Micro Focus International PLC (MFGP, Financial)(LSE:MCR) recently released its fourth quarter and full-year 2021 results, and they were once again not good. The promised turnaround is taking longer than expected, but I continue to hold and add to my position, as I think the opportunity here is still valid but postponed.

Micro Focus is a U.K.-based vendor of enterprise software. The company specializes in acquiring infrastructure software from larger companies who want to focus on other strategic priorities.

Though it has a long history of successfully acquiring and integrating software companies, it bit off much more than it could chew when, in 2017, it acquired the software business of Hewlett Packard Enterprise Co. (HPE, Financial). It paid $2.5 billion in cash (financed with debt) to Hewlett Packard and then proceeded to merge with its software business while obtaining a listing on the New York Stock Exchange. It continues to be listed on the London Stock Exchange as well.

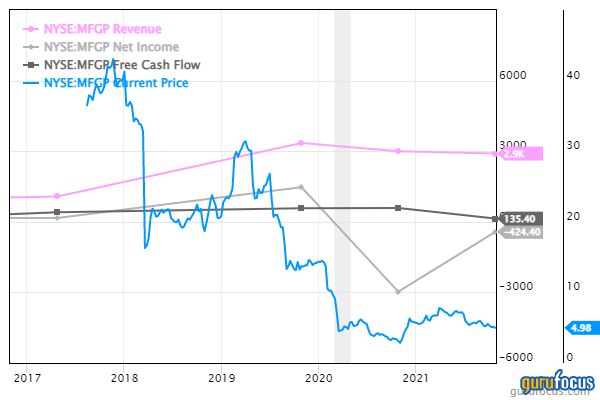

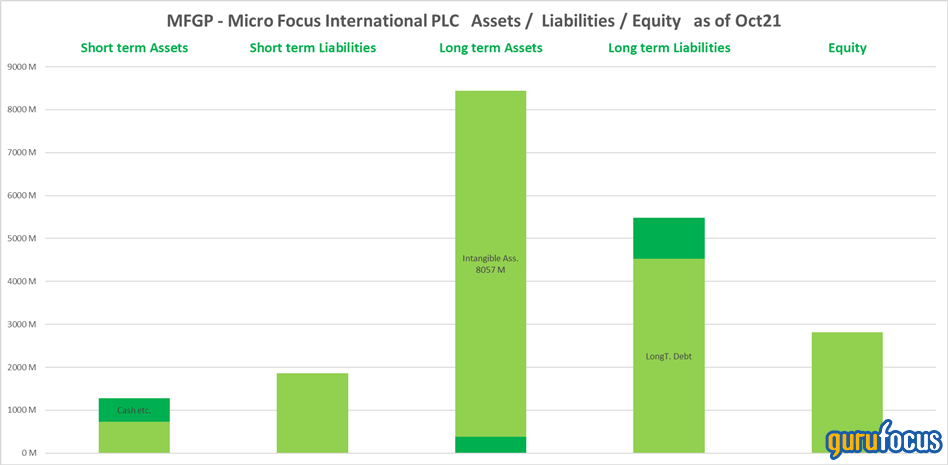

This transformative deal, together with debt and equity, was valued at over $8 billion. After the transaction, former Hewlett Packard shareholders owned 50.1% of the combined company. However, the integration of the two businesses did not go smoothly, so both the company's revenue and the stock plumeted. Since the deal, the company has booked heavy losses to the tune of around $3.5 billion, which have been mostly asset impairment charges as intangibles were written down.

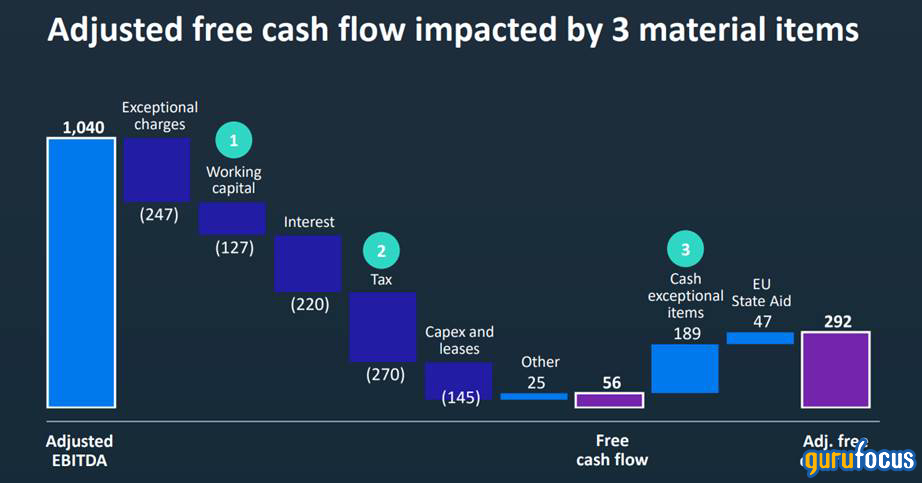

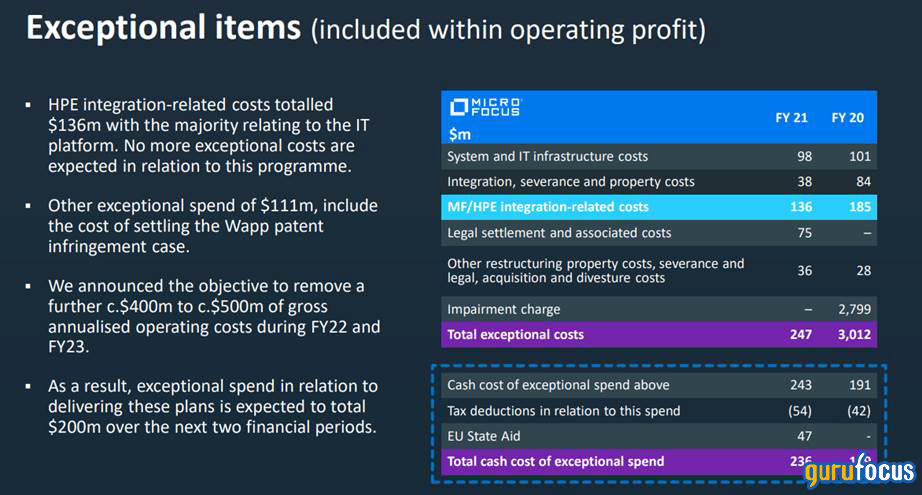

While revenue declined slightly and the net loss was much less than last year (due mostly to the absence of goodwill impairments), free cash flow, previously a bright point, also took a hit due to "exceptional cash costs" as detailed in the slides below from the company's earnings presentation.

The company says that it expects stabilization of revenues by 2023 and a run rate of $500 million per annum of free cash going forward.

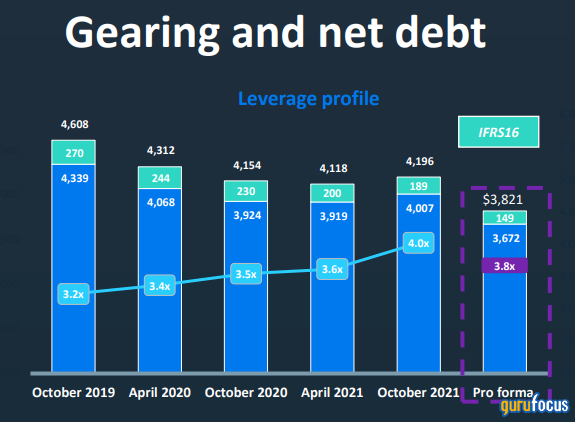

In terms of the balance sheet, the company has refinanced with a $1.6 billion term loan, taking the average maturity of debt from 2.7 years to 3.6 years. Though the company has substantial debt, it is making progress in reducing debt, with a debt-to-adjusted-Ebitda ratio of 3.8 on a pro-forma basis.

I believe the company can bring its debt down substantially in the next five years due its sticky and cash-generative business. The revenue decline is slowing, and Micro Focus believes it can stabilize it in the next two years.

The company also recently reinstated its dividend, now yielding 6.3%, thus signaling increased confidence in the business. At the same time, investors should note the remarkably high debt load and elevated risk of bankruptcy that such a prominent level of debt entails.

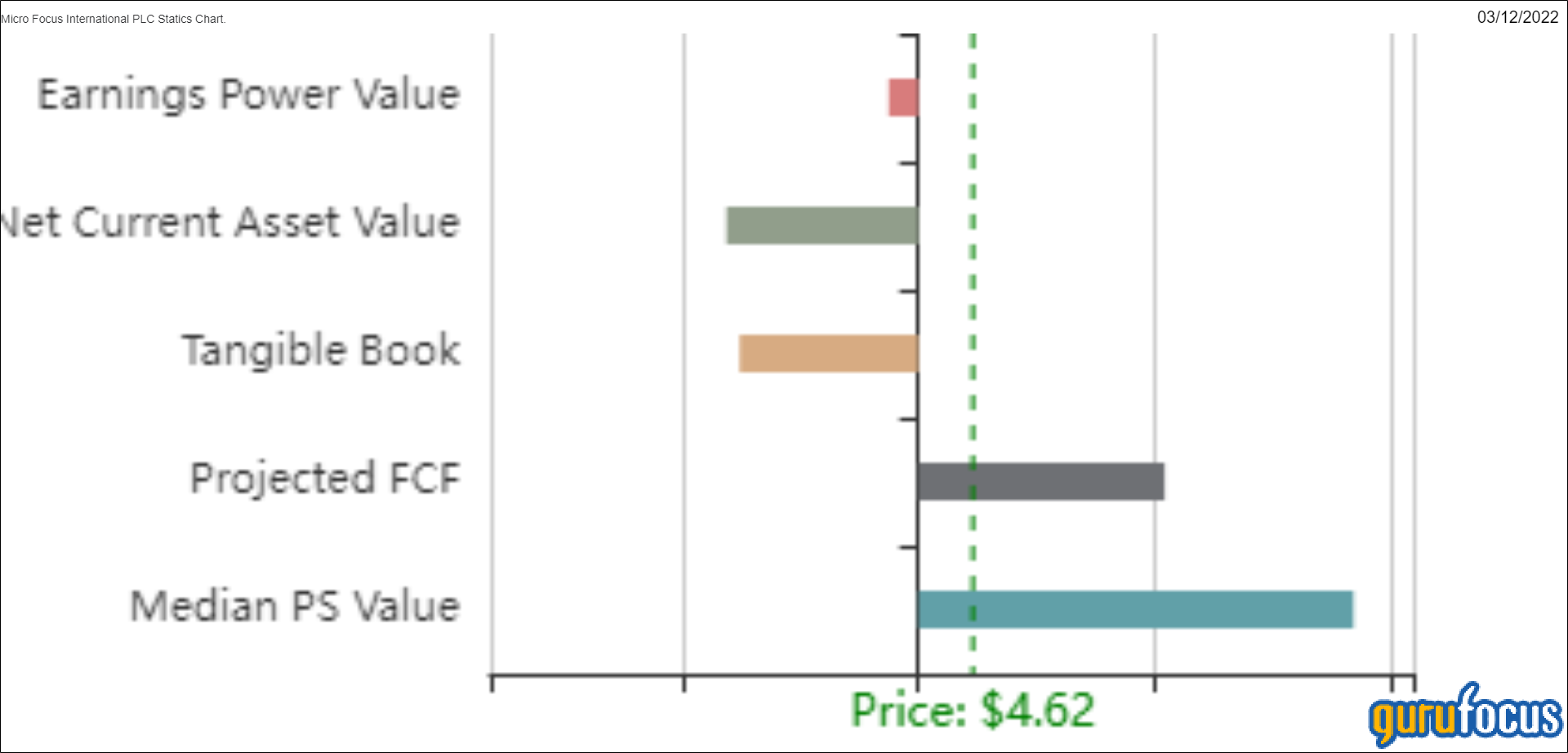

My reasons for initially becoming interested in Micro Focus can be summarized in the GuruFocus valuation panel. It derives from the high projected free cash flow value and median price-sales value, which are higher than the stock price. I believe and hope this value will emerge once the dust from the turnaround settles (though admittedly, it is taking longer than I previously thought).

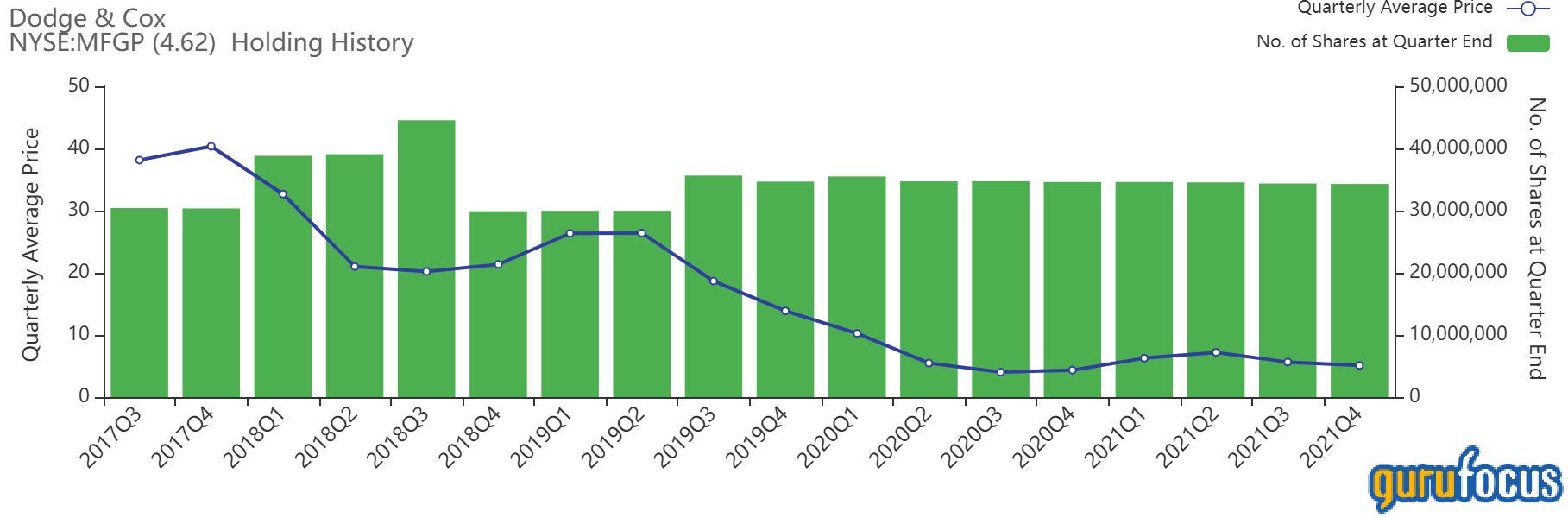

In terms of guru ownership, Dodge & Cox owns over 10% of outstanding shares and is holding steady even though the stock price has gone down from $40 to now below $5.

Management says its is focused on exiting fiscal 2023 with a flat or better revenue trajectory, $400 million to $500 million of gross cost reduction and an exit run-rate of $500 million of adjusted free cash flow. I think if it can achieve that, the stock could appreciate several times over its current value. But am I waiting for Godot, who will never come? Only time will tell, but at least they are paying me a 6.3% dividend while I wait!