Amazon (AMZN, Financial) is the global leader in e-commerce and cloud computing (through Amazon Web Services), and it even even has a handle on entertainment with Prime Video and Kindle. The company was founded just 28 years ago in 1994 as an online book seller, but today, it has grown into one of the largest companies in the world with a market cap of over $1.5 trillion.

Investing $10,000 in 2008 would have made you a whopping $570,000 - this is a return of over 5,700%. However, in my opinion, it's still not too late to for investors to profit from Amazon, as the company is going from strength to strength and recently had a price pullback.

Amazon still leads e-commerce

In the U.S., Amazon is the dominant market leader in e-commerce, making up over 40% of online sales in its home market, according to a study by Emarketer. This dominance leaves competitors such as Walmart (WMT, Financial) trailing behind with just a 7.1% share of U.S. ecommerce sales and eBay (EBAY, Financial) with a 4.3% market share.

Despite Amazon being the "Everything Store," the company is just getting started in areas with low e-commerce penetration. For instance, areas such as food/beverages have minimal e-commerce penetration (3.7%) and thus offer a potential runway for growth.

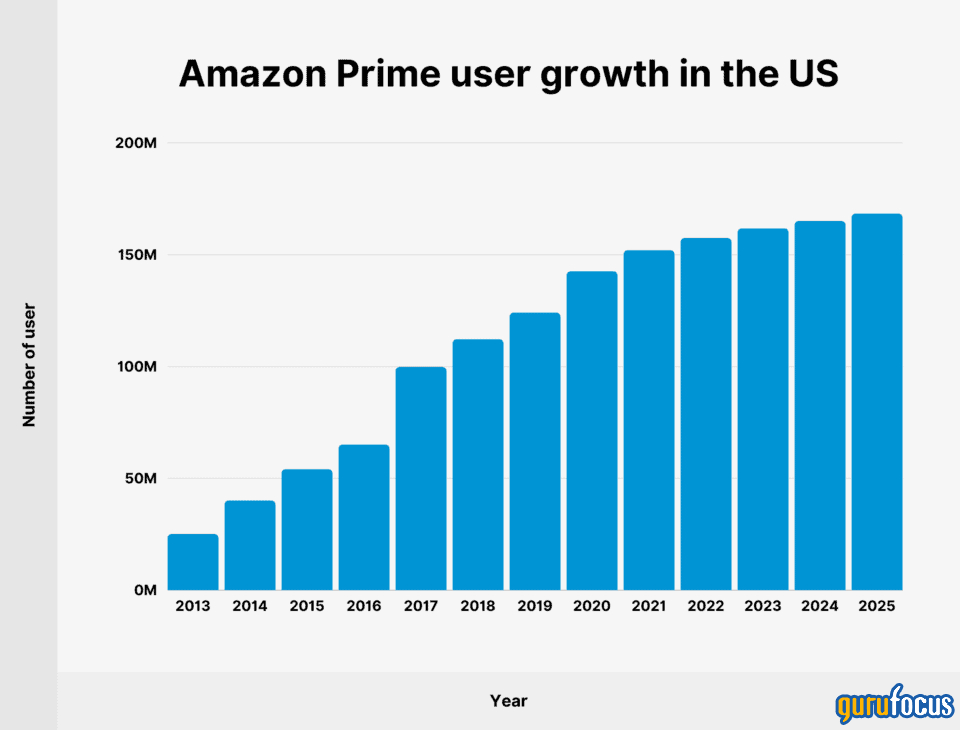

Prime is an ecosystem

Amazon's Prime membership ecosystem also continues to grow with over 200 million members globally. In the U.S., there are over 150 million Prime members that represent just under 50% of the population.

The Prime member ecosystem has proven remarkably sticky for customers and allows the cross selling of services and more value to be provided to customers; this is the competitive advantage of Amazon's scale.

Amazon dominates the cloud market

According to Statista, in Q4 2021, global cloud service revenues surpassed $50 billion for the first time, bringing the industry total for the year to $178 billion.

Amazon Web Services (AWS) is the market leader in cloud computing with a 33% worldwide market share. They are followed by Microsoft Azure (MSFT, Financial) with a 21% share and then Google Cloud (GOOG, Financial) (GOOGL, Financial) with a 7% share.

Is Amazon u?

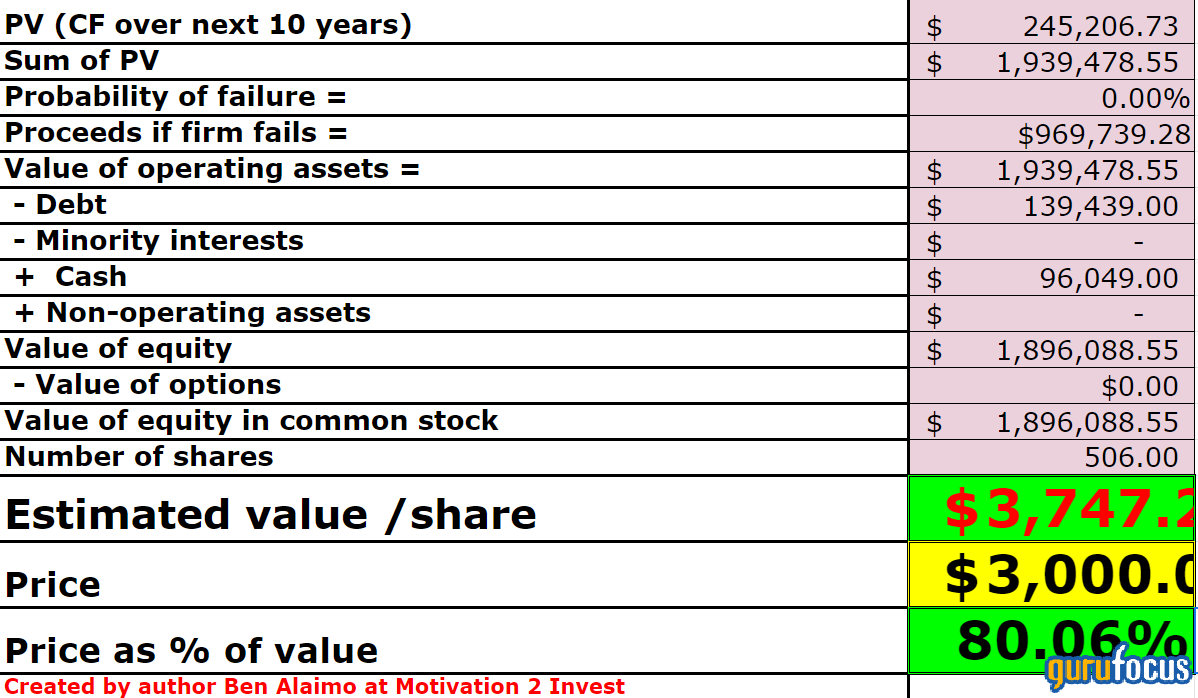

For my valuation of Amazon stock, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation.

I have projected a 15% revenue growth rate for the next five years, which is less than the prior 22% growth rate. I have predicted margins to increase by 2.5%, due to the growth of the company's higher margin Cloud business.

From my model, I get a fair value estimate of $3,747 per share. The stock is currently trading at approximately $3,000 per share and thus is 20% undervalued. This discount offers a margin of safety.

Conclusion

Amazon is an dominant and exceptional company that is a market leader in multiple areas from e-commerce to cloud computing. The company has historically made many strategic bets or "experiments" which are now paying off with huge profitability, such as AWS.

The risks to the company are numerous, including the exit of Jeff Bezos, which I think will effect the company's culture. In addition, as the company expands market share, there is the danger of possible antitrust regulation, which i believe is the biggest threat to the company. Moving forward, I see this company going from strength to strength as the cloud business brings in more profits and the e-commerce side maintains its dominance.