,800 shares of Corning (GLW, Financial), trimming 1.42% of its equity portfolio.

Shares of Corning averaged $37.47 during the fourth quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 1.05.

GuruFocus ranks the Corning, New York-based materials science hardware company’s profitability 8 out of 10 on the back of a high Piotroski F-score of 7 and profit margins outperforming more than 84% of global competitors despite returns outperforming just over 55% of global hardware companies.

ServiceNow

The fund sold all 86,170 shares of ServiceNow (NOW, Financial), trimming 1.42% of its equity portfolio.

Shares of ServiceNow averaged $656.59 during the fourth quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.99.

GuruFocus ranks the Santa Clara, California-based software solutions company’s financial strength 6 out of 10 on the back of a double-digit Altman Z-score despite interest coverage and debt ratios underperforming more than 70% of global competitors.