Western Alliance Bankcorp (WAL, Financial) caught my eye due to recent insider activity. Both the CEO and chief financial officer have purchased shares this year, spending a substantial amount to do so.

An overview of recent insider transactions is illustrated below:

| Insider | Position | Insider Trade Date | Shares Change | Buy/Sell | Price |

| Theisen Randall S | General Counsel | 2022-02-09 | 2,963 | Sell | 101.96 |

| GIBBONS DALE | Vice Chairman and CFO | 2022-02-01 | 5,000 | Buy | 99.68 |

| Vecchione Kenneth | President and CEO | 2022-01-31 | 5,600 | Buy | 97.88 |

The stock has fallen further since they bought, so now it is even a better deal. But, of course, it can still get even cheaper.

Western Alliance is a Phoenix-based holding company with regional banks operating in Nevada, Arizona and California. The bank offers retail banking services and focuses on mortgages for retail customers and commercial loans, mainly for real estate. The bank also has an investment advisory business that manages investment portfolios for clients.

- Commercial segment: provides commercial banking and treasury management products and services to small and middle-market businesses, specialized banking services to sophisticated commercial institutions and investors within niche industries, as well as financial services to the real estate industry.

- Consumer Related segment: offers consumer banking services, such as residential mortgage banking, and commercial banking services to enterprises in consumer-related sectors.

- Corporate & Other segment: consists of the company's investment portfolio, corporate borrowings and other related items, income and expense items not allocated to our other reportable segments and inter-segment eliminations.

As of Dec. 31, the company's loan portfolio totaled $39.1 billion.

Western Alliance looks like a good opportunity because it has a high return on equity of 21.7% and a relatively low price-earnings ratio of around 10. The company's three-year revenue and earnings per share growth is over 20%.

|  |

|  |

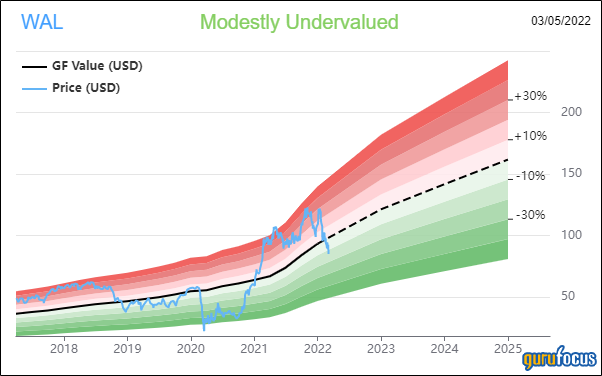

The GF Value Line indicates modest undervaluation based on historical ratios, past financial performance and future earnings projections.

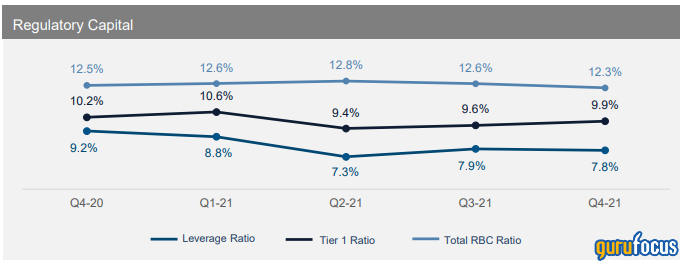

Regulatory capital ratios are strong, and the bank is well capitalized.

Conclusion

Notorious bank robber Willie Sutton was on the FBI's most wanted list in the 1920s. After he was finally arrested and asked why he robbed banks, Sutton simply replied, “Because that’s where the money is.” Rather than robbing banks, a safer tactic is to see if senior bank executives are buying shares and, if they are, then after some due diligence, we can do the same. Western Alliance fits the bill and looks like a suitable candidate for my version of a bank heist.