Brave Warrior Advisors, the firm managed by Glenn Greenberg (Trades, Portfolio), disclosed in a regulatory 13F filing that its top four trades during the fourth quarter included a boost to its holding of Apollo Global Management Inc. (APO, Financial), the closure of its position in Charles Schwab Corp. (SCHW, Financial) and the reduction of its positions in Aon PLC (AON, Financial) and JPMorgan Chase & Co. (JPM, Financial).

The New York-based firm follows a “defense against ignorance” approach to investing: Brave Warrior maintains a concentrated portfolio of stocks in companies with little competition and high returns on invested capital.

As of December 2021, the firm’s $3.14 billion 13F equity portfolio contains 23 stocks, with one new position and a turnover ratio of 2%. The top three sectors in terms of weight are financial services, health care and energy, representing 61.49%, 28.70% and 9.65% of the equity portfolio.

Apollo Global Management

Brave Warrior invested in 839,093 shares of Apollo Global Management (APO, Financial), boosting the position by 33.47% and its equity portfolio by 1.94%.

Shares of Apollo averaged $72.36 during the fourth quarter; the stock is significantly undervalued based on Friday’s price-to-GF Value ratio of 0.51.

GuruFocus ranks the New York-based asset management company’s profitability 8 out of 10 on the back of returns outperforming more than 90% of global competitors despite three-year revenue and earnings decline rates underperforming over 72% of global asset management companies.

Other gurus with holdings in Apollo include Chase Coleman (Trades, Portfolio)’s Tiger Global Management and Jim Simons (Trades, Portfolio)’ Renaissance Technologies.

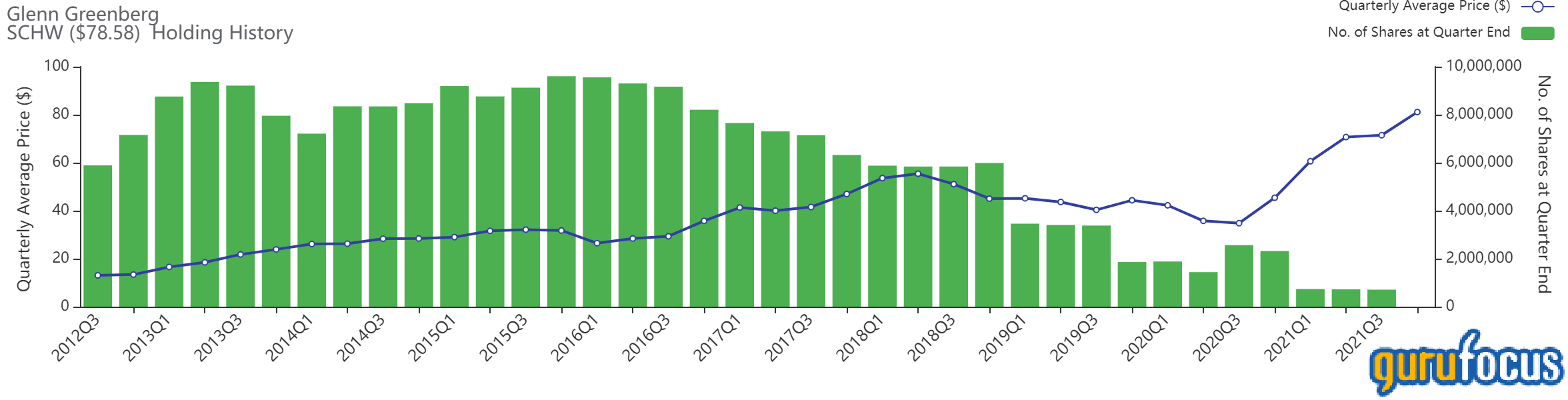

Charles Schwab

The firm sold all 707,943 shares of Charles Schwab (SCHW, Financial), trimming 1.81% of its equity portfolio.

Shares of Charles Schwab averaged $81.09 during the fourth quarter; the stock is significantly overvalued based on Friday’s price-to-GF Value ratio of 1.33.

GuruFocus ranks the Westlake, Texas-based brokerage company’s profitability 7 out of 10 on the back of net profit margins and three-year revenue growth rates outperforming more than 65% of global competitors.

Other gurus with holdings in Charles Schwab include Dodge & Cox, PRIMECAP Management (Trades, Portfolio) and Al Gore (Trades, Portfolio)’s Generation Investment Management.

Aon

The firm sold 112,133 shares of Aon (AON, Financial), slicing 97.62% of the position and 1.12% of its equity portfolio.

Shares of Aon averaged $299.80 during the fourth quarter; the stock is modestly overvalued based on Friday’s price-to-GF Value ratio of 1.20.

GuruFocus ranks the U.K.-based insurance company’s profitability 8 out of 10 on several positive investing signs, which include profit margins and returns outperforming more than 80% of global competitors.

Other gurus with holdings in Aon include Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (BRK.A)(BRK.B) and Andreas Halvorsen (Trades, Portfolio)’s Viking Global Partners.

JPMorgan Chase

The firm sold 177,133 shares of JPMorgan Chase (JPM, Financial), trimming 10.59% of the position and 1.01% of its equity portfolio.

Shares of JPMorgan Chase averaged $164.11 during the fourth quarter; the stock is fairly valued based on Friday’s price-to-GF Value ratio of 0.92.

GuruFocus ranks the New York-based bank’s profitability 6 out of 10 on the back of profit margins and returns outperforming more than 70% of global competitors.