Inflation has been all over the news recently, as it’s been hitting "the highest levels since 1982" for several months now. This has led to a devaluation of many investments, especially growth stocks, in addition to company profits being squeezed.

What are the implications of inflation on growth stocks, and how long will inflation last? These are the questions investors are asking themselves as we get closer to the first round of interest rate hikes to curb inflation.

What is inflation?

For those who aren't familiar with inflation, I like to think of it as “inflating” the prices of goods. Or you can also think of it as a “devaluing” of the currency in question, in this case the U.S. dollar. A loss in purchasing power basically means the same $1 buys less than previously. Inflation comes mainly as a result of too much currency chasing too few goods and services. Increases in money printing and lowering interest rates (which encourages more debt) are both common drivers of inflation.

How is inflation measured?

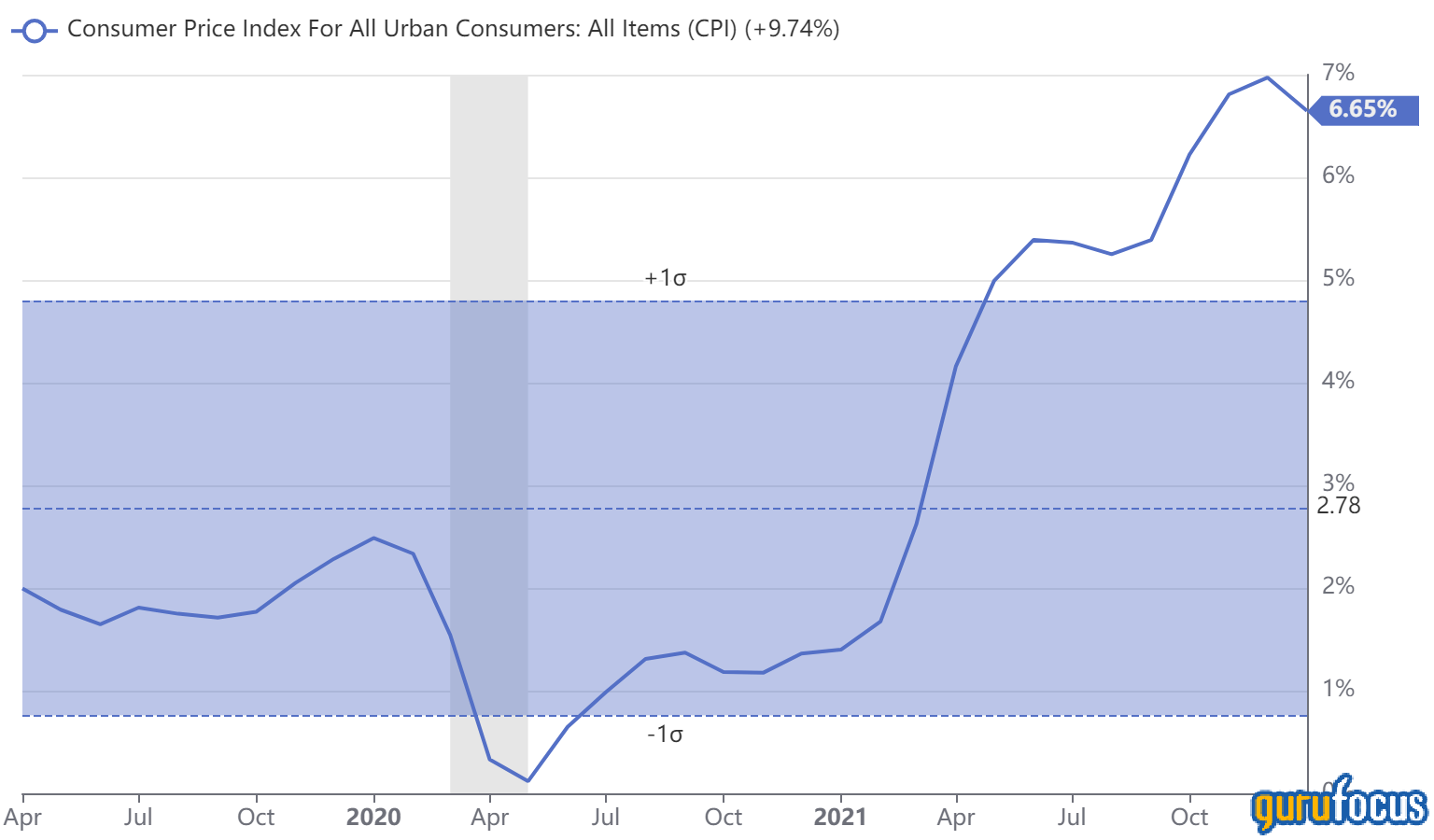

Inflation is measured in a variety of ways, but the one most commonly referred to in the U.S. is the consumer price index (aka the CPI). This takes a look at a basket of everyday goods (food, bread, milk, oil, lumber, etc.) and then looks at the average change in prices of these goods.

The U.S. Federal Reserve has a goal of a 2% average annual inflation rate, which is generally thought of as the ideal level to prevent both economic distress and delayed consumption. If prices are always increasing, people will want to buy now, which is good for the economy, but if inflation gets too high, it can trigger a recession as prices grow faster than most people can afford.

We have recently seen super high inflation at levels not seen since the 1980’s, with over 7% rates consistently. The Fed deemed this to be “transitory” originally, but it seems they turned out to be wrong.

What causes Inflation?

In its essence, inflation is caused from the devaluing of a currency, most notably via too much stimulus (money printing, low interest rates, etc.). If inflation gets too high and spirals out of the central bank's control, it can become hyperinflation.

Germany experienced an extreme case of hyperinflation during the 1930s. The cash-strapped government was straddled with reparations debt from the war, and it decided to print money to solve the problem, but of course this solution didn't work for long, and the currency became worthless. People were photographed using a wheelbarrow full of cash just to buy a loaf of bread.

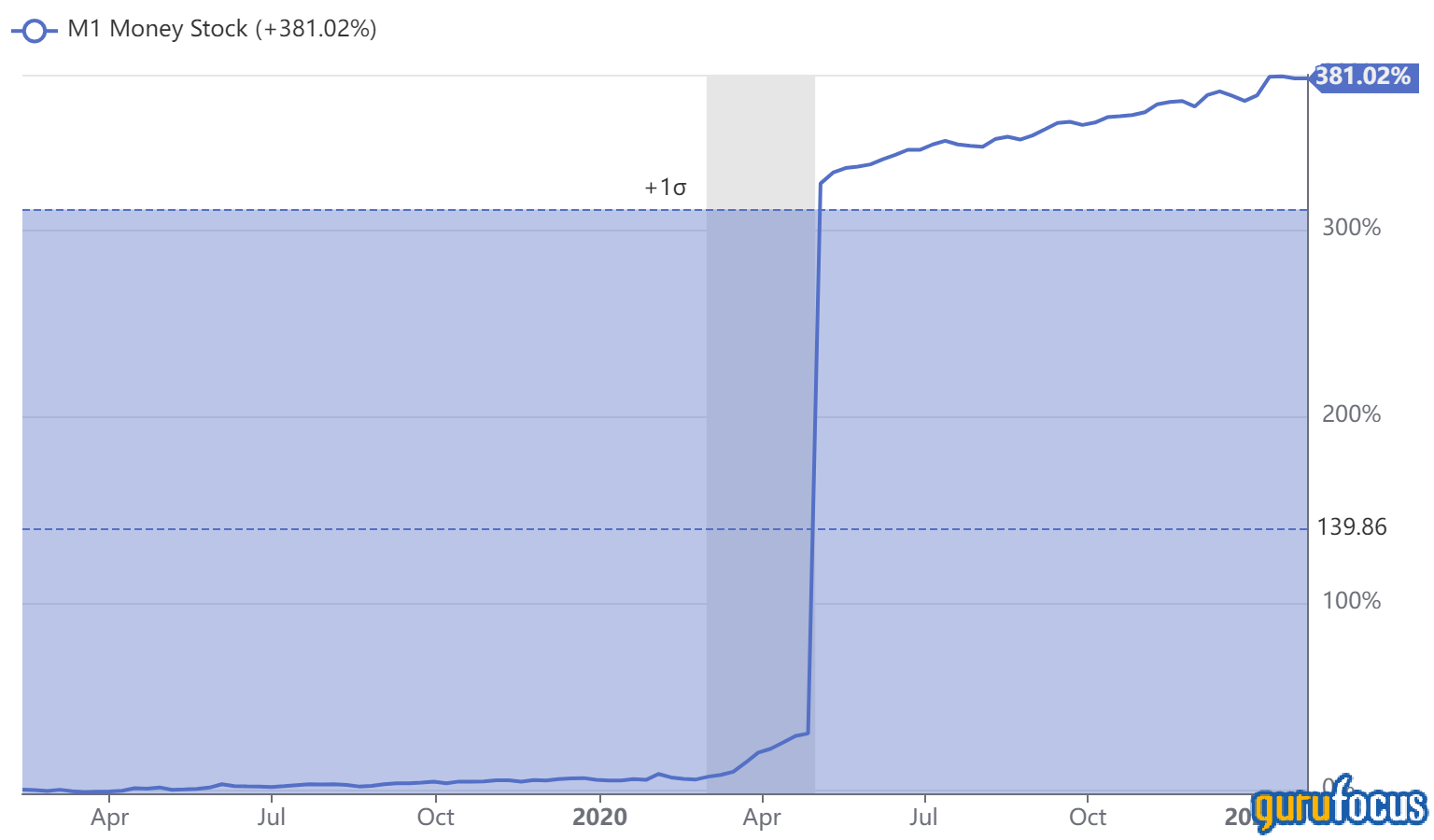

In more recent times, there have been similar situations in Venezuela and Zimbabwe. Luckily, the U.S. is not near hyperinflation territory right now, but one out of every five dollars in circulation were printed in 2020. You can see the major spike in M1 money supply in the chart below. Even if the government were to stop printing money and hike interest rates now, we're still looking at another couple of years of around 7% inflation just from this alone!

Supply crunch

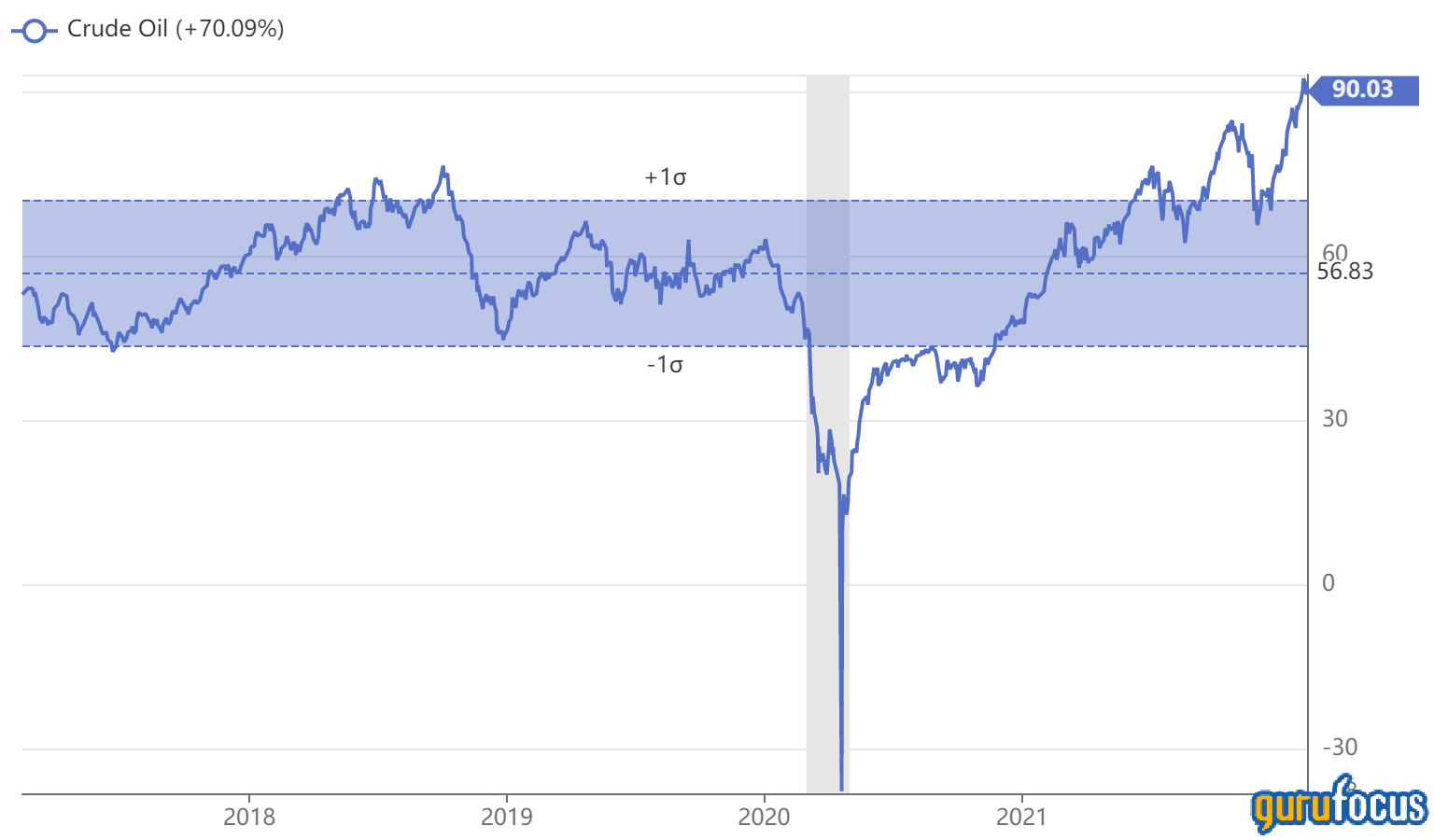

A supply crunch of “too much demand chasing too few goods or services” can also cause inflation. Now in a way this could be seen as the “good type” of inflation because it shows the demand for products is there. A recent example of this is oil, where we saw demand halted in the global lockdown of 2020, and oil prices plummeted to less than $20 per barrel before the economy rebounded, and the vast demand for oil caused prices to spike to over $90 per barrel. As a value investor with a contrarian streak, I saw the 2020 crash as a buying opportunity for oil stocks.

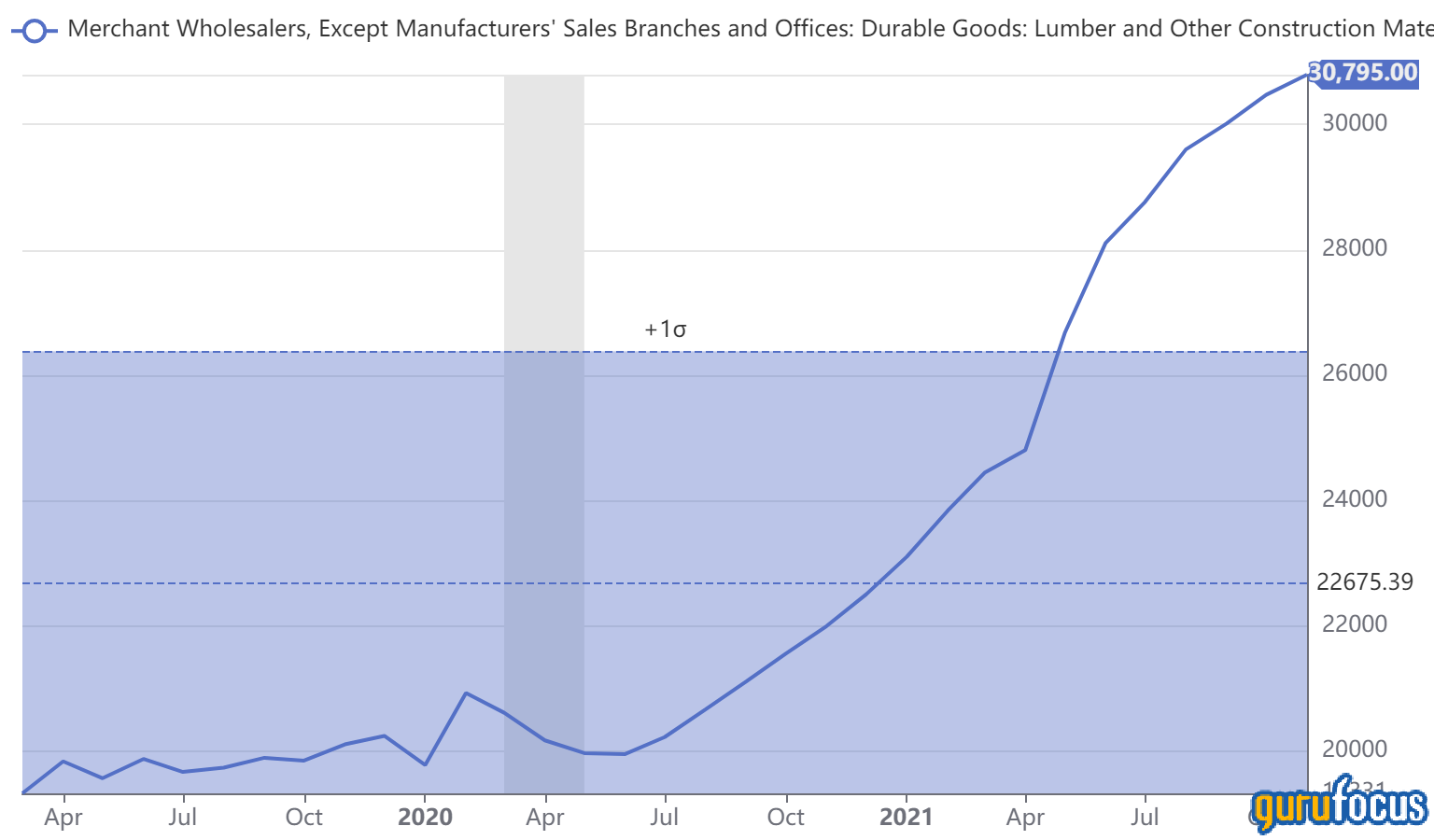

We also saw a similar spike in the lumber market, as years of underbuilding for homes met with record low interest rates to drive demand for housing well above supply. Lumber suppliers didn’t estimate the extremely high demand spike which occurred.

Can the Fed slow inflation?

To slow down Inflation, the Fed can use the tools at its disposal, such as raising interest rates, dialing back its bond-buying and asset-purchasing programs and so on.

Goldman Sachs (GS, Financial) even forecasted five interest rate hikes by the Fed in 2022. Bill Ackman (Trades, Portfolio) predicted this rise in 2021 and publicly hedged for his investments.

Anexpected rise in interest rates causes rising Treasury yields, which impacts the valuation of all stocks, but especially growth stocks. This is due mainly to two reasons: firstly, high interest rates increase the cost of borrowing for companies, which can squeeze company profits, and secondly, the value of a company is the present value of the company's expected future cash flows. As growth stocks have their value weighted disproportionally more towards the future, rising Treasury yields mean a higher discount rate, which impacts growth stocks hugely.

Federal Reserve Chairman Jerome Powell has outlined a plan to curb inflation. As Powell told Congress:

“We will use our tools to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched.”

The Fed can't just wave magic wand and decrease the price of a loaf of bread at the grocery store or a gallon of gas at the pump, though. A rule of thumb is to expect a two year time lag between a stricter monetary policy and inflation lowering.

According to data from the International Journal of Central Banking, which conducted an analysis of 67 studies of the time lag, “The average transmission lag is twenty-nine months.”

What can we learn from history?

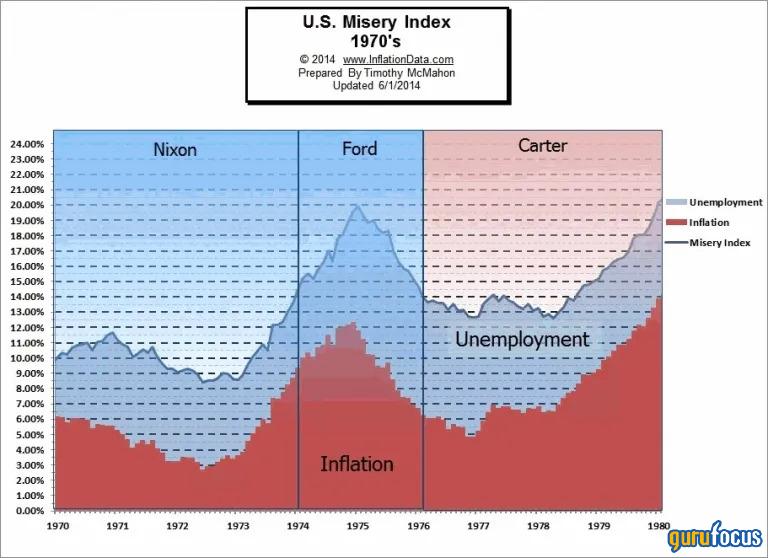

The 1970s inflation boom started to gain traction in 1973 when inflation doubled to 8.8%. By 1980, inflation was 14%. I interviewed a Wall Street Stock Investing veteran, who said this situation reminded him of the 1970s.

Source: InflationData.com

Now of course, we hope the Federal Reserve and economists have learned a lot since then, and we also have the benefit of technology and declining birth rates, which should produce a deflationary effect.

However, the fact is there are many unknowns to exactly when inflation will subside - it could be faster or slower. In the meantime, there is an opportunity cost for investors who are holding growth stocks in a rising rate environment.

Also check out: