Proterra Inc. (PTRA, Financial), an American automobile and energy storage company, reported fourth-quarter 2021 earnings on March 2 with better-than-expected sales. However, after the company issued a dismal outlook for 2022. Proterra shares plunged roughly 15% in after-hours trading following the news.

The company designs and manufactures zero-emission electric transit vehicles and develops commercial electric vehicle technology solutions, giving it a competitive advantage over other EV manufacturers that primarily focus on passenger vehicles.

The current supply chain challenges faced by the automobile industry have led to an increase in costs, and the company expects this to remain a concerning factor that is likely to affect the financial performance in the first quarter of 2022. Despite this, I believe Proterra's long-term prospects remain bright, as it leads the electric bus market and assists other commercial electric vehicle fleets to embrace EV technology.

Supply chain challenges will affect performance

Proterra reported $68 million in revenue for the fourth quarter, up 26% year-over-year. The company reported $1.3 billion in backlog and contracted orders as of December 2021, aided by an increase in Proterra Transit contracts and the expansion of partnerships.

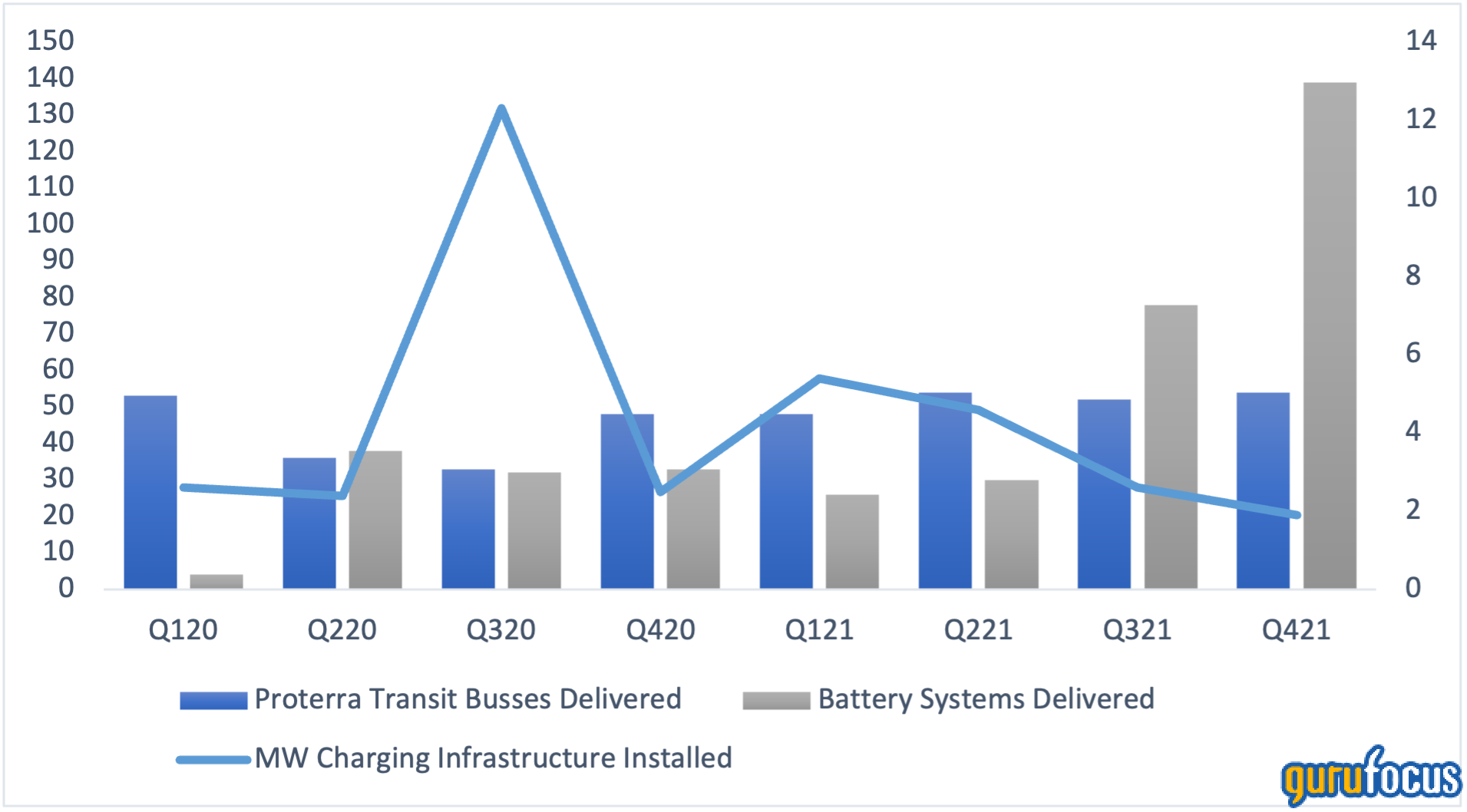

Proterra Transit's revenue increased 28% to $55 million in 2021. Transit orders increased 45% year-over-year in the full year, with current customers accounting for more than 70% of new orders. The number of new bus deliveries climbed 13% to 54 electric transit vehicles in the quarter, up from 48 in the fourth quarter of 2020, while Proterra Transit's backlog was at $450 million by the end of 2021.

The Proterra Powered and Energy segment revenue increased 19% year-over-year to $13 million in the fourth quarter of 2021, supported by strong demand for Proterra Energy charging solutions for both Proterra Transit and Proterra Powered vehicles. Battery system deliveries increased 321% from 33 vehicles in Q4 2020 to 139 vehicles in Q4 2021. Proterra Powered added eight new OEMs in 2021, bringing the total number of OEMs to 13 along with 19 vehicle programs, resulting in contracted orders totaling $800 million through 2025.

The installations of charging infrastructure were affected by supply chain issues in the last quarter. Proterra Energy installed 1.9 megawatts of DC fast-chargers in the fourth quarter, down 24% year-over-year, while almost 5 megawatts of charging installations were rescheduled for 2022.

Proterra operating metrics

Source: Quarterly shareholder letter

The company reported larger-than-expected losses due to higher costs and supply chain disruptions. In 2021, the pandemic-related restrictions and increasing number of infections continued resulting in production and shipment delays and shortages across business sectors. The supply chain challenges have worsened in some sectors, impacting sales in the current quarter as well.

As a result, Proterra is also experiencing material shortages and shipment delays. In addition, labor shortages have come to light as well, making life even more difficult for Proterra to meet the demand for its vehicles and technology solutions. To increase manufacturing capacity, Proterra’s third battery factory is expected to commence production in late 2022, but the company’s growth might come to a standstill this year if the supply-chain situation does not improve in the next few months.

The increasing demand for EVs will drive Proterra’s growth

The transportation sector is one of the most significant contributors to greenhouse gas emissions. To meet the emission control targets imposed upon themselves, many governments have set aggressive electrification goals and taken initiatives to promote the use of EVs.

Investors' interest in EV companies is also increasing, and demand for emission-free vehicles such as electric buses is growing. According to P&S Intelligence, the U.S. market for electric buses is predicted to grow at a 31.4% compounded annual growth rate through 2026, reaching $1.92 billion. The California Air Resources Board has mandated that all public transportation agencies should migrate to 100% zero-emission bus fleets by 2040. To achieve this, the Valley Transportation Authority announced it will collaborate with Proterra and Scale Microgrid Solutions to create an innovative clean energy microgrid and EV fleet charging system to power its electric buses.

Businesses continue to transition from carbon-emitting technology to zero or low-emitting operations as people become more conscious of climate change and its increasingly severe effects. According to BlueWeave Consultancy, a strategic consulting and market research firm, the global electric bus market was valued at $37 billion in 2021 and is expected to expand at a compounded annual growth rate of 10.5% through 2028. The electric bus market is gaining traction, and governments are also investing heavily in public transportation infrastructure, which is expected to drive the demand for electric buses in the next decade.

Takeaway

With a solid order backlog for both buses and battery systems, Proterra is growing its vehicle programs and diversifying into new markets. The company’s fundamentals remain strong, and while it may not experience rapid growth this year, Proterra is well on its way to becoming Ebitda positive in 2023. Growth investors with a focus on sustainable investing might find Proterra an attractive opportunity given that the company is making steady progress, unlike many EV startups that are yet to make any sales.