When a company's return on equity ratio is superior to most of its competitors, it generally indicates the company has been very efficient in generating profits. Thus, investors may want to consider the following stocks since they are performing better than most of their peer group companies in terms of a higher ROE ratio.

Laboratory Corp of America

The first stock investors could be interested in is Laboratory Corp of America Holdings (LH, Financial), a Burlington, North Carolina-based independent clinical laboratory company.

Laboratory Corp of America, or LabCorp, has a ROE ratio of 23.54% versus the industry median of 3.38%, ranking higher than 79.82% of 218 companies that are operating in the medical diagnostic and research industry.

The share price was $265.66 at close on Monday, up 12.85% year over year, for a market capitalization of $25.18 billion and a 52-week range of $237 to $317.17.

The stock has a price-earnings ratio of 11.04 and a price-book ratio of 2.46.

GuruFocus has assigned a score of 7 out of 10 to the company's financial strength and 10 out of 10 to its profitability.

On Wall Street, the stock has a median recommendation rating of buy and an average target price of $335.14 per share.

Lennar

The second stock investors could be interested in is Lennar Corp. (LEN, Financial), a Miami-based homebuilder.

Lennar has a ROE ratio of 22.35% versus the industry median of 13.25%, which ranks higher than 76.42% of the 106 companies that are operating in the homebuilding and construction industry.

The share price has dropped by 4.44% over the past year to trade at $83.34 at close on Monday for a market capitalization of $24.56 billion and a 52-week range of $79.52 to $117.54.

The stock has a price-earnings ratio of 5.93 and a price-book ratio of 1.22.

GuruFocus has assigned a score of 7 out of 10 to the company's financial strength and 9 out of 10 to its profitability.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $125.25 per share.

Burlington Stores

The third stock investors may be interested in is Burlington Stores Inc. (BURL, Financial), a Burlington, New Jersey-based operator of 840 stores in 45 states in the United States and Puerto Rico, where customers can buy branded clothing.

Burlington Stores has a ROE ratio of 64.74% versus the industry median of 6.93%, ranking it higher than 96.66% of the 1,049 companies that operate in the Retail - Cyclical industry.

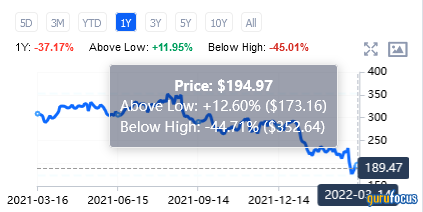

The share price has fallen by 37.17% over the past year to close at $194.97 on Monday, determining a market capitalization of $12.99 billion and a 52-week range of $171.15 to $357.34.

The stock has a price-earnings ratio of 32.02 and a price-book ratio of 16.88.

GuruFocus has assigned a score of 5 out of 10 to the company's financial strength and 7 out of 10 to its profitability.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $258.05 per share.