A big, boring insurance company is one of the best performing stocks among the Dow Jones Industrial Average’s components at the moment. The Travelers Companies (TRV, Financial) just hit new all-time highs while the index itself languished below its highs from many weeks ago.

Despite the recent share price gains, the property and casualty insurer looks like a value stock with a price-earnings ratio of just 11.88. For reference, the average price-earnings ratio of the Dow 30 taken together is about 20.

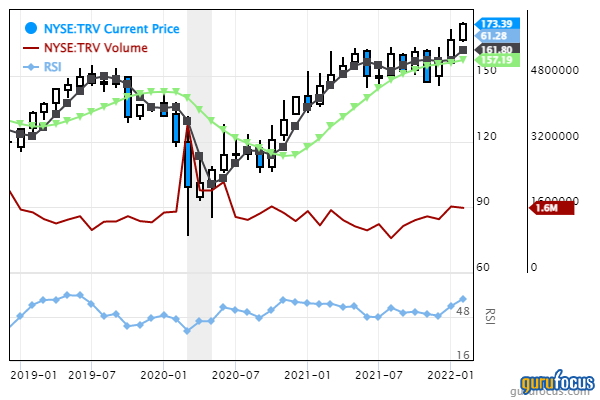

Take a look at the price performance of The Travelers Companies lately:

Note the all-time high and the way that the price continues to remain well above its up-trending 50-day moving average (the grey line) and its up-trending 200-day moving average (the green line).

The Travelers Companies is a huge business with a market capitalization of $41.62 billion and an enterprise value of $48.12 billion. The stock trades at a price-book ratio of 1.44, a price-sales ratio of 1.24 and a price-to-free-cash-flow ratio of 6.64. All of these metrics suggest value.

Earnings per share this year increased by 6.00%. The EPS growth rate for the past five years is -70%. Wall Street expects next year’s earnings to improve at a 12.87% rate.

In the meantime, investors are paid a $3.52 per share dividend for a yield of 2.04%.

The NYSE-traded equity is highly liquid with an average daily volume of 1.55 million shares, which is what you might expect of a Dow component.

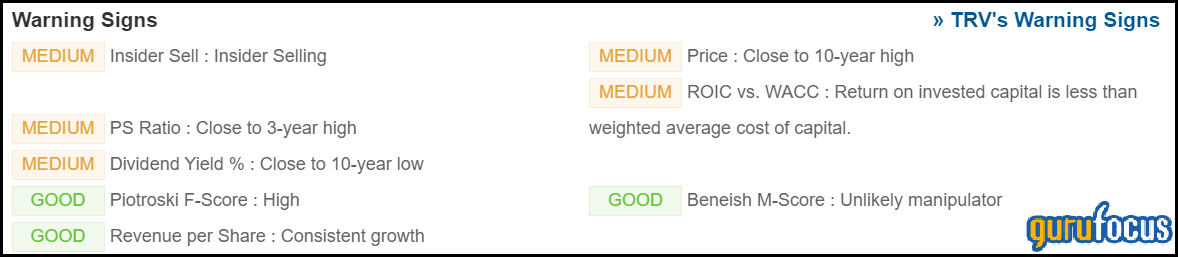

The GuruFocus summary of the financials finds three good signs and five medium warning signs for The Travelers Companies:

The financial strength metrics look decent. The cash-debt ratio is low, but the interest coverage ratio is sufficient. Overall, it gets a score of 4 out of 10 from GuruFocus for financial strength.

Hedge fund managers Ken Fisher (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio) added to their positions in the stock late last year, a sign of confidence in The Travelers Companies from two legendary stock pickers.

The company has many strong competitors in the field, including Allstate (ALL, Financial), CNA Financial (CNA, Financial), Progressive (PGR, Financial) and American Financial Group, among others.

That the big insurer is beating most of the other stocks in the Dow Jones Industrial Average suggests good strength, especially when high price-earnings growth stocks seem unable to reach their former highs. The success of The Travelers Companies is another sign that recently value stocks are the better choice in this market.

Become a Premium Member to See This: (Free Trial):