Executives of General Electric Co. (GE, Financial) stuck by their reduced profit forecasts on Thursday, as shares traded lower and Wall Street investors await its coming division into three more highly-focused companies.

The multinational conglomerate reported it is projecting 2022 adjusted earnings per share of $2.80 to $3.50 and free cash flow of $5.5 billion to $6.5 billion, compared to estimates of $5.3 billion. Executives also said they expect organic revenue growth in the high single-digit percentage range. The company’s guidance remains unchanged from what it reported in its fourth-quarter results on Jan. 25.

Shares traded lower after the company reaffirmed its reduced profit forecasts. GE’s stock dipped by 0.9% in premarket trading on Thursday after management repeated its full-year profit and cash flow outlook ahead of its investor meeting in Greenville, South Carolina. Shortly after midday, shares were trading at around $89.78, down 1.61% or $1.44.

Input costs and supply chain disruptions “continue to test its ongoing turnaround under CEO Larry Culp,” TheStreet reported. In the first week of March, executives said they foresee supply chain and cost pressures continuing through 2022’s final two quarters. In addition, they expect free cash flow of about $5.5 billion to $6.5 billion, and that it will rise as high as $7 billion next year.

GE is gearing up for its much-publicized split into a trio of companies that will focus on health care, aviation and power generation. Specifically, GE Healthcare will be spun off in early 2023, with GE retaining a 19.9% stake. The GE Power, GE Renewable Energy and GE Digital units will be put together and spun off in 2024. The remaining part will be an aviation-focused company.

Many analysts expect the split to result in companies that are more focused and more open to mergers and acquisitions. The newly formed entities could trade at higher valuation multiples, some suggest, and in general could run more efficiently. Culp himself recently made the point that the individuated companies will enjoy improved "focus" and be "more tailored capital structures and capital allocation frameworks that are aligned with each company's distinct strategies and industry dynamics.”

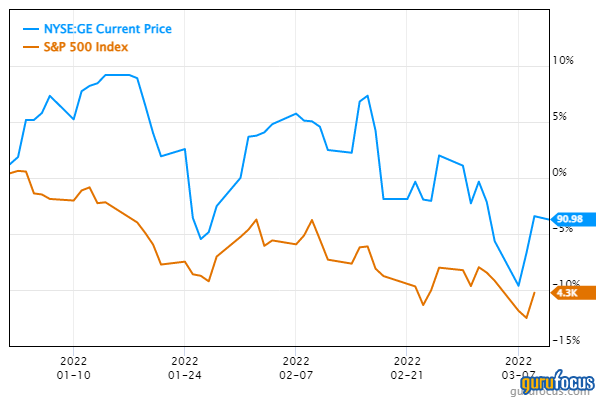

"Our teams are excited about the future as we lay the groundwork for our planned three independent companies focused on the critical global needs of precision health, the energy transition and the future of flight," said Culp. The stock has lost 5.9% over the past three months, even as the S&P 500 has lost 9.2%.

Of the three, it is the power business that is furrowing many analysts’ brows. The Boston-based company’s aviation division has proven to be a perennial profit generator, even during the thick of the Covid-19 pandemic. Its health care division has proven similarly resilient and profitable.

The power business is “more challenged,” according to Barrons. The financial news outlet said power and renewable energy businesses have together lost approximately $2 billion over the last three years. The GE business, which includes natural gas power-generation turbines, had sales of $16.9 billion in 2021, “but operating profit margins have ranged from positive 14% to negative 5% over the past six years. Renewable energy, which includes wind turbines, had sales of $15.7 billion in 2021; but it hasn’t produced a full-year profit in the last three years, and operating-profit margins have averaged about negative 5% over that span.”

In spite of the complexity, or perhaps because of it, the new power business is projected to result in approximately $1.1 billion in operating profit this year and $1.5 billion more in 2023. “Profits like that imply profit margins of about 5% in 2022 and 8% to 10% in 2023,” Barrons added. “In the long run, GE sees the business growing at a low-single-digit percentage annually. Earnings should grow faster than sales.”