Bridgewater Associates, the mega hedge fund founded by Ray Dalio (Trades, Portfolio), disclosed in a regulatory portfolio filing that its top five trades during the fourth quarter of 2021 included sells in iShares MSCI Emerging Markets ETF (EEM, Financial), iShares Core MSCI Emerging Markets ETF (IEMG, Financial), Vanguard FTSE Emerging Markets ETF (VWO, Financial), Walmart Inc. (WMT, Financial) and Danaher Corp. (DHR, Financial).

The Greenwich, Connecticut-based firm develops insights and designs strategies to deliver value through its clients regardless of the economic environment. Bridgewater applies Dalio’s key principles, which include employing radical truth and radical transparency, encouraging open and honest dialogue and allowing the best thinking to prevail.

As of December 2021, the firm’s $17.20 billion equity portfolio contains 732 stocks, with 137 new positions and a quarterly turnover ratio of 10%. Excluding exchange-traded fund holdings, the fund’s top three sectors in terms of weight are consumer defensive, consumer cyclical and health care, representing 28.08%, 17.86% and 17.47% of the equity portfolio.

IShares MSCI Emerging Markets

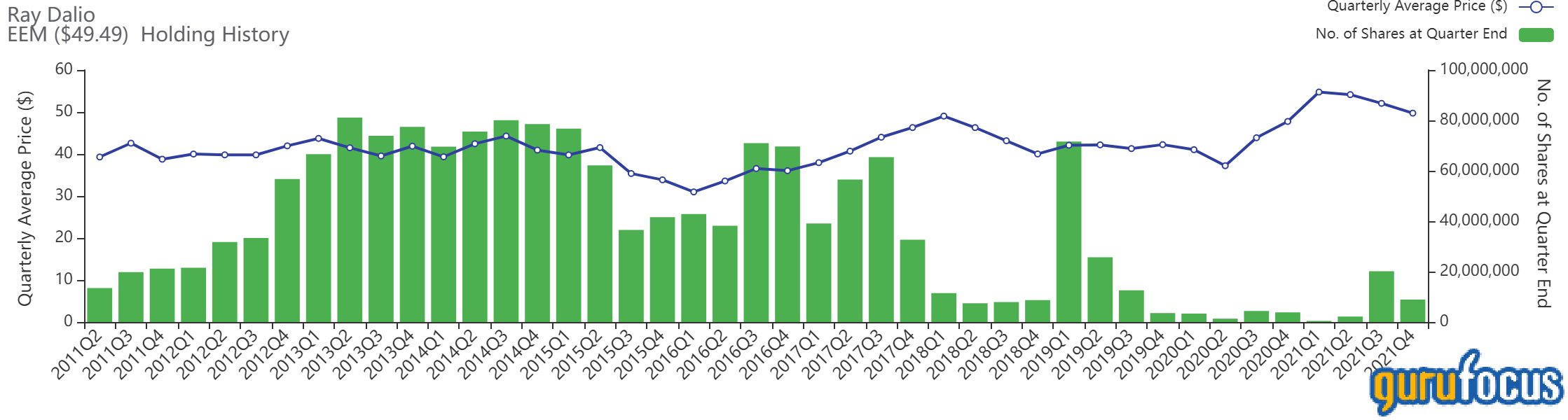

The firm sold 11,227,034 shares of iShares MSCI Emerging Markets ETF (EEM, Financial), slashing 55.75% of the position and 3.10% of its equity portfolio. Shares averaged $49.73 during the fourth quarter.

According to the iShares website, the ETF seeks to track the investment results of an index composed of large-cap and mid-cap emerging market equities.

IShares Core MSCI Emerging Markets

Bridgewater sold 5,467,457 shares of iShares Core MSCI Emerging Markets ETF (IEMG, Financial), chopping 39.73% of the holding and 1.85% of its equity portfolio. Shares averaged $60.63 during the fourth quarter.

Like the iShares MSCI Emerging Markets ETF, the iShares Core MSCI Emerging Markets ETF also seeks to track the investment results of an index composed of emerging market equities.

Vanguard FTSE Emerging Markets

The firm sold 6,640,461 shares of Vanguard FTSE Emerging Markets ETF (VWO, Financial), slicing 28.32% of the holding and 1.82% of its equity portfolio. Shares averaged $50.01 during the fourth quarter.

According to Vanguard’s website, the ETF invests in the stock of companies trading in emerging markets like China, Taiwan, South Africa and Brazil.

Walmart

Bridgewater sold 2,193,879 shares of Walmart (WMT, Financial), trimming 43.65% of the position and 1.68% of its equity portfolio.

Shares of Walmart averaged $143.31 during the fourth quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.99.

GuruFocus ranks the Bentonville, Arkansas-based company's profitability 7 out of 10 on the back of a high Piotroski F-score of 7 despite net profit margins and returns underperforming more than half of global defensive retail competitors.

Danaher

The firm sold 688,735 shares of Danaher (DHR, Financial), chopping 97.88% of the position and 1.15% of its equity portfolio.

Shares of Danaher averaged $311.04 during the fourth quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.94.

GuruFocus ranks the Washington, D.C.-based medical diagnostics company’s profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and profit margins that outperform more than 80% of global competitors.