The main commodity index in the U.S. is the Dow Jones Commodity Index. This index has outperformed the rest of the U.S. stock market over the past year, returning 33.3% compared to 17.1% for the S&P 500.

This has been driven by high inflation (7.5% vs. the Federal Reserve's 2% target) as well as surging energy and precious metal prices thanks to supply chain disruptions and the Ukraine-Russia conflict. From the chart below, we can see the rise in prices of various metals.

Investing into commodities could help to hedge your portfolio against inflation. However, it should also be noted that commodity prices are determined by supply and demand, which can change rapidly and cause volatility, especially with an unstable geopolitical situation. In general, though, commodities tend to surge when geopolitical tensions are high, and this time is shaping up to be more of the same. Here are my top three commodity ETF picks to hedge against this high-inflation and high-tension environment.

1. iShares Bloomberg Roll Select Commodity Strategy ETF

- Expense Ratio: 0.29%

- Style: Diversified

The iShares Bloomberg Roll Select Commodity Strategy ETF (CMDY, Financial) offers exposure to an array of 20 different commodities, which include agriculture, energy and metals through futures. The sector breakdown shows a 34% weighting towards energy, followed by agriculture at 28% and precious metals at 17%.

The expense ratio is the cheapest on this list at just 0.29%. The fund tracks the Bloomberg Roll Select Commodity Total Return Index.

2. First Trust Global Tactical Commodity Strategy Fund

- Expense Ratio: 0.95%

- Style: Active Metal Focused

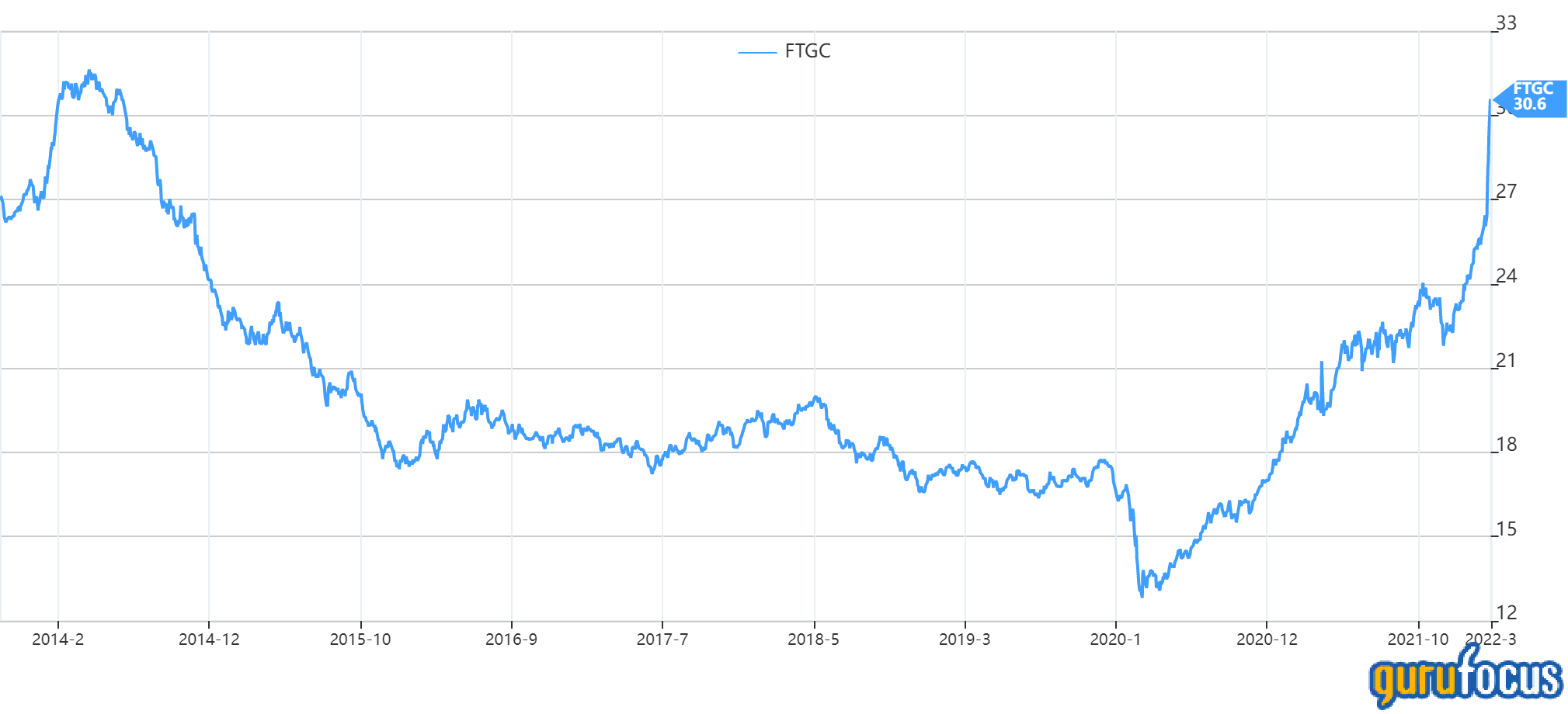

First Trust Global Tactical Commodity Strategy Fund (FTGC, Financial)is an actively managed commodity fund which offers investors a way to tactically bet on raw material prices. The iconic Brown Brothers Harriman offers the fund, which has holdings in mostly metals, including gold, aluminum, copper and silver futures. The beauty of the firm's active management strategy is that they can bet heavily on oil, gas or even agricultural futures such as corn when their analysis encourages them to.

Year-to-date, their strategy is working well with the fund up 21%. However, be aware past performance doesn’t guarantee future results, and the fund's high expense ratio of 0.95% must be taken into account.

3. Invesco Commodity Index Tracking Fund

- Expense Ratio: 0.85%

- Style: Diversified Energy

Invesco Commodity Index Tracking Fund (DBC, Financial) is one of the largest and most diversified commodity ETFs, with over $3.5 billion in assets under management. The firm tracks a basket of the 14 most traded commodity future contracts. However, they do have a bias towards energy, which currently makes up around 50% of the assets. In addition, base metals such as zinc and agricultural commodities such as corn and soybeans also are in the fund. The expense ratio is relatively high at 0.85%.