Value investor Daniel Loeb (Trades, Portfolio) thinks Amazon.com Inc. (AMZN, Financial) is deeply undervalued. In the fourth-quarter letter to investors of his hedge fund, Third Point, he highlights the company as one of the best opportunities on the market right now.

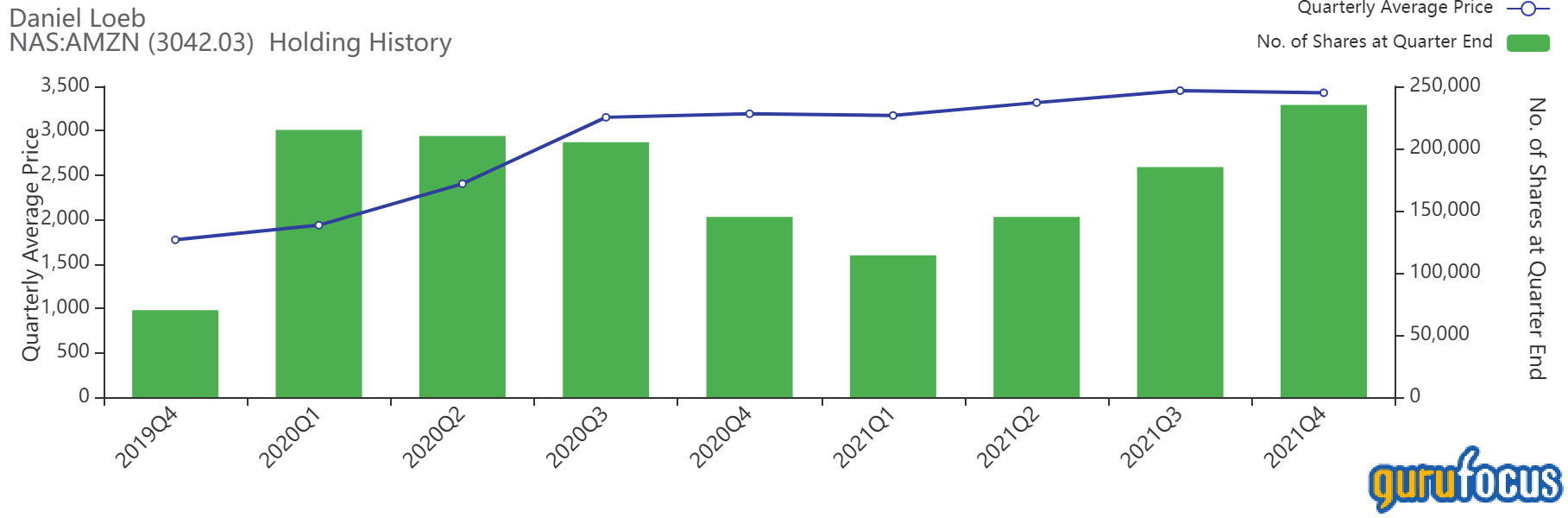

According to the hedge fund's 13F reports, it started buying Amazon in the fourth quarter of 2019. It revealed a holding of 70,000 shares at that time and it continued to increase the position during the first quarter of 2020.

The fund was able to buy a position at less than $2,000 per share as it started to move before the rest of the world realized how the pandemic would shape online retail and the general tech environment.

After building a position of around 215,000 shares in the first quarter of 2020, the hedge fund gradually reduced its holdings over the next 12 months.

By the end of the first quarter of 2021, its filings showed the position had fallen to just 114,000 shares. It seems as if Third Point capitalized on the market sentiment toward the company. It was able to sell the position, accumulated for less than $2,000 per share, for $3,000 and over.

However, after selling down the holding, the fund reversed course in 2021. During the last three quarters of the year, it doubled its position. At the end of the year, its 13F report shows the firm owned 235,000 shares, giving the position a 5.5% weighting in the equity portfolio. It is now a top five holding for the fund.

An important crossroads for the business

Loeb believes the company is at an important crossroads. After years of breakneck growth, the company is planning for its next stage of expansion and development.

The long-term secular growth drivers for the business, primarily cloud computing and e-commerce penetration, remain firmly intact, and the company should also benefit as excess costs associated with the pandemic and labor shortages start to disappear over the next few months.

The hedge fund manager also believes the company should benefit from a significant investment cycle, which effectively doubled its fulfillment capacity over the past two years.

When the costs of this expansion are behind Amazon, fixed cost leverage should improve and it will be able to capitalize on its enlarged position in the market.

The hedge fund manager believes that two developments over the past couple of months show the company's direction. In January, the board repurchased shares for the first time in a decade. Loeb believes this could be a sign of things to come as the group moves toward a net cash position and free cash flow improves.

He is also encouraged by the company's decision to break out advertising revenue and detail capital expenditure by category. He argues that this will help investors better understand the various parts of the business and its sum-of-the-parts value.

Loeb believes these two initiatives show which direction the new management team wants to take the company. He thinks Amazon could be pursuing a more shareholder-friendly future, with investor returns taking priority as the company exits its latest capital spending cycle.

The fund believes the company is trading at a discount of around 40% to its underlying intrinsic value.

Unfortunately, it does not provide the breakdown of this analysis, so it isn't easy to relate the calculation back to the business.

Still, for investors who might be looking for an undervalued growth stock with significant potential to generate large amounts of cash in the years ahead, Amazon could be worth a closer look. It also has robust competitive advantages in its primary markets.